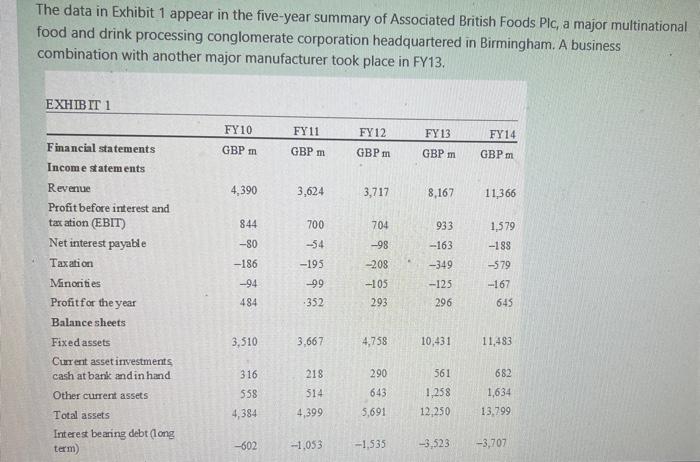

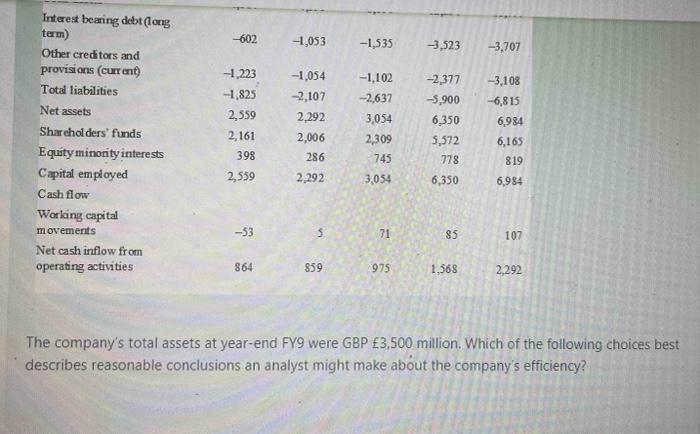

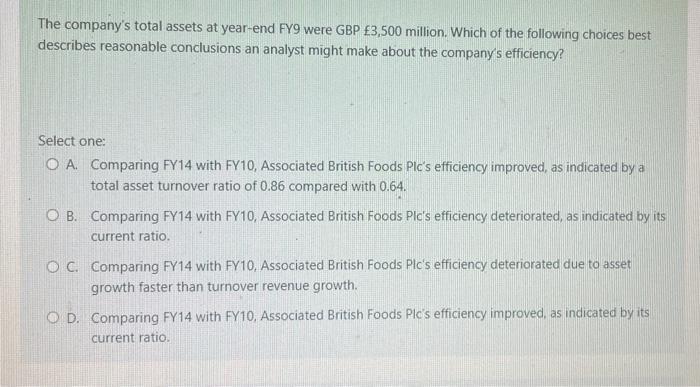

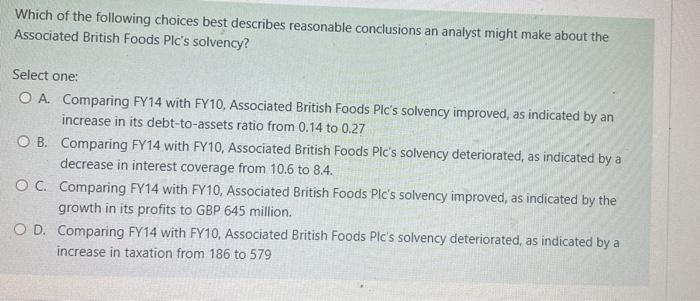

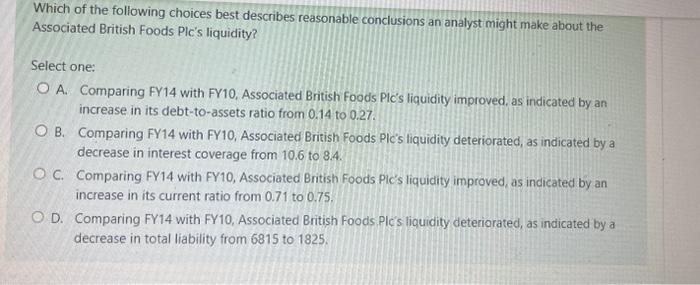

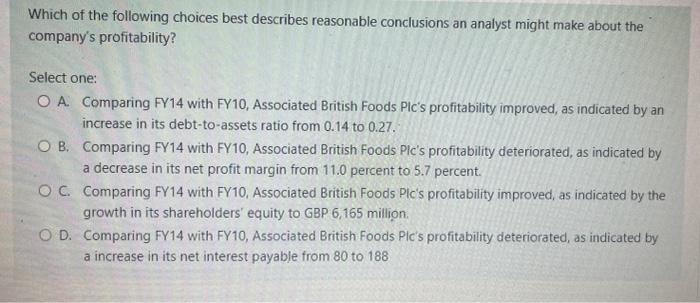

The data in Exhibit 1 appear in the five-year summary of Associated British Foods Plc, a major multinational food and drink processing conglomerate corporation headquartered in Birmingham. A business combination with another major manufacturer took place in FY13. The company's total assets at year-end FY9 were GBP 3,500 million. Which of the following choices best describes reasonable conclusions an analyst might make about the company's efficiency? The company's total assets at year-end FY9 were GBP 3,500 million. Which of the following choices best describes reasonable conclusions an analyst might make about the company's efficiency? Select one: A. Comparing FY14 with FY10, Associated British Foods Plc's efficiency improved, as indicated by a total asset turnover ratio of 0.86 compared with 0.64. B. Comparing FY14 with FY10, Associated British Foods Plc's efficiency deteriorated, as indicated by its current ratio. C. Comparing FY14 with FY10, Associated British Foods Plc's efficiency deteriorated due to asset growth faster than turnover revenue growth. D. Comparing FY14 with FY10, Associated British Foods Plc's efficiency improved, as indicated by its current ratio. Which of the following choices best describes reasonable conclusions an analyst might make about the Associated British Foods Plc's solvency? Select one: A. Comparing FY 14 with FY10, Associated British Foods PIc's solvency improved, as indicated by an increase in its debt-to-assets ratio from 0.14 to 0.27 B. Comparing FY14 with FY10, Associated British Foods PIc's solvency deteriorated, as indicated by a decrease in interest coverage from 10.6 to 8.4. C. Comparing FY 14 with FY10, Associated British Foods. Plc's solvency improved, as indicated by the growth in its profits to GBP 645 million. D. Comparing FY 14 with FY10, Associated British Foods Plc's solvency deteriorated, as indicated by a increase in taxation from 186 to 579 Which of the following choices best describes reasonable conclusions an analyst might make about the Associated British Foods Plc's liquidity? Select one: A. Comparing FY14 with FY10, Associated British foods Plc's liquidity improved, as indicated by an increase in its debt-to-assets ratio from 0.14 to 0.27. B. Comparing FY14 with FY10, Associated British Foods P/C's liquidity deteriorated, as indicated by a decrease in interest coverage from 10.6 to 8.4. C. Comparing FY14 with FY10, Associated British Foods Plc's liquidity improved, as indicated by an increase in its current ratio from 0.71 to 0.75. D. Comparing FY14 with FY10, Associated British Foods Plc's liquidity deteriorated, as indicated by a decrease in total liability from 6815 to 1825. Which of the following choices best describes reasonable conclusions an analyst might make about the company's profitability? Select one: A. Comparing FY 14 with FY10, Associated British Foods PIC's profitability improved, as indicated by an increase in its debt-to-assets ratio from 0.14 to 0.27. B. Comparing FY 14 with FY10, Associated British Foods Pic's profitability deteriorated, as indicated by a decrease in its net profit margin from 11.0 percent to 5.7 percent. C. Comparing FY14 with FY10, Associated British Foods Plc's profitability improved, as indicated by the growth in its shareholders' equity to GBP 6,165 million. D. Comparing FY 14 with FY10, Associated British Foods Pl's s profitability deteriorated, as indicated by a increase in its net interest payable from 80 to 188