Answered step by step

Verified Expert Solution

Question

1 Approved Answer

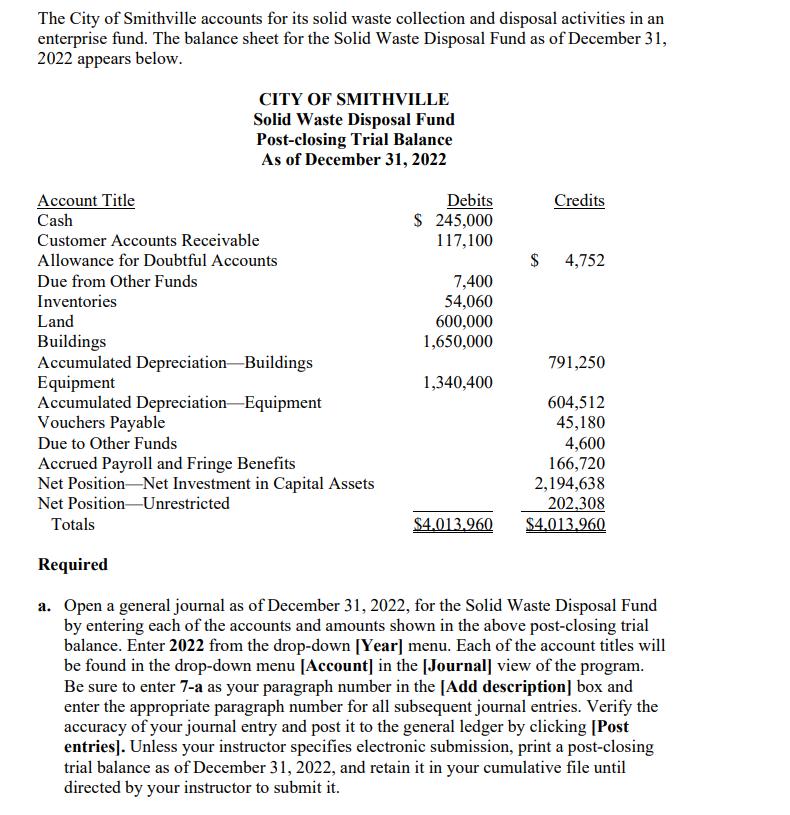

The City of Smithville accounts for its solid waste collection and disposal activities in an enterprise fund. The balance sheet for the Solid Waste

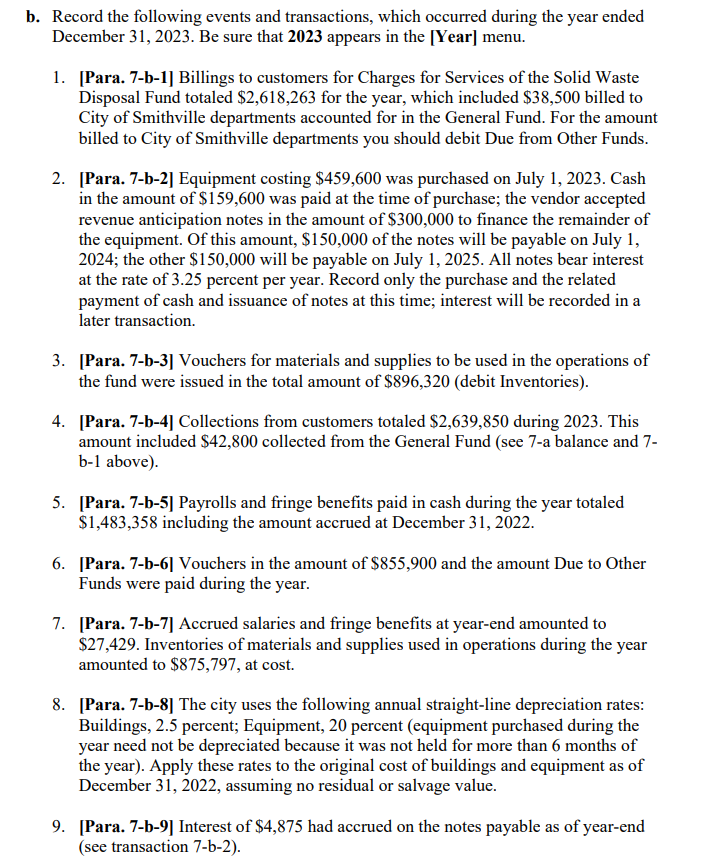

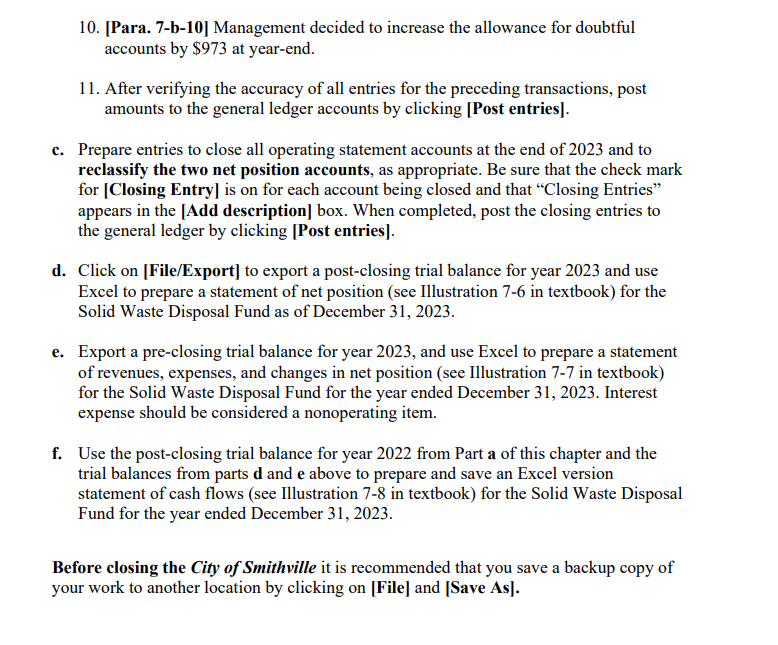

The City of Smithville accounts for its solid waste collection and disposal activities in an enterprise fund. The balance sheet for the Solid Waste Disposal Fund as of December 31, 2022 appears below. CITY OF SMITHVILLE Solid Waste Disposal Fund Post-closing Trial Balance As of December 31, 2022 Account Title Cash Customer Accounts Receivable Debits $ 245,000 117,100 Credits Allowance for Doubtful Accounts $ 4,752 Due from Other Funds Inventories Land 7,400 54,060 600,000 Buildings 1,650,000 Accumulated Depreciation-Buildings 791,250 Equipment 1,340,400 Accumulated Depreciation Equipment 604,512 Vouchers Payable 45,180 Due to Other Funds 4,600 Accrued Payroll and Fringe Benefits 166,720 Net Position Net Investment in Capital Assets 2,194,638 Net Position Totals Required Unrestricted 202,308 $4.013.960 $4.013.960 a. Open a general journal as of December 31, 2022, for the Solid Waste Disposal Fund by entering each of the accounts and amounts shown in the above post-closing trial balance. Enter 2022 from the drop-down [Year] menu. Each of the account titles will be found in the drop-down menu [Account] in the [Journal] view of the program. Be sure to enter 7-a as your paragraph number in the [Add description] box and enter the appropriate paragraph number for all subsequent journal entries. Verify the accuracy of your journal entry and post it to the general ledger by clicking [Post entries]. Unless your instructor specifies electronic submission, print a post-closing trial balance as of December 31, 2022, and retain it in your cumulative file until directed by your instructor to submit it. b. Record the following events and transactions, which occurred during the year ended December 31, 2023. Be sure that 2023 appears in the [Year] menu. 1. [Para. 7-b-1] Billings to customers for Charges for Services of the Solid Waste Disposal Fund totaled $2,618,263 for the year, which included $38,500 billed to City of Smithville departments accounted for in the General Fund. For the amount billed to City of Smithville departments you should debit Due from Other Funds. 2. [Para. 7-b-2] Equipment costing $459,600 was purchased on July 1, 2023. Cash in the amount of $159,600 was paid at the time of purchase; the vendor accepted revenue anticipation notes in the amount of $300,000 to finance the remainder of the equipment. Of this amount, $150,000 of the notes will be payable on July 1, 2024; the other $150,000 will be payable on July 1, 2025. All notes bear interest at the rate of 3.25 percent per year. Record only the purchase and the related payment of cash and issuance of notes at this time; interest will be recorded in a later transaction. 3. [Para. 7-b-3] Vouchers for materials and supplies to be used in the operations of the fund were issued in the total amount of $896,320 (debit Inventories). 4. [Para. 7-b-4] Collections from customers totaled $2,639,850 during 2023. This amount included $42,800 collected from the General Fund (see 7-a balance and 7- b-1 above). 5. [Para. 7-b-5] Payrolls and fringe benefits paid in cash during the year totaled $1,483,358 including the amount accrued at December 31, 2022. 6. [Para. 7-b-6] Vouchers in the amount of $855,900 and the amount Due to Other Funds were paid during the year. 7. [Para. 7-b-7] Accrued salaries and fringe benefits at year-end amounted to $27,429. Inventories of materials and supplies used in operations during the year amounted to $875,797, at cost. 8. [Para. 7-b-8] The city uses the following annual straight-line depreciation rates: Buildings, 2.5 percent; Equipment, 20 percent (equipment purchased during the year need not be depreciated because it was not held for more than 6 months of the year). Apply these rates to the original cost of buildings and equipment as of December 31, 2022, assuming no residual or salvage value. 9. [Para. 7-b-9] Interest of $4,875 had accrued on the notes payable as of year-end (see transaction 7-b-2). 10. [Para. 7-b-10] Management decided to increase the allowance for doubtful accounts by $973 at year-end. 11. After verifying the accuracy of all entries for the preceding transactions, post amounts to the general ledger accounts by clicking [Post entries]. c. Prepare entries to close all operating statement accounts at the end of 2023 and to reclassify the two net position accounts, as appropriate. Be sure that the check mark for [Closing Entry] is on for each account being closed and that "Closing Entries" appears in the [Add description] box. When completed, post the closing entries to the general ledger by clicking [Post entries]. d. Click on [File/Export] to export a post-closing trial balance for year 2023 and use Excel to prepare a statement of net position (see Illustration 7-6 in textbook) for the Solid Waste Disposal Fund as of December 31, 2023. e. Export a pre-closing trial balance for year 2023, and use Excel to prepare a statement of revenues, expenses, and changes in net position (see Illustration 7-7 in textbook) for the Solid Waste Disposal Fund for the year ended December 31, 2023. Interest expense should be considered a nonoperating item. f. Use the post-closing trial balance for year 2022 from Part a of this chapter and the trial balances from parts d and e above to prepare and save an Excel version statement of cash flows (see Illustration 7-8 in textbook) for the Solid Waste Disposal Fund for the year ended December 31, 2023. Before closing the City of Smithville it is recommended that you save a backup copy of your work to another location by clicking on [File] and [Save As].

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address the question regarding the City of Smithvilles Solid Waste Disposal Fund transactions and trial balance lets break down the necessary steps ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started