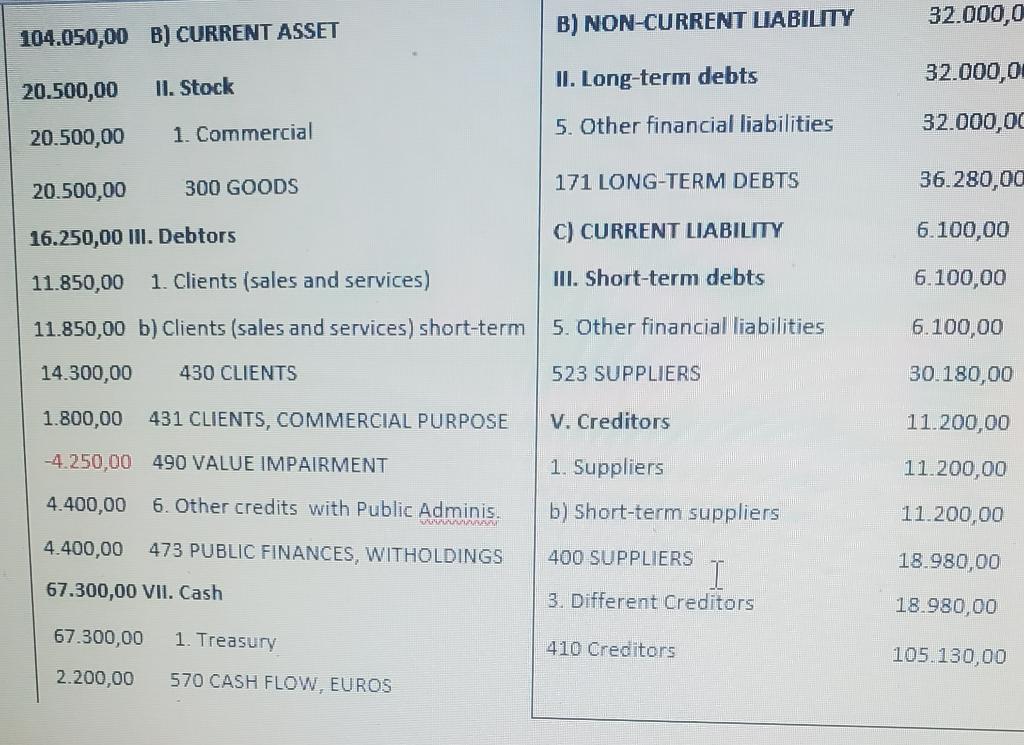

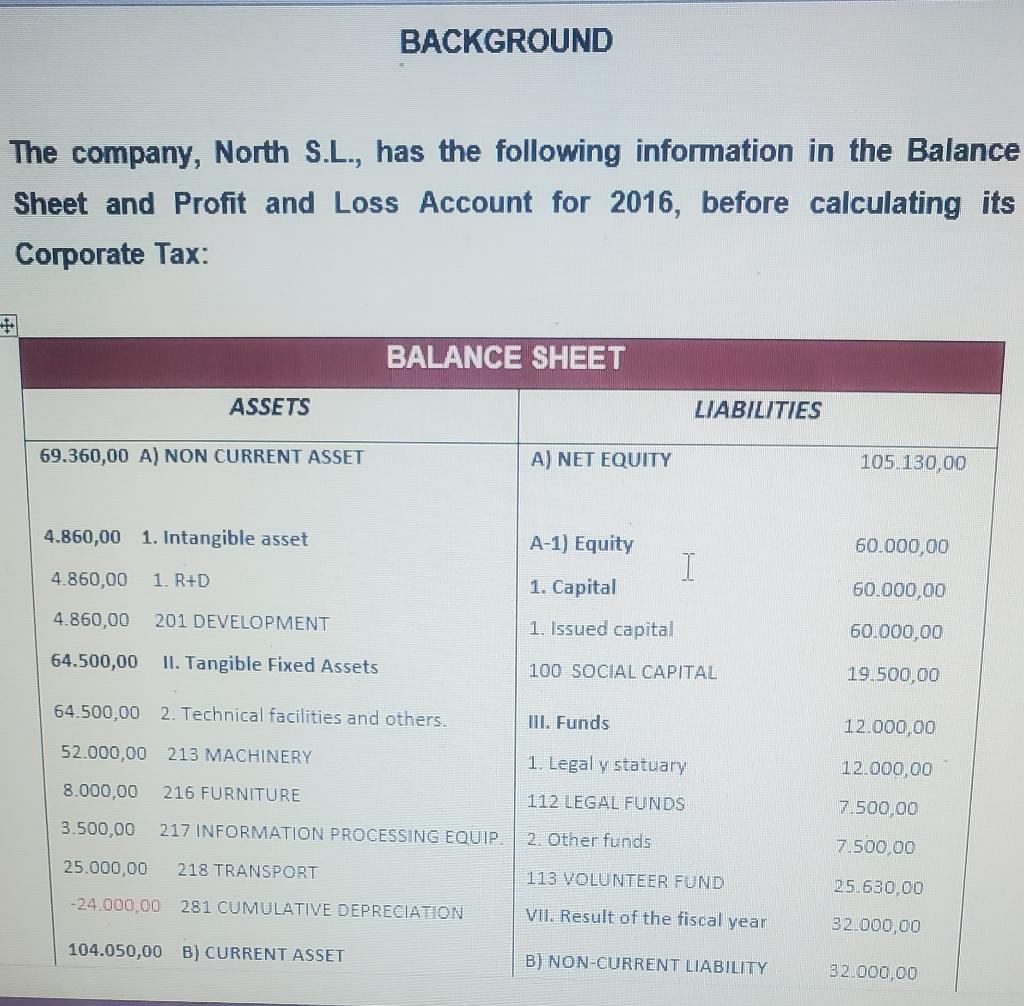

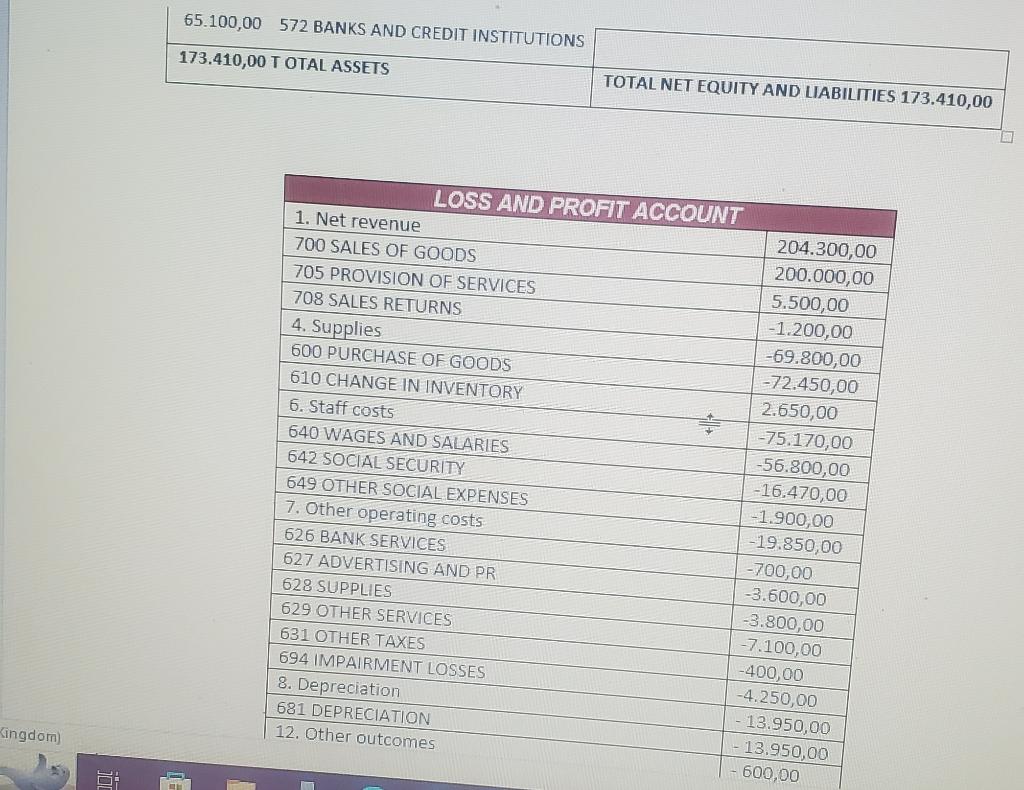

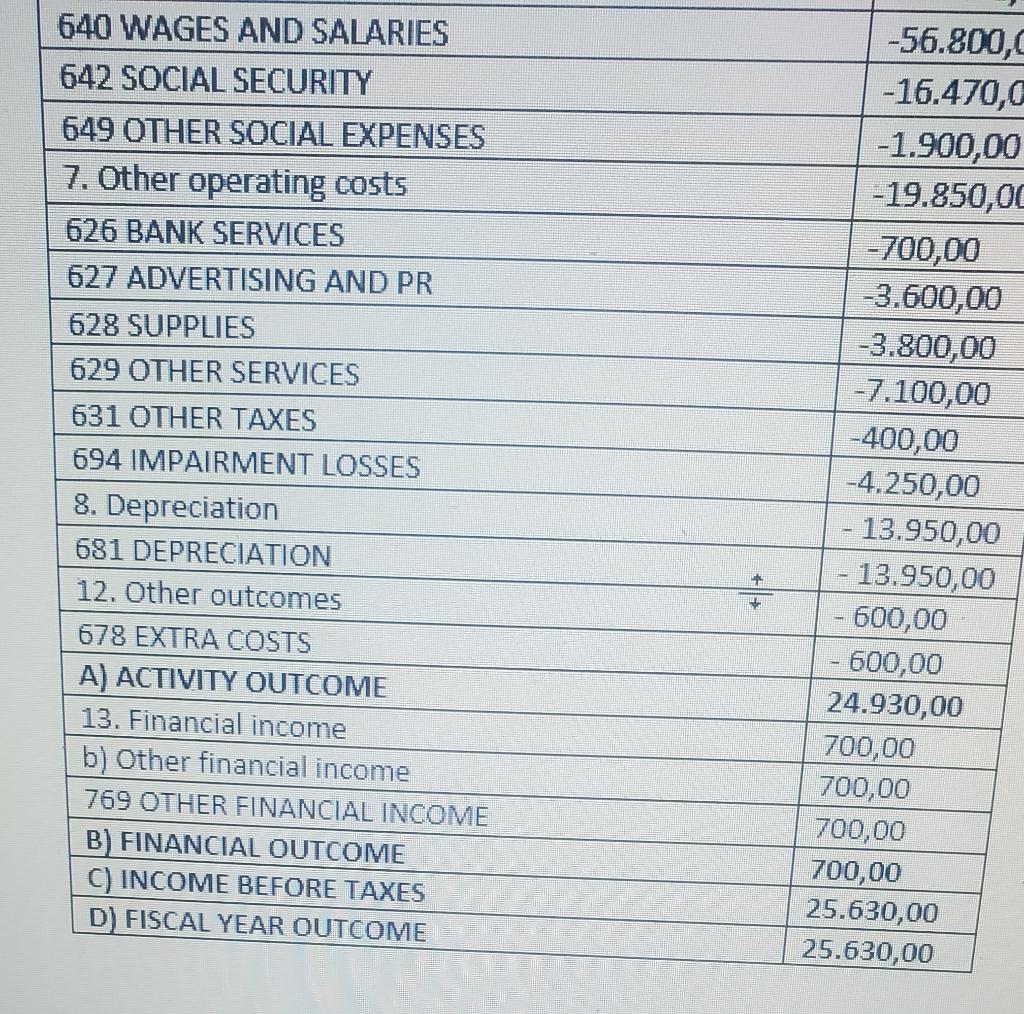

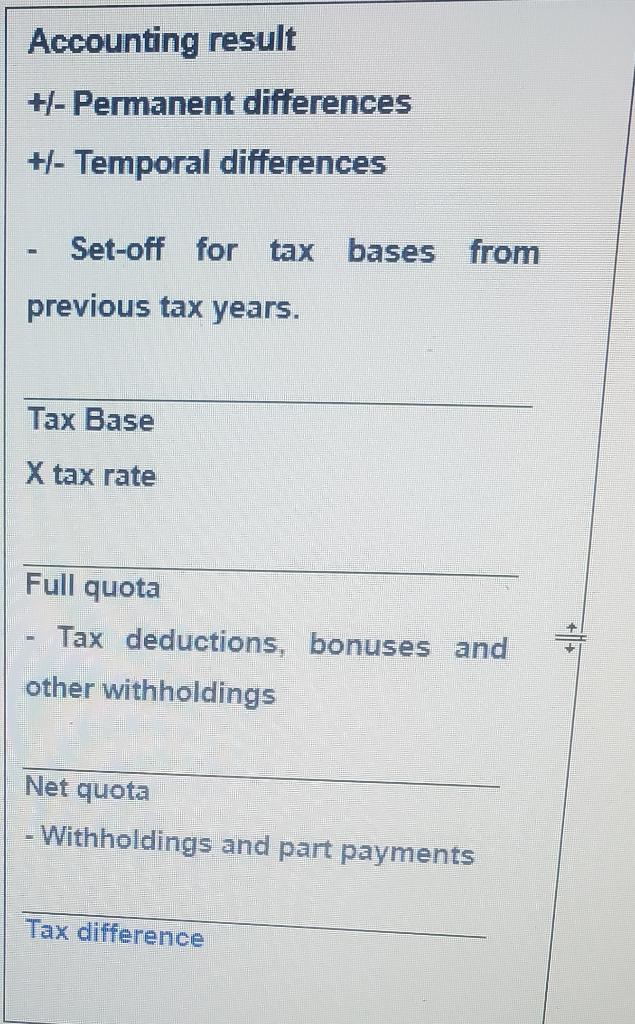

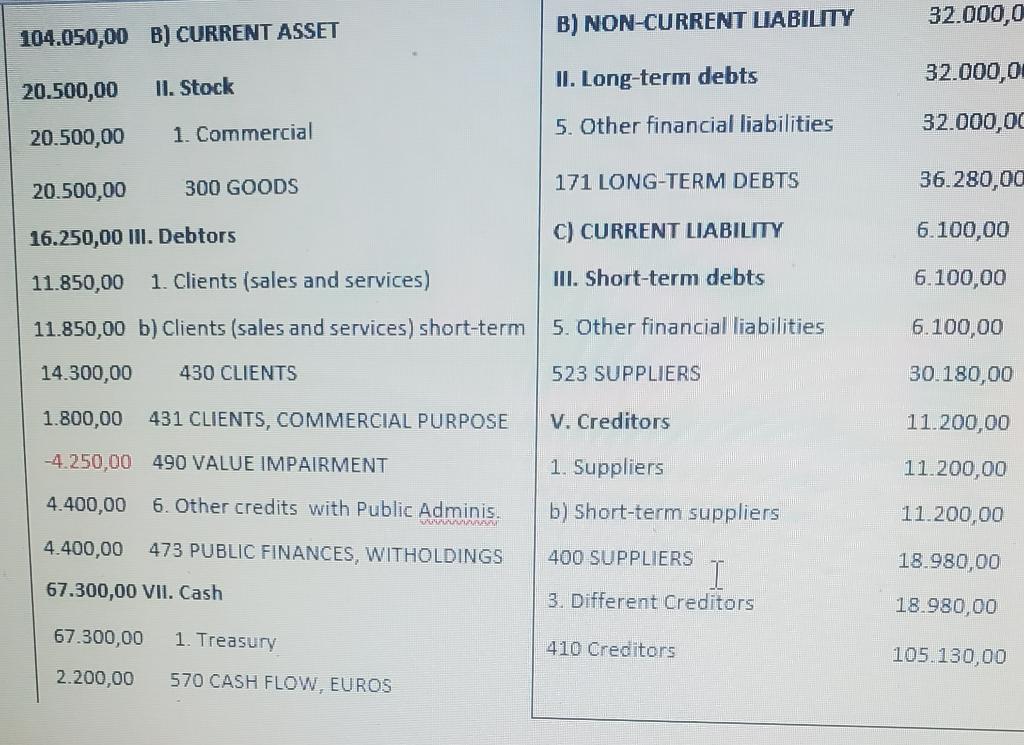

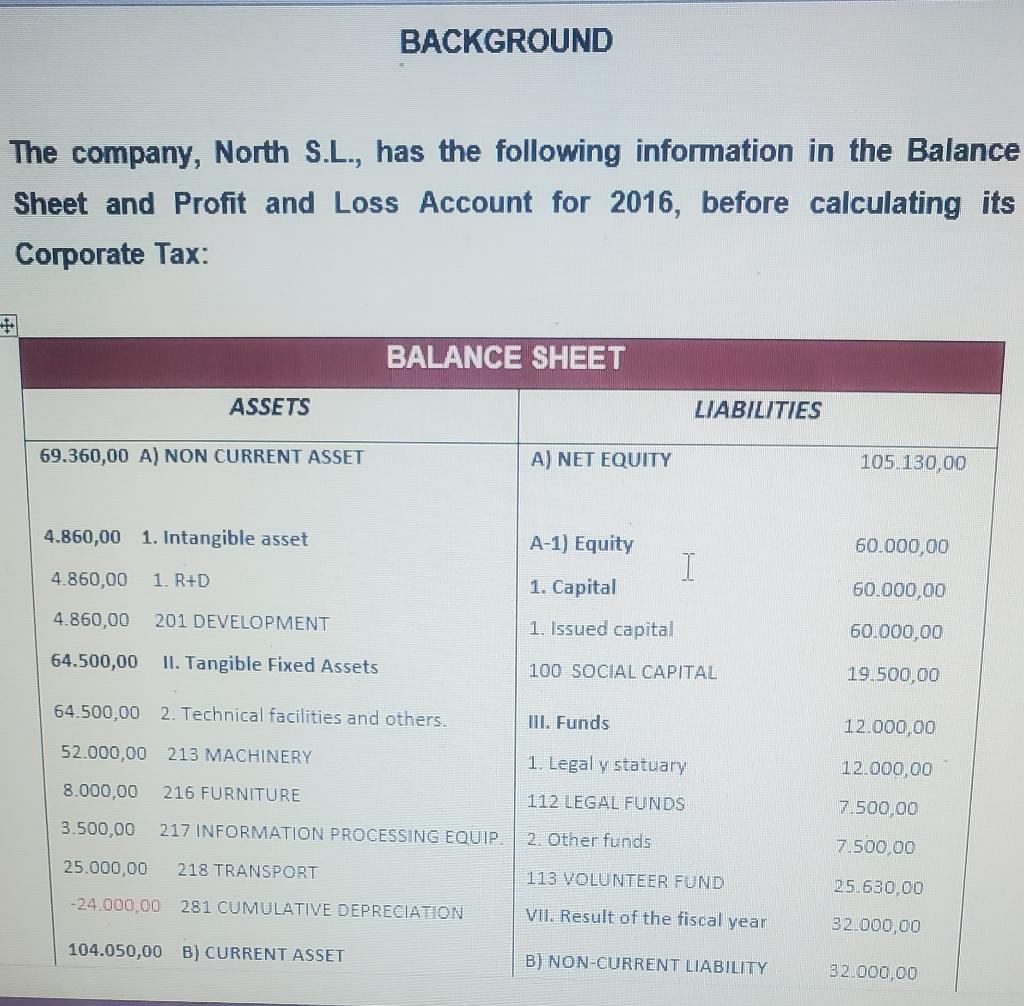

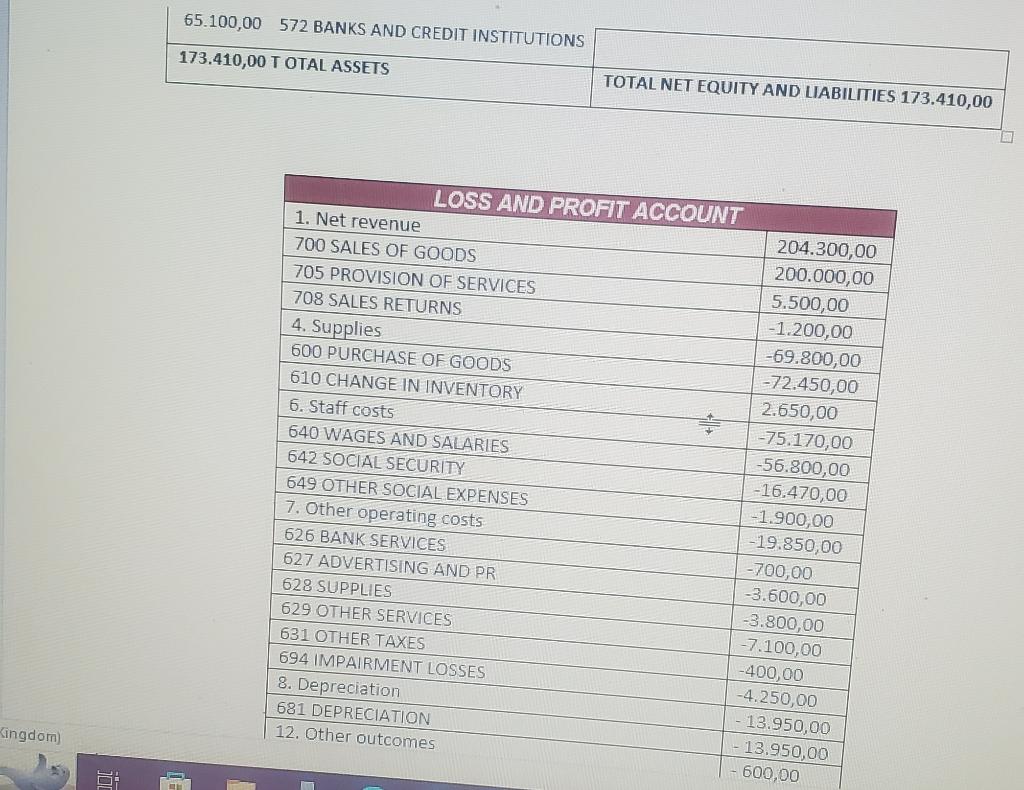

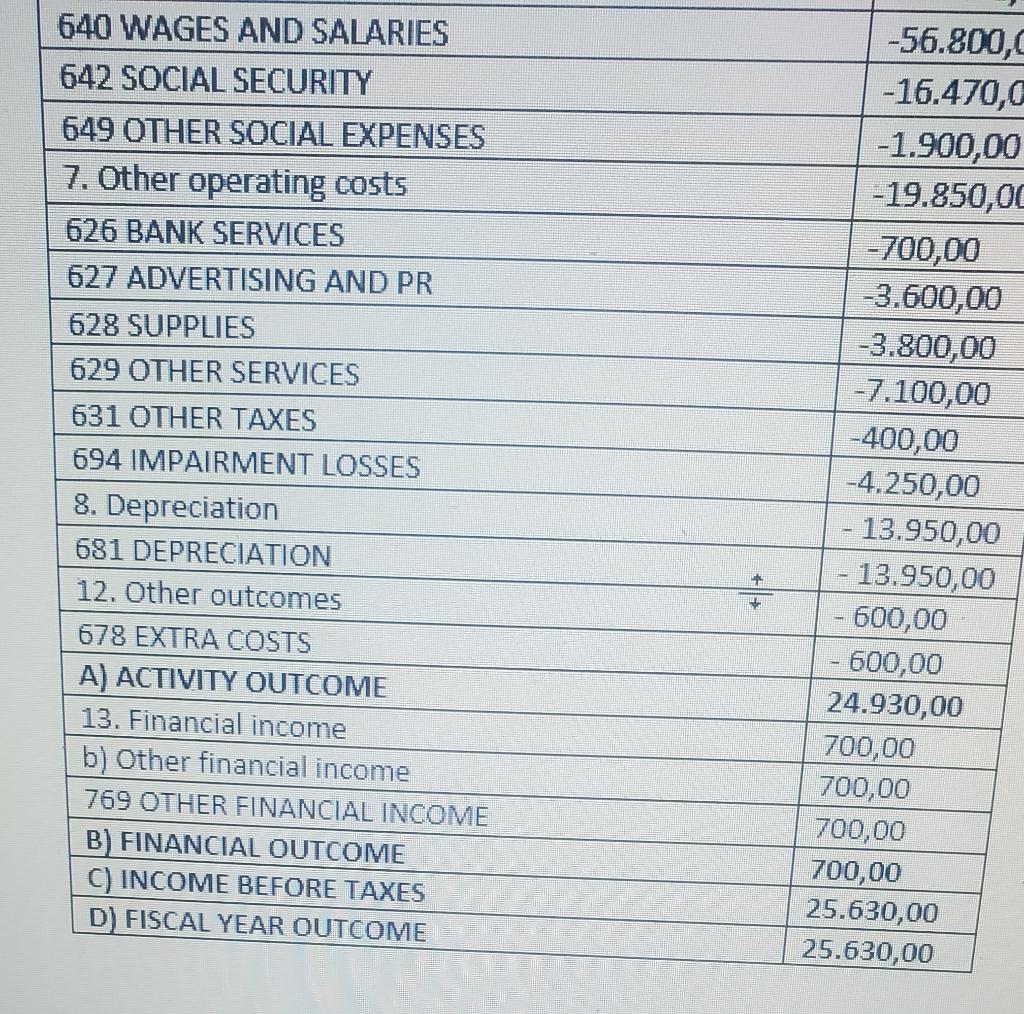

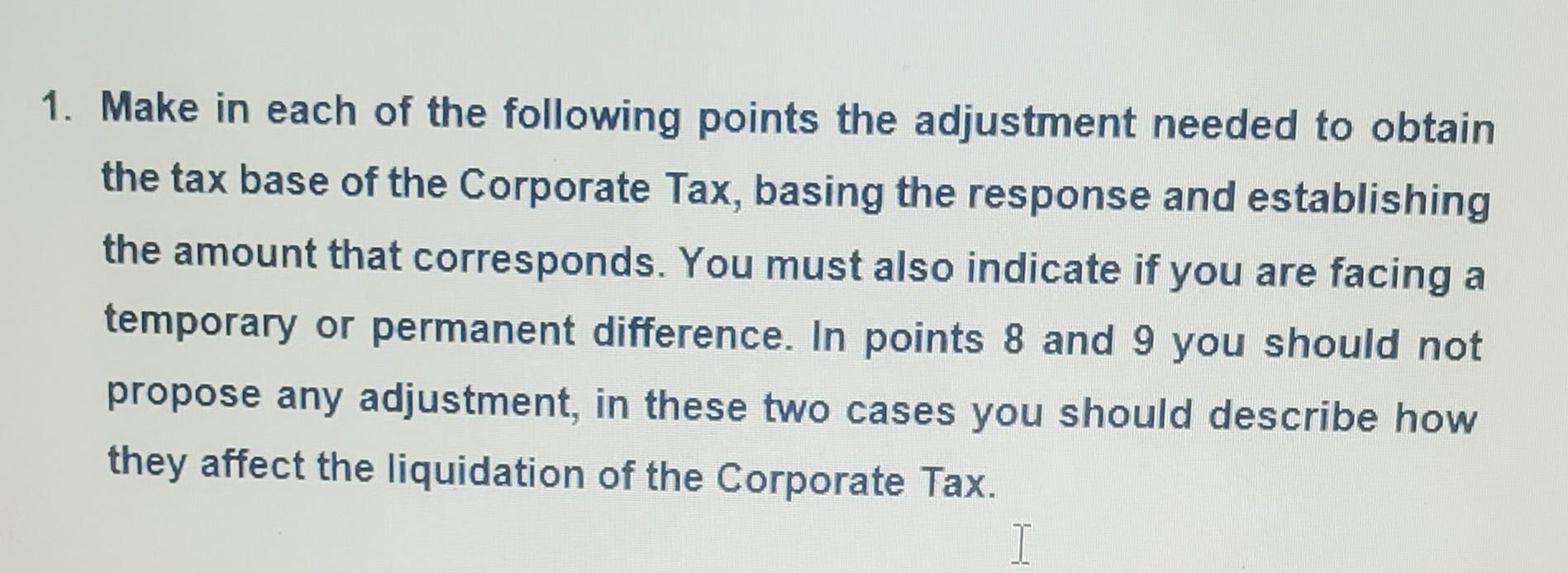

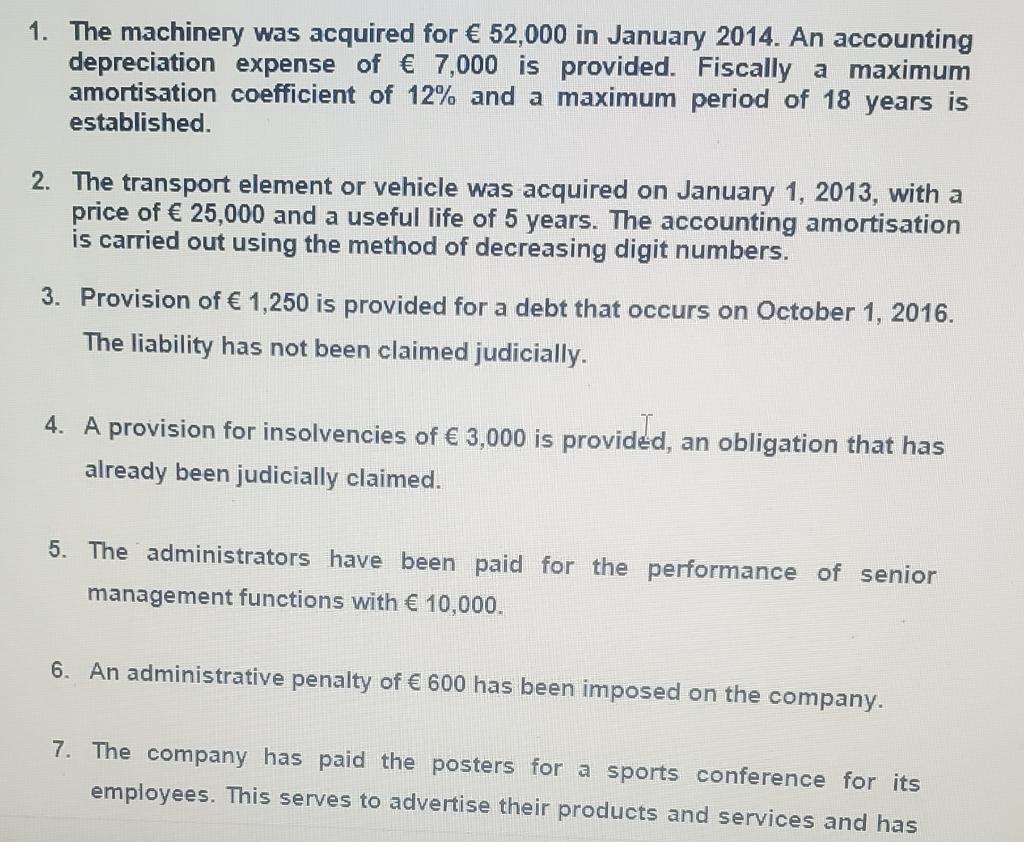

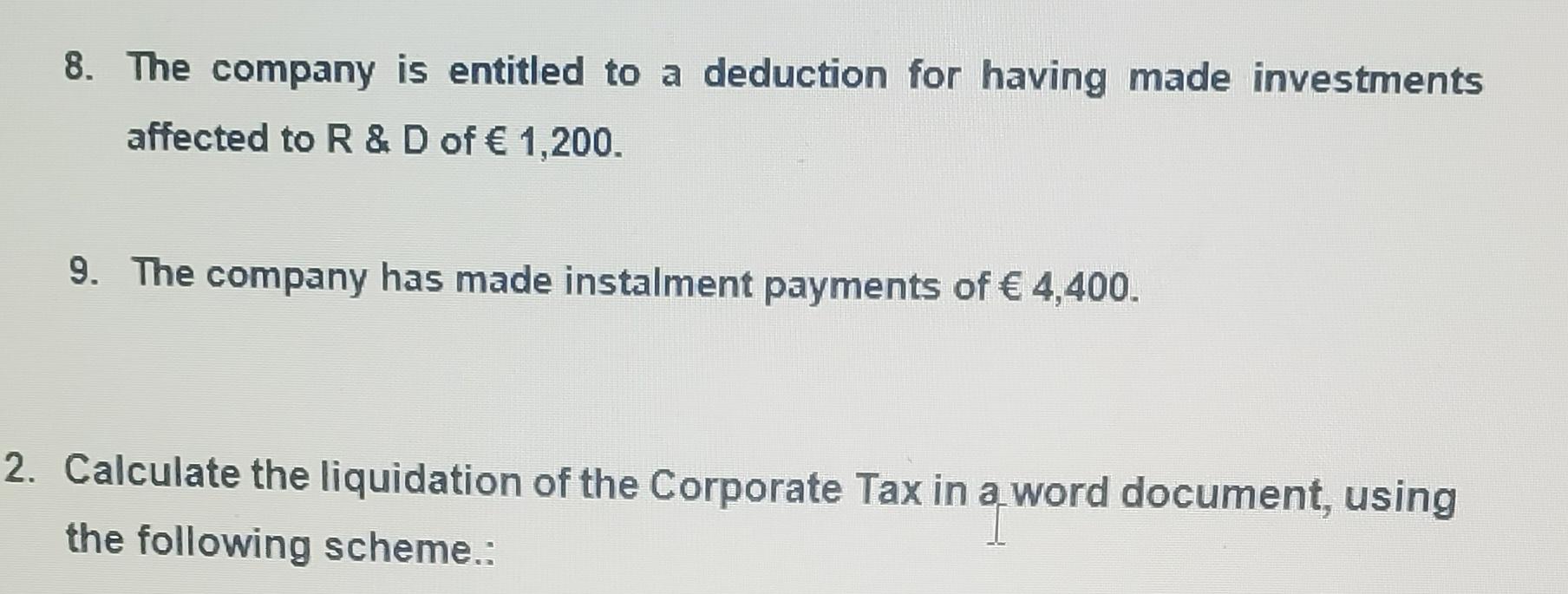

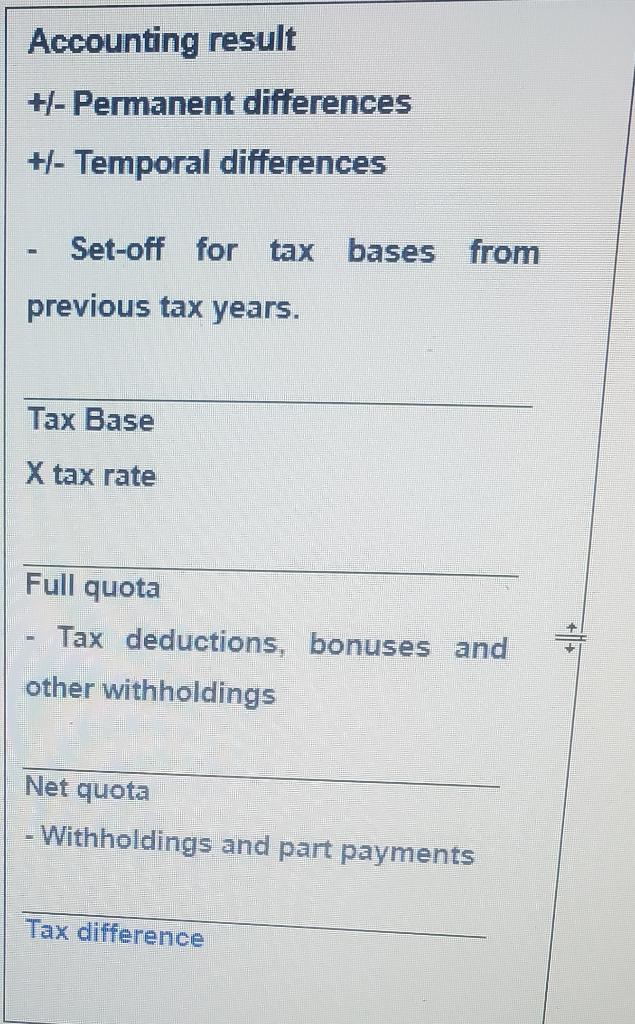

The company, North S.L., has the following information in the Balance Sheet and Profit and Loss Account for 2016, before calculating its Corporate Tax: \begin{tabular}{|l|l|} \hline 640 WAGES AND SALARIES & 56.800,0 \\ \hline 642 SOCIAL SECURITY & 16.470,0 \\ \hline 649 OTHER SOCIAL EXPENSES & 1.900,00 \\ \hline 7. Other operating costs & 19.850,00 \\ \hline 626 BANK SERVICES & 700,00 \\ \hline 627 ADVERTISING AND PR & 3.600,00 \\ \hline 628 SUPPLIES & 3.800,00 \\ \hline 629 OTHER SERVICES & 7.100,00 \\ \hline 631 OTHER TAXES & 400,00 \\ \hline 694 IMPAIRMENT LOSSES & 4.250,00 \\ \hline 8. Depreciation & 13.950,00 \\ \hline 681 DEPRECIATION & 13.950,00 \\ \hline 12. Other outcomes & 600,00 \\ \hline 678 EXTRA COSTS & 600,00 \\ \hline A) ACTIVITY OUTCOME & 24.930,00 \\ \hline 13. Financial income & 700,00 \\ \hline b) Other financial income & 700,00 \\ \hline 769 OTHER FINANCIAL INCOME & 700,00 \\ \hline B) FINANCIAL OUTCOME & 700,00 \\ \hline C) INCOME BEFORE TAXES & 25.630,00 \\ \hline D) FISCAL YEAR OUTCOME & 25.630,00 \\ \hline \end{tabular} 1. Make in each of the following points the adjustment needed to obtain the tax base of the Corporate Tax, basing the response and establishing the amount that corresponds. You must also indicate if you are facing a temporary or permanent difference. In points 8 and 9 you should not propose any adjustment, in these two cases you should describe how they affect the liquidation of the Corporate Tax. 1. The machinery was acquired for 52,000 in January 2014. An accounting depreciation expense of 7,000 is provided. Fiscally a maximum amortisation coefficient of 12% and a maximum period of 18 years is established. 2. The transport element or vehicle was acquired on January 1,2013 , with a price of 25,000 and a useful life of 5 years. The accounting amortisation is carried out using the method of decreasing digit numbers. 3. Provision of 1,250 is provided for a debt that occurs on October 1, 2016. The liability has not been claimed judicially. 4. A provision for insolvencies of 3,000 is provided, an obligation that has already been judicially claimed. 5. The administrators have been paid for the performance of senior management functions with 10,000. 6. An administrative penalty of 600 has been imposed on the company. 7. The company has paid the posters for a sports conference for its employees. This serves to advertise their products and services and has 8. The company is entitled to a deduction for having made investments affected to R&D of 1,200. 9. The company has made instalment payments of 4,400. Calculate the liquidation of the Corporate Tax in a word document, using the following scheme.: Accounting result +/- Permanent difierences + - Temporal differences - Set-off for tax bases from previous tax years