Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The common stock for Southern Sofa Company (SSC) is currently selling for $27.50. Earnings for the year just completed were $1.10 per share, giving the

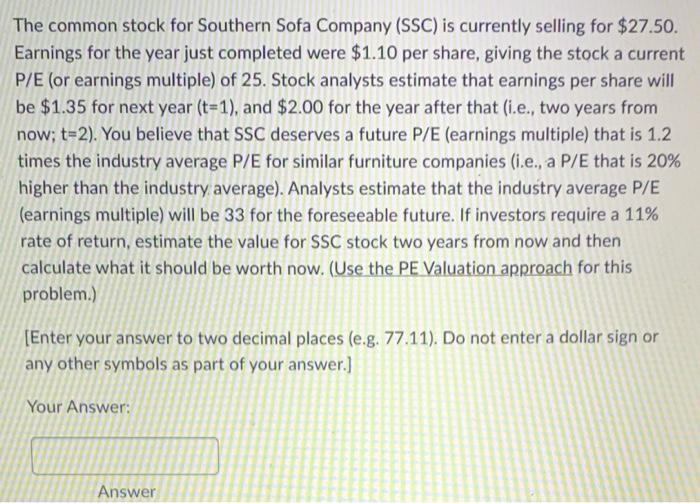

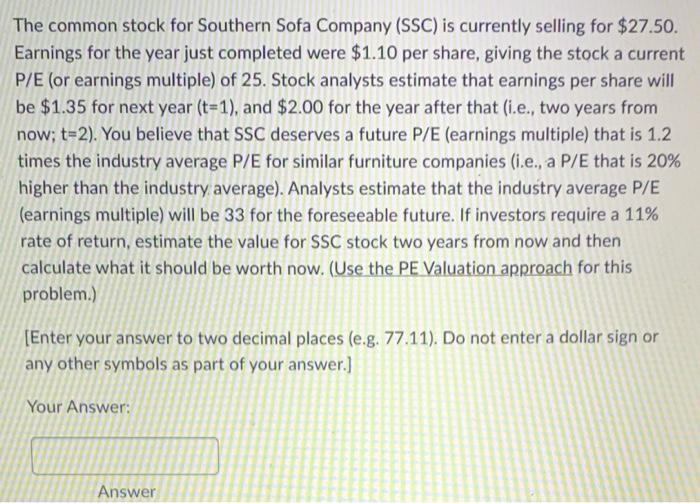

The common stock for Southern Sofa Company (SSC) is currently selling for $27.50. Earnings for the year just completed were $1.10 per share, giving the stock a current P/E (or earnings multiple) of 25. Stock analysts estimate that earnings per share will be $1.35 for next year (t-1), and $2.00 for the year after that (i.e., two years from now; t=2). You believe that SSC deserves a future P/E (earnings multiple) that is 1.2 times the industry average P/E for similar furniture companies (i.e., a P/E that is 20% higher than the industry average). Analysts estimate that the industry average P/E (earnings multiple) will be 33 for the foreseeable future. If investors require a 11% rate of return, estimate the value for SSC stock two years from now and then calculate what it should be worth now. (Use the PE Valuation approach for this problem.) [Enter your answer to two decimal places (e.g. 77.11). Do not enter a dollar sign or any other symbols as part of your answer.] Your

The common stock for Southern Sofa Company (SSC) is currently selling for $27.50. Earnings for the year just completed were $1.10 per share, giving the stock a current P/E (or earnings multiple) of 25. Stock analysts estimate that earnings per share will be $1.35 for next year (t-1), and $2.00 for the year after that (i.e., two years from now; t=2). You believe that SSC deserves a future P/E (earnings multiple) that is 1.2 times the industry average P/E for similar furniture companies (i.e., a P/E that is 20% higher than the industry average). Analysts estimate that the industry average P/E (earnings multiple) will be 33 for the foreseeable future. If investors require a 11% rate of return, estimate the value for SSC stock two years from now and then calculate what it should be worth now. (Use the PE Valuation approach for this problem.) [Enter your answer to two decimal places (e.g. 77.11). Do not enter a dollar sign or any other symbols as part of your answer.] Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started