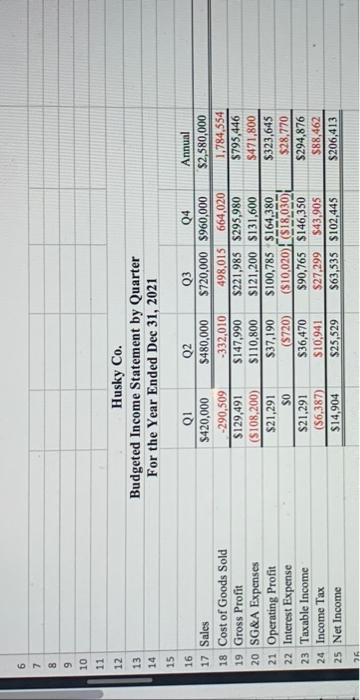

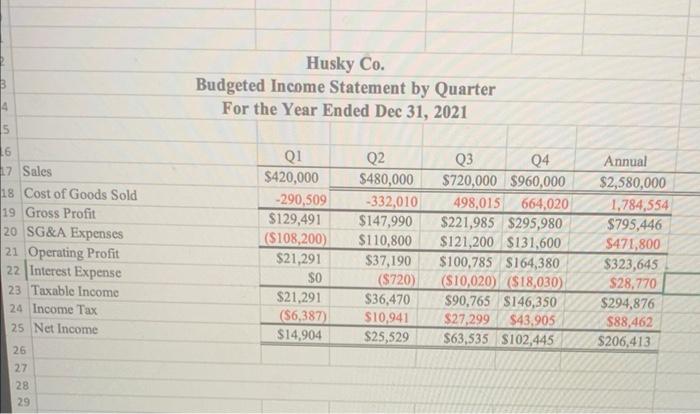

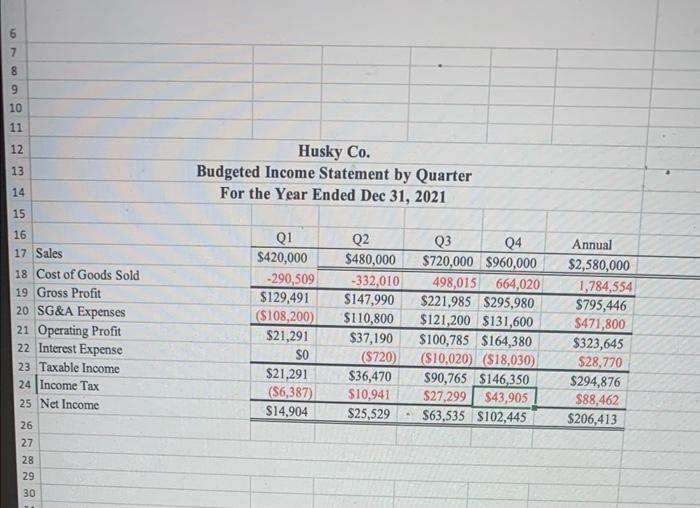

the completed income statement is needed to answer the cash budget

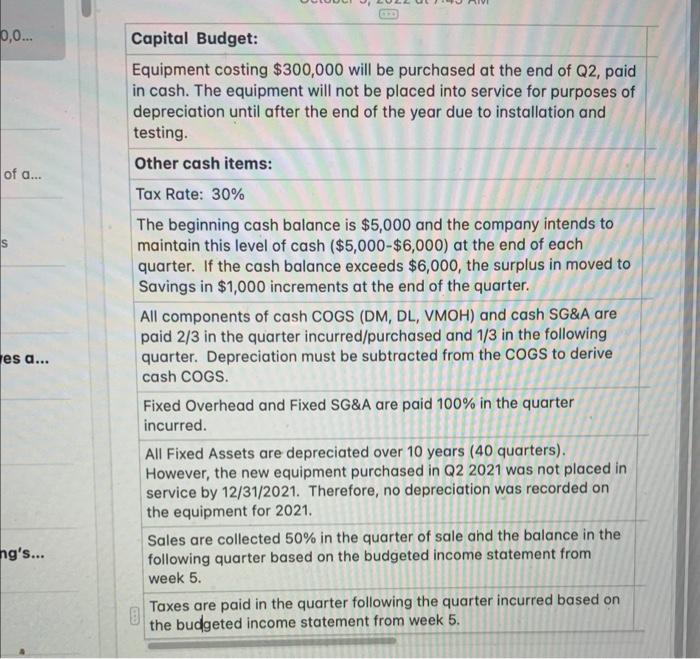

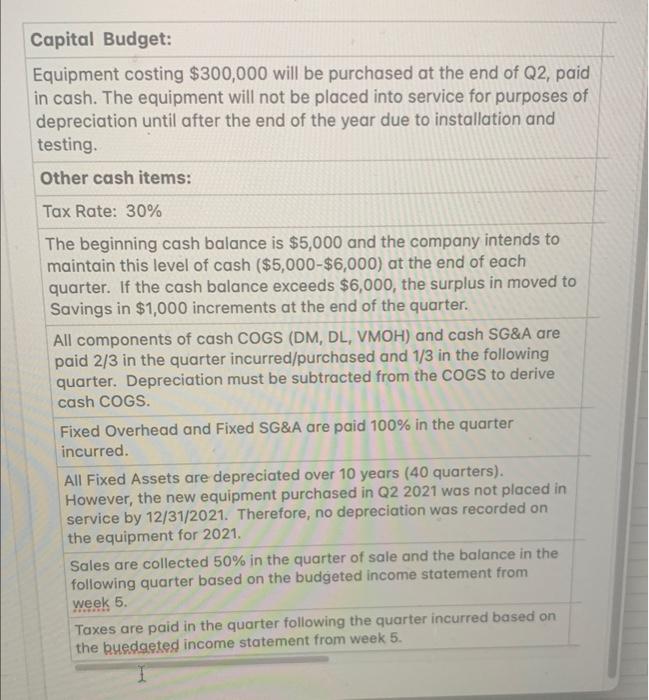

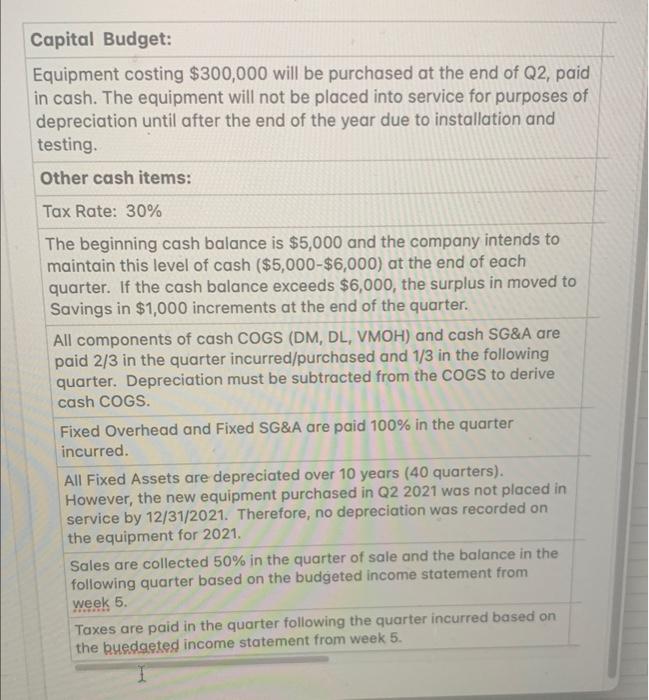

this is the information needed to answer the cash budget chart

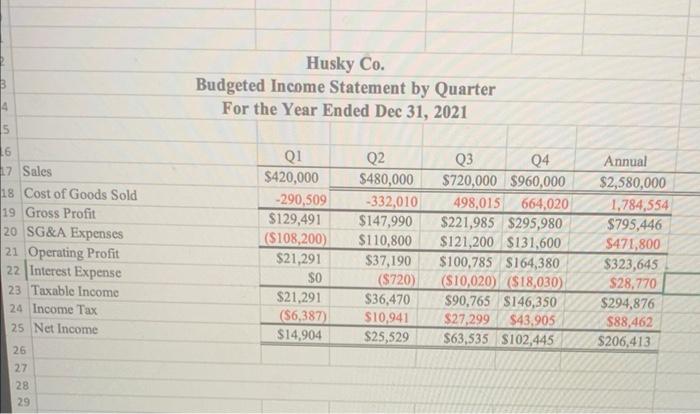

income chart from week 5

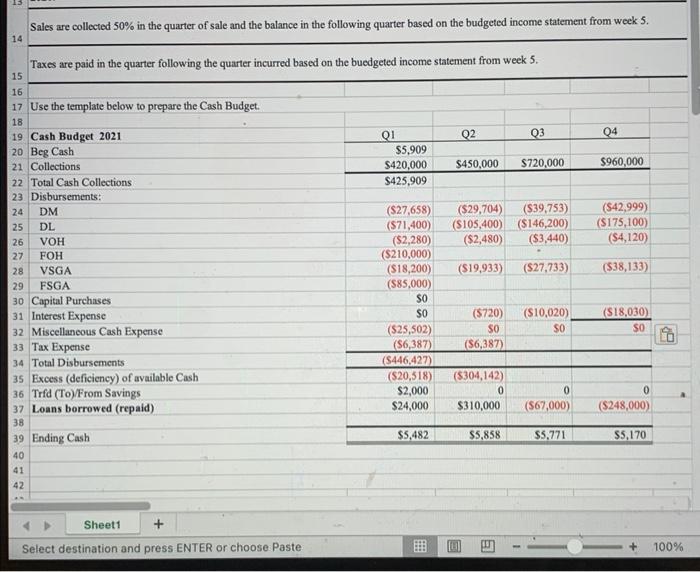

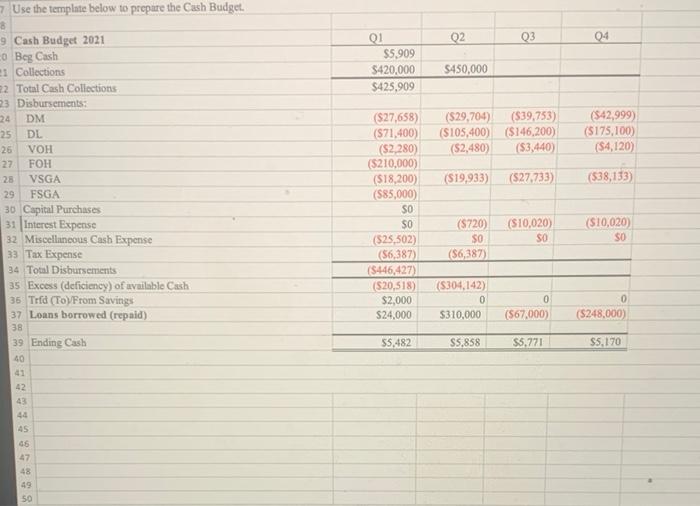

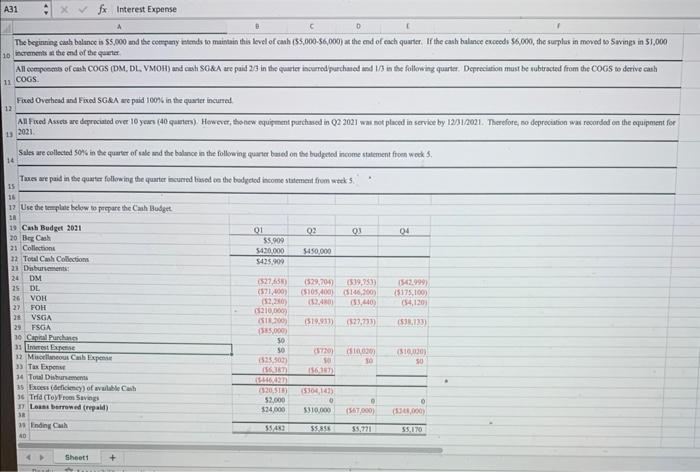

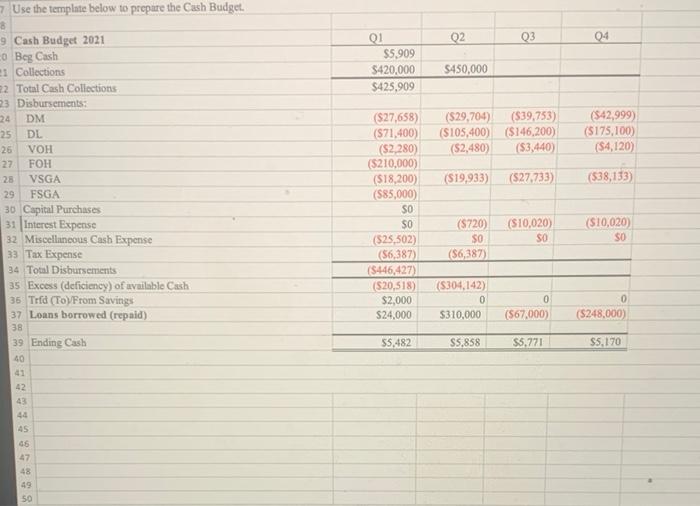

cash budget chart needs to be completed

\begin{tabular}{|l|l|l|} \hline 6 & & \\ \hline 7 & & \\ \hline 8 & & \\ \hline 9 & & \\ \hline 10 & & \\ \hline 11 & Husky Co. \\ \hline 12 & Budgeted Income Stateme \end{tabular} 13 Budgeted Income Statement by Quarter \begin{tabular}{|l|l|} 14 & For the Year Ended Dec 31, 2021 \\ \hline 15 & \end{tabular} 11 cogs. FiodovehadandFirodSGesarepu 1) 2021 19 in Cuih Bedzet 2021 22. Toal Cah Colofer 3) Lasei berroned (mpaid) is Endiny Cuh 40 4 > sheet + Capital Budget: Equipment costing $300,000 will be purchased at the end of Q2, paid in cash. The equipment will not be placed into service for purposes of depreciation until after the end of the year due to installation and testing. Other cash items: Tax Rate: 30% The beginning cash balance is $5,000 and the company intends to maintain this level of cash ($5,000$6,000) at the end of each quarter. If the cash balance exceeds $6,000, the surplus in moved to Savings in $1,000 increments at the end of the quarter. All components of cash COGS (DM, DL, VMOH) and cash SG\&A are paid 2/3 in the quarter incurred/purchased and 1/3 in the following quarter. Depreciation must be subtracted from the COGS to derive cash COGS. Fixed Overhead and Fixed SG\&A are paid 100% in the quarter incurred. All Fixed Assets are depreciated over 10 years ( 40 quarters). However, the new equipment purchased in Q2 2021 was not placed in service by 12/31/2021. Therefore, no depreciation was recorded on the equipment for 2021 . Sales are collected 50% in the quarter of sale and the balance in the following quarter based on the budgeted income statement from week 5. Taxes are paid in the quarter following the quarter incurred based on the buedgeted income statement from week 5. Husky Co. Budgeted Income Statement by Quarter For the Year Ended Dec 31, 2021 28 29 Use the template below to prepare the Cash Budget. Sales are collected 50% in the quarter of sale and the balance in the following quarter based on the budgeted income statement from week 5. \begin{tabular}{|c|l|} \hline 6 & \\ \hline 7 & \\ 8 & \\ \hline 9 & \\ \hline 10 & \\ 11 & \\ 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & \\ \hline 17 & Sales \\ \hline \end{tabular} Budgeted Income Statement by Quarter For the Year Ended Dec 31, 2021 18 Cost of Goods Sold \begin{tabular}{ll} 19 & Gross Profit \\ 20 & SG\&A Expenses \\ \hline 21 & Operating Profit \end{tabular} 21 Operating Profit 22 Interest Expense 23 Taxable Income 24 Income Tax 25 Net Income \begin{tabular}{|r|r|r|r|r|} \hline \multicolumn{1}{|c|}{ Q1 } & \multicolumn{1}{c|}{ Q2 } & \multicolumn{1}{c|}{ Q3 } & \multicolumn{1}{c|}{ Q4 } & \multicolumn{1}{|c|}{ Annual } \\ \hline$420,000 & $480,000 & $720,000 & $960,000 & $2,580,000 \\ \hline290,509 & 332,010 & 498,015 & 664,020 & 1,784,554 \\ \hline$129,491 & $147,990 & $221,985 & $295,980 & $795,446 \\ \hline($108,200) & $110,800 & $121,200 & $131,600 & $471,800 \\ \hline$21,291 & $37,190 & $100,785 & $164,380 & $323,645 \\ \hline$0 & ($720) & ($10,020) & ($18,030) & $28,770 \\ \hline$21,291 & $36,470 & $90,765 & $146,350 & $294,876 \\ \hline($6,387) & $10,941 & $27,299 & $43,905 & $88,462 \\ \hline$14,904 & $25,529 & $63,535 & $102,445 & $206,413 \\ \hline \hline \end{tabular} Capital Budget: Equipment costing $300,000 will be purchased at the end of Q2, paid in cash. The equipment will not be placed into service for purposes of depreciation until after the end of the year due to installation and testing. Other cash items: Tax Rate: 30% The beginning cash balance is $5,000 and the company intends to maintain this level of cash ($5,000$6,000) at the end of quarter. If the cash balance exceeds $6,000, the surplus in moved to Savings in $1,000 increments at the end of the quarter. All components of cash COGS (DM, DL, VMOH) and cash SG\&A are paid 2/3 in the quarter incurred/purchased and 1/3 in the following quarter. Depreciation must be subtracted from the COGS to derive cash COGS. Fixed Overhead and Fixed SG\&A are paid 100\% in the quarter incurred. All Fixed Assets are depreciated over 10 years ( 40 quarters). However, the new equipment purchased in Q2 2021 was not placed in service by 12/31/2021. Therefore, no depreciation was recorded on the equipment for 2021. Sales are collected 50% in the quarter of sale and the balance in the following quarter based on the budgeted income statement from week 5. Taxes are paid in the quarter following the quarter incurred based on the budgeted income statement from week 5. \begin{tabular}{|l|l|l|} \hline 6 & & \\ \hline 7 & & \\ \hline 8 & & \\ \hline 9 & & \\ \hline 10 & & \\ \hline 11 & Husky Co. \\ \hline 12 & Budgeted Income Stateme \end{tabular} 13 Budgeted Income Statement by Quarter \begin{tabular}{|l|l|} 14 & For the Year Ended Dec 31, 2021 \\ \hline 15 & \end{tabular} 11 cogs. FiodovehadandFirodSGesarepu 1) 2021 19 in Cuih Bedzet 2021 22. Toal Cah Colofer 3) Lasei berroned (mpaid) is Endiny Cuh 40 4 > sheet + Capital Budget: Equipment costing $300,000 will be purchased at the end of Q2, paid in cash. The equipment will not be placed into service for purposes of depreciation until after the end of the year due to installation and testing. Other cash items: Tax Rate: 30% The beginning cash balance is $5,000 and the company intends to maintain this level of cash ($5,000$6,000) at the end of each quarter. If the cash balance exceeds $6,000, the surplus in moved to Savings in $1,000 increments at the end of the quarter. All components of cash COGS (DM, DL, VMOH) and cash SG\&A are paid 2/3 in the quarter incurred/purchased and 1/3 in the following quarter. Depreciation must be subtracted from the COGS to derive cash COGS. Fixed Overhead and Fixed SG\&A are paid 100% in the quarter incurred. All Fixed Assets are depreciated over 10 years ( 40 quarters). However, the new equipment purchased in Q2 2021 was not placed in service by 12/31/2021. Therefore, no depreciation was recorded on the equipment for 2021 . Sales are collected 50% in the quarter of sale and the balance in the following quarter based on the budgeted income statement from week 5. Taxes are paid in the quarter following the quarter incurred based on the buedgeted income statement from week 5. Husky Co. Budgeted Income Statement by Quarter For the Year Ended Dec 31, 2021 28 29 Use the template below to prepare the Cash Budget. Sales are collected 50% in the quarter of sale and the balance in the following quarter based on the budgeted income statement from week 5. \begin{tabular}{|c|l|} \hline 6 & \\ \hline 7 & \\ 8 & \\ \hline 9 & \\ \hline 10 & \\ 11 & \\ 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & \\ \hline 17 & Sales \\ \hline \end{tabular} Budgeted Income Statement by Quarter For the Year Ended Dec 31, 2021 18 Cost of Goods Sold \begin{tabular}{ll} 19 & Gross Profit \\ 20 & SG\&A Expenses \\ \hline 21 & Operating Profit \end{tabular} 21 Operating Profit 22 Interest Expense 23 Taxable Income 24 Income Tax 25 Net Income \begin{tabular}{|r|r|r|r|r|} \hline \multicolumn{1}{|c|}{ Q1 } & \multicolumn{1}{c|}{ Q2 } & \multicolumn{1}{c|}{ Q3 } & \multicolumn{1}{c|}{ Q4 } & \multicolumn{1}{|c|}{ Annual } \\ \hline$420,000 & $480,000 & $720,000 & $960,000 & $2,580,000 \\ \hline290,509 & 332,010 & 498,015 & 664,020 & 1,784,554 \\ \hline$129,491 & $147,990 & $221,985 & $295,980 & $795,446 \\ \hline($108,200) & $110,800 & $121,200 & $131,600 & $471,800 \\ \hline$21,291 & $37,190 & $100,785 & $164,380 & $323,645 \\ \hline$0 & ($720) & ($10,020) & ($18,030) & $28,770 \\ \hline$21,291 & $36,470 & $90,765 & $146,350 & $294,876 \\ \hline($6,387) & $10,941 & $27,299 & $43,905 & $88,462 \\ \hline$14,904 & $25,529 & $63,535 & $102,445 & $206,413 \\ \hline \hline \end{tabular} Capital Budget: Equipment costing $300,000 will be purchased at the end of Q2, paid in cash. The equipment will not be placed into service for purposes of depreciation until after the end of the year due to installation and testing. Other cash items: Tax Rate: 30% The beginning cash balance is $5,000 and the company intends to maintain this level of cash ($5,000$6,000) at the end of quarter. If the cash balance exceeds $6,000, the surplus in moved to Savings in $1,000 increments at the end of the quarter. All components of cash COGS (DM, DL, VMOH) and cash SG\&A are paid 2/3 in the quarter incurred/purchased and 1/3 in the following quarter. Depreciation must be subtracted from the COGS to derive cash COGS. Fixed Overhead and Fixed SG\&A are paid 100\% in the quarter incurred. All Fixed Assets are depreciated over 10 years ( 40 quarters). However, the new equipment purchased in Q2 2021 was not placed in service by 12/31/2021. Therefore, no depreciation was recorded on the equipment for 2021. Sales are collected 50% in the quarter of sale and the balance in the following quarter based on the budgeted income statement from week 5. Taxes are paid in the quarter following the quarter incurred based on the budgeted income statement from week 5

this is the information needed to answer the cash budget chart

this is the information needed to answer the cash budget chart  income chart from week 5

income chart from week 5  cash budget chart needs to be completed

cash budget chart needs to be completed