Question

The Early Start Learning Essentials Company has been a family run company for the last 30 years. It is well recognized in the state of

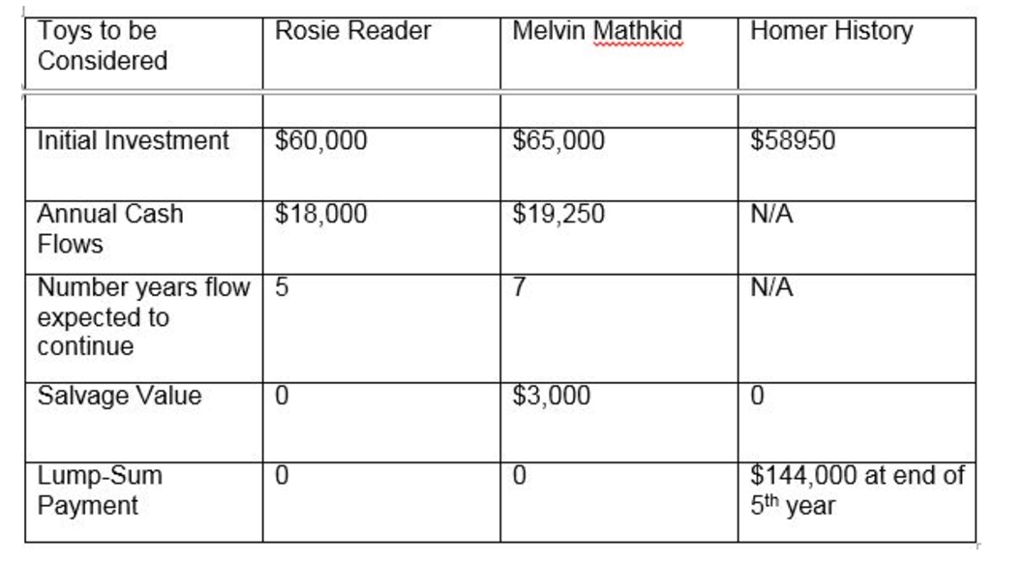

The Early Start Learning Essentials Company has been a family run company for the last 30 years. It is well recognized in the state of Michigan for selling educational related toys specifically for children, ages 6 through 12. Once a year, Early Start goes through an extensive analysis as to which new learning product they should promote for the upcoming year. They always have room for only one new product promotion because they will drop the poorest selling product, automatically, from their product line. Glendolene, Carlos, and Danora Mae, Market Experts employed by Early Start Essentials Company, have prepared the following information regarding their suggestions as to which educational product should be promoted next during the upcoming year. Additional Information: The hurdle rate of return is 8 per cent. The current rate of interest available on long-term securities is 4 per cent. The educational products are mutually exclusive; Early Start will only have funding to promote the product with the best capital return. Required: Rank these investment opportunities: 1 = highest, 2 = middle, 3 = lowest. Show all computations in good form. Suppose that Early Start had a capital budget of $125,000 annually AND the toys were not mutually exclusive. Would your answer change as to which educational product you would recommend they promotes? Show all narrative and computations in good form.

The Early Start Learning Essentials Company has been a family run company for the last 30 years. It is well recognized in the state of Michigan for selling educational related toys specifically for children, ages 6 through 12. Once a year, Early Start goes through an extensive analysis as to which new learning product they should promote for the upcoming year. They always have room for only one new product promotion because they will drop the poorest selling product, automatically, from their product line. Glendolene, Carlos, and Danora Mae, Market Experts employed by Early Start Essentials Company, have prepared the following information regarding their suggestions as to which educational product should be promoted next during the upcoming year. Additional Information: The hurdle rate of return is 8 per cent. The current rate of interest available on long-term securities is 4 per cent. The educational products are mutually exclusive; Early Start will only have funding to promote the product with the best capital return. Required: Rank these investment opportunities: 1 = highest, 2 = middle, 3 = lowest. Show all computations in good form. Suppose that Early Start had a capital budget of $125,000 annually AND the toys were not mutually exclusive. Would your answer change as to which educational product you would recommend they promotes? Show all narrative and computations in good form.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started