The companys accountant has discovered the following error. In the Adjusted file, insert rows at appropriate places for any omission or include correct figure where it is incorrect in the Data sheet to make the following adjustments as needed:

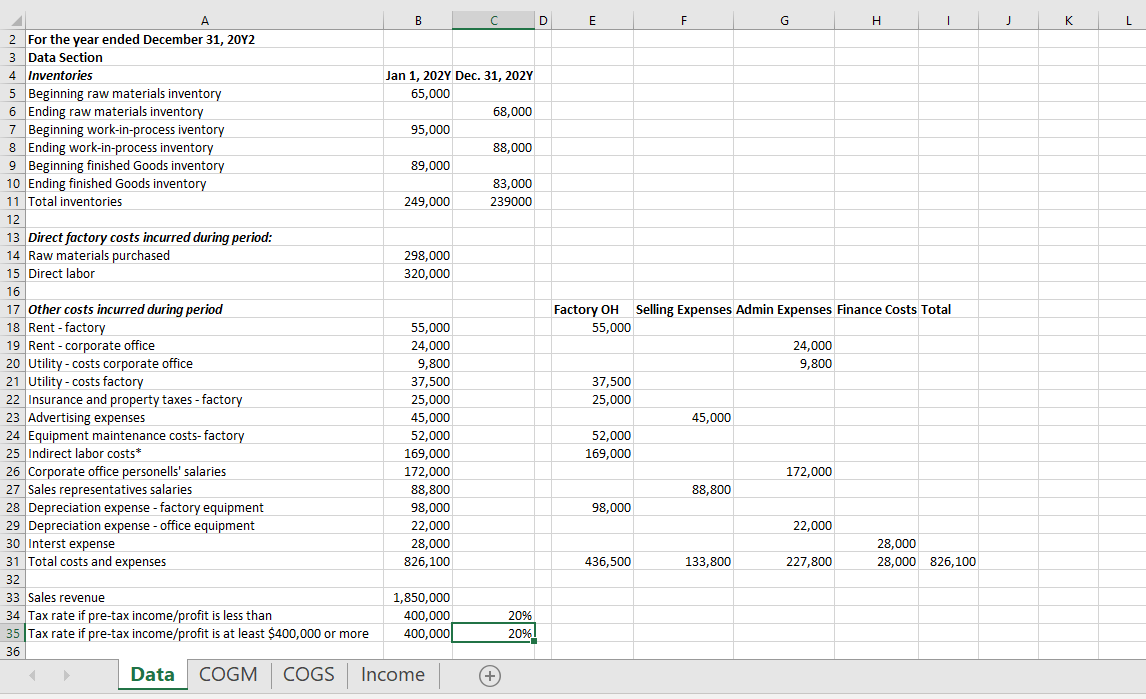

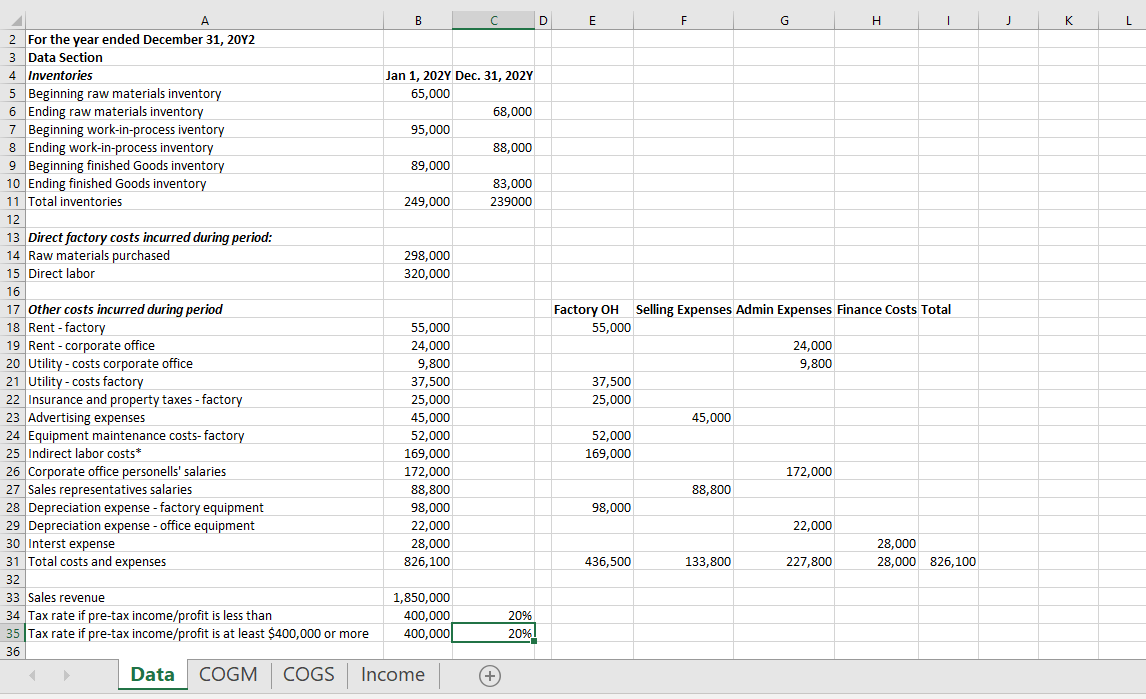

(i) (ii) The accountant did not account for the environmental emission tax due on the company's use of factory utility. The taxable penalty is equal to 20% of annual factory utilities and should be reported as a separate factory overhead cost. You should modify your Data sheet to include this extra factory overhead and allow for the % change to be modified in future years. Do not hard code this expense amount or add itet it off against the $37,500 of factory utilities for 20Y2. Do not use emission tax to calculate the company's income tax calculation. The following costs, expenses, and revenues were omitted or not recorded correctly in the original Data sheet and hence, must be included/amended in your Data sheet in the appropriate place: a. BDP is required to undertake proper disposal of its manufacturing waste under the state environmental protection authority. It was charged $30,000 for using the service of EnviroPro Inc. for safe waste disposal during the year. This safe factory waste disposal cost was omitted mistakenly while computing factory overhead costs for the year. b. Advertising expense was overstated by $10,000. C. Interest expense was understated by $8,000. d. The amount of revenue provided in the data sheet does not include $50,000 of sales on account. K L B D E G H I 2 For the year ended December 31, 20Y2 3 Data Section 4 Inventories Jan 1, 2027 Dec. 31, 202Y 5 Beginning raw materials inventory 65,000 6 Ending raw materials inventory 68,000 7 Beginning work-in-process iventory 95,000 8 Ending work-in-process inventory 88,000 9 Beginning finished Goods inventory 89,000 10 Ending finished Goods inventory 83,000 11 Total inventories 249,000 239000 12 13 Direct factory costs incurred during period: 14 Raw materials purchased 298,000 15 Direct labor 320,000 16 17 Other costs incurred during period Factory OH Selling Expenses Admin Expenses Finance Costs Total 18 Rent-factory 55,000 55,000 19 Rent - corporate office 24,000 24,000 20 Utility - costs corporate office 9,800 9,800 21 Utility - costs factory 37,500 37,500 22 Insurance and property taxes - factory 25,000 25,000 23 Advertising expenses 45,000 45,000 24 Equipment maintenance costs-factory 52,000 52,000 25 Indirect labor costs* 169,000 169,000 26 Corporate office personells' salaries 172,000 172,000 27 Sales representatives salaries 88,800 88,800 28 Depreciation expense - factory equipment 98,000 98,000 29 Depreciation expense - office equipment 22,000 22,000 30 Interst expense 28,000 28,000 31 Total costs and expenses 826,100 436,500 133,800 227,800 28,000 826,100 32 33 Sales revenue 1,850,000 34 Tax rate if pre-tax income/profit is less than 400,000 20% 35 Tax rate if pre-tax income/profit is at least $400,000 or more 400,000) 20% 36 Data COGM COGS Income +