Question

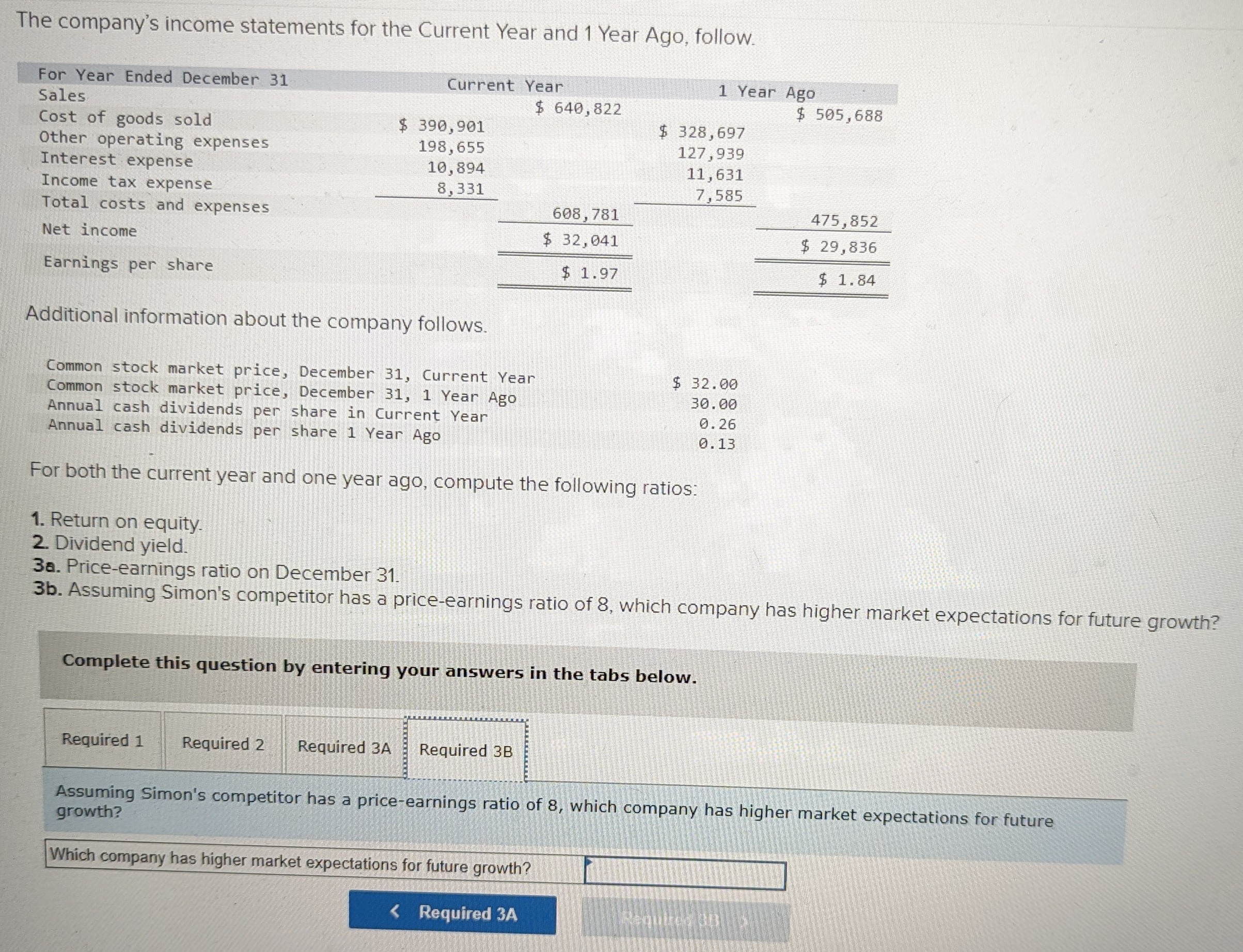

The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Current Year 1 Year Ago Sales $

The company's income statements for the Current Year and 1 Year Ago, follow.

For Year Ended December 31

Current Year

1 Year Ago

Sales

$ 640,822

$ 505,688

Cost of goods sold

$390,901

$ 328,697

Other operating expenses Interest expense

198,655

10,894

127,939

11,631

Income tax expense

Total costs and expenses

8,331

7,585

608,781

475,852

$29,836

Net income

$32,041

Earnings per share

$ 1.97

$1.84

Additional information about the company follows.

Common stock market price, December 31, Current Year

$32.00

30.00

Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year

Annual cash dividends per share 1 Year Ago

0.26

0.13

For both the current year and one year ago, compute the following ratios:

1. Return on equity.

2. Dividend yield.

30. Price-earnings ratio on December 31.

3b. Assuming Simon's competitor has a price-earnings ratio of 8, which company has higher market expectations for future growth?

The company's income statements for the Current Year and 1 Year Ago, follow. Additional information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 8, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Assuming Simon's competitor has a price-earnings ratio of 8 , which company has higher market expectations for future growth? Which company has higher market expectations for future growth

The company's income statements for the Current Year and 1 Year Ago, follow. Additional information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 8, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Assuming Simon's competitor has a price-earnings ratio of 8 , which company has higher market expectations for future growth? Which company has higher market expectations for future growth Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started