Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The comparative balance sheets of Loop Movie Theater Company at September 30, 2021 and 2020, reported the following: (Click the icon to view the balance

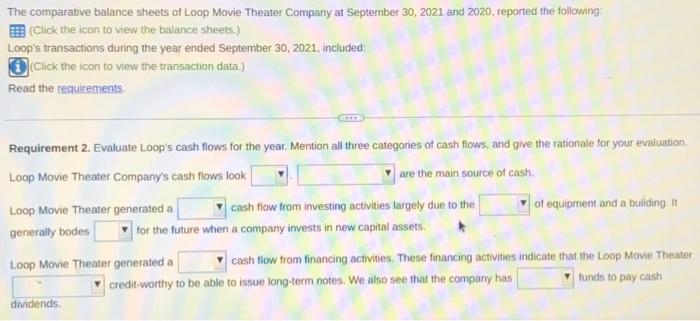

The comparative balance sheets of Loop Movie Theater Company at September 30, 2021 and 2020, reported the following: (Click the icon to view the balance sheets.) Loop's transactions during the year ended September 30, 2021, included: (Click the icon to view the transaction data.) Read the requirements. Requirement 2. Evaluate Loop's cash flows for the year. Mention all three categories of cash flows, and give the rationale for your evaluation. Loop Movie Theater Company's cash flows look are the main source of cash. Loop Movie Theater generated a generally bodes dividends. cash flow from investing activities largely due to the for the future when a company invests in new capital assets. Loop Movie Theater generated a of equipment and a building. It cash flow from financing activities. These financing activities indicate that the Loop Movie Theater funds to pay cash credit-worthy to be able to issue long-term notes. We also see that the company has

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started