Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Fashion Rack is a retail merchandising business that sells brand-name clothing at discount prices. The firm is owned and managed by Teresa Logan,

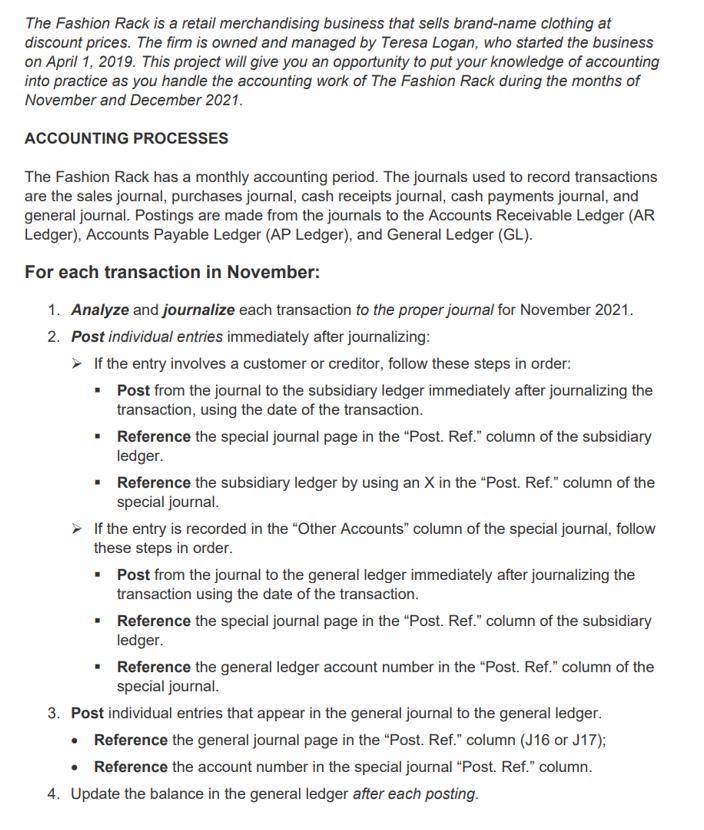

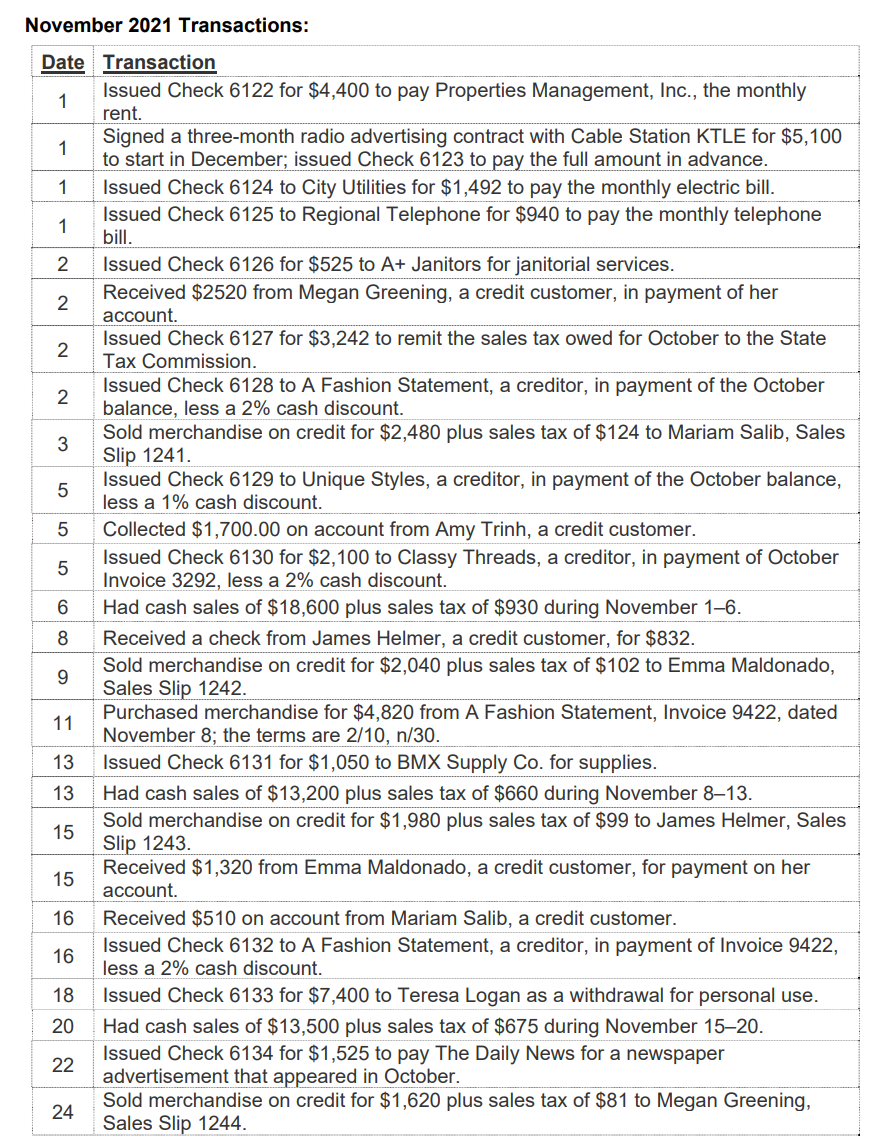

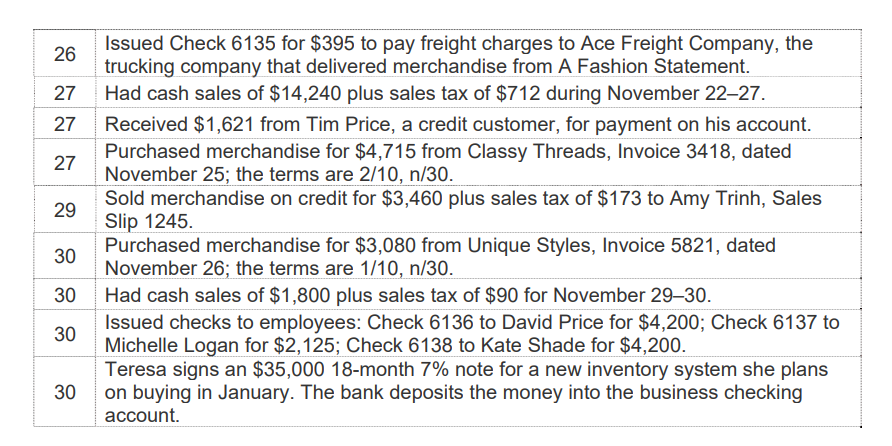

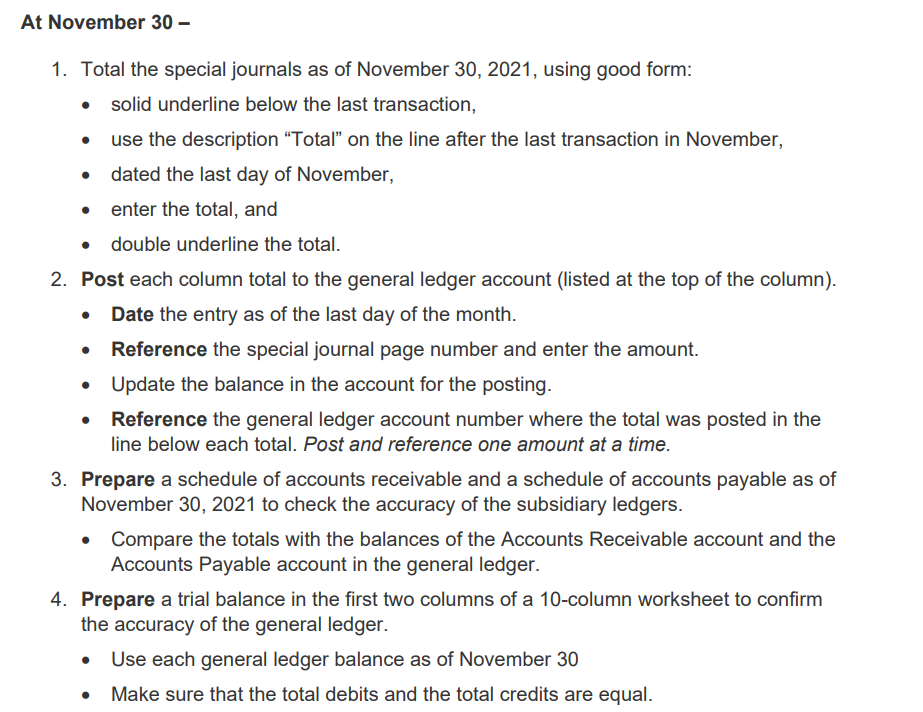

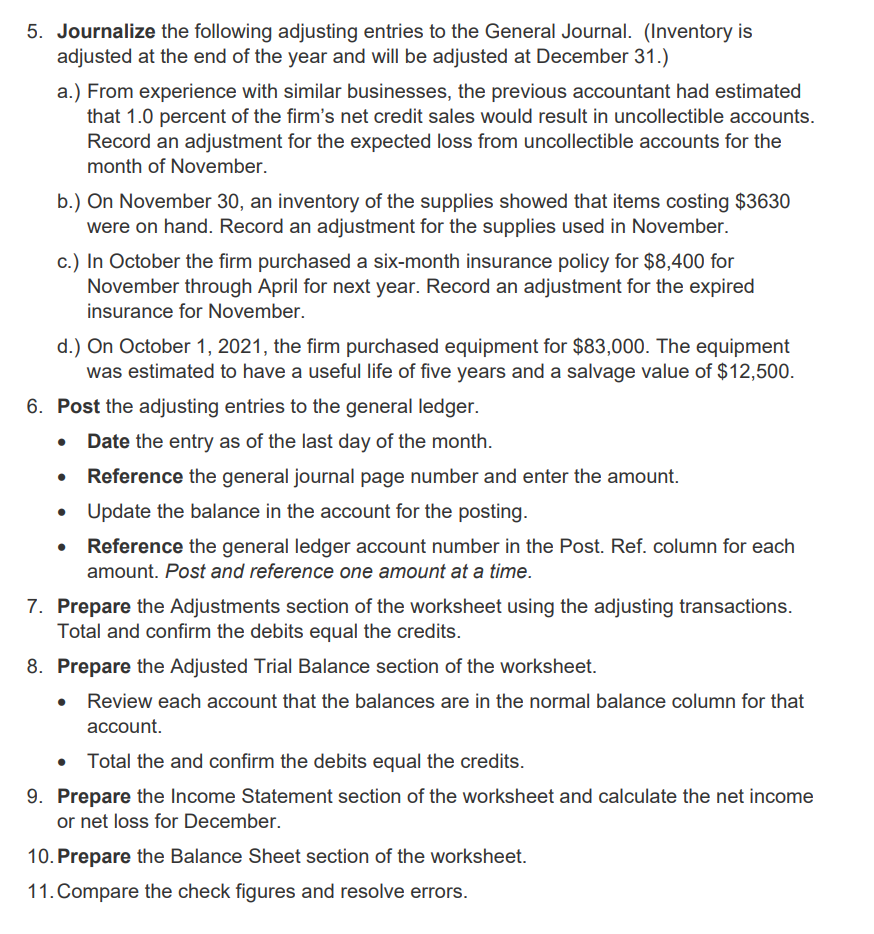

The Fashion Rack is a retail merchandising business that sells brand-name clothing at discount prices. The firm is owned and managed by Teresa Logan, who started the business on April 1, 2019. This project will give you an opportunity to put your knowledge of accounting into practice as you handle the accounting work of The Fashion Rack during the months of November and December 2021. ACCOUNTING PROCESSES The Fashion Rack has a monthly accounting period. The journals used to record transactions are the sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Postings are made from the journals to the Accounts Receivable Ledger (AR Ledger), Accounts Payable Ledger (AP Ledger), and General Ledger (GL). For each transaction in November: 1. Analyze and journalize each transaction to the proper journal for November 2021. 2. Post individual entries immediately after journalizing: If the entry involves a customer or creditor, follow these steps in order: Post from the journal to the subsidiary ledger immediately after journalizing the transaction, using the date of the transaction. Reference the special journal page in the "Post. Ref." column of the subsidiary ledger. Reference the subsidiary ledger by using an X in the "Post. Ref." column of the special journal. If the entry is recorded in the "Other Accounts" column of the special journal, follow these steps in order. Post from the journal to the general ledger immediately after journalizing the transaction using the date of the transaction. Reference the special journal page in the "Post. Ref." column of the subsidiary ledger. Reference the general ledger account number in the "Post. Ref." column of the special journal. 3. Post individual entries that appear in the general journal to the general ledger. Reference the general journal page in the "Post. Ref." column (J16 or J17); Reference the account number in the special journal "Post. Ref." column. 4. Update the balance in the general ledger after each posting. November 2021 Transactions: Date Transaction 1 1 1 1 2 2 2 2 3 50 5 Issued Check 6122 for $4,400 to pay Properties Management, Inc., the monthly rent. Signed a three-month radio advertising contract with Cable Station KTLE for $5,100 to start in December; issued Check 6123 to pay the full amount in advance. Issued Check 6124 to City Utilities for $1,492 to pay the monthly electric bill. Issued Check 6125 to Regional Telephone for $940 to pay the monthly telephone bill. Issued Check 6126 for $525 to A+ Janitors for janitorial services. Received $2520 from Megan Greening, a credit customer, in payment of her account. Issued Check 6127 for $3,242 to remit the sales tax owed for October to the State Tax Commission. Issued Check 6128 to A Fashion Statement, a creditor, in payment of the October balance, less a 2% cash discount. Sold merchandise on credit for $2,480 plus sales tax of $124 to Mariam Salib, Sales Slip 1241. Issued Check 6129 to Unique Styles, a creditor, in payment of the October balance, less a 1% cash discount. Collected $1,700.00 on account from Amy Trinh, a credit customer. Issued Check 6130 for $2,100 to Classy Threads, a creditor, in payment of October Invoice 3292, less a 2% cash discount. 5 6 Had cash sales of $18,600 plus sales tax of $930 during November 1-6. 8 9 11 13 33 Received a check from James Helmer, a credit customer, for $832. Sold merchandise on credit for $2,040 plus sales tax of $102 to Emma Maldonado, Sales Slip 1242. Purchased merchandise for $4,820 from A Fashion Statement, Invoice 9422, dated November 8; the terms are 2/10, n/30. Issued Check 6131 for $1,050 to BMX Supply Co. for supplies. 13 Had cash sales of $13,200 plus sales tax of $660 during November 8-13. 15 15 16 1 60 16 Sold merchandise on credit for $1,980 plus sales tax of $99 to James Helmer, Sales Slip 1243. Received $1,320 from Emma Maldonado, a credit customer, for payment on her account. Received $510 on account from Mariam Salib, a credit customer. Issued Check 6132 to A Fashion Statement, a creditor, in payment of Invoice 9422, less a 2% cash discount. 18 Issued Check 6133 for $7,400 to Teresa Logan as a withdrawal for personal use. 20 22 24 24 Had cash sales of $13,500 plus sales tax of $675 during November 15-20. Issued Check 6134 for $1,525 to pay The Daily News for a newspaper advertisement that appeared in October. Sold merchandise on credit for $1,620 plus sales tax of $81 to Megan Greening, Sales Slip 1244. 26 27 27 NNN 27 29 30 30 30 30 Issued Check 6135 for $395 to pay freight charges to Ace Freight Company, the trucking company that delivered merchandise from A Fashion Statement. Had cash sales of $14,240 plus sales tax of $712 during November 22-27. Received $1,621 from Tim Price, a credit customer, for payment on his account. Purchased merchandise for $4,715 from Classy Threads, Invoice 3418, dated November 25; the terms are 2/10, n/30. Sold merchandise on credit for $3,460 plus sales tax of $173 to Amy Trinh, Sales Slip 1245. Purchased merchandise for $3,080 from Unique Styles, Invoice 5821, dated November 26; the terms are 1/10, n/30. Had cash sales of $1,800 plus sales tax of $90 for November 29-30. Issued checks to employees: Check 6136 to David Price for $4,200; Check 6137 to Michelle Logan for $2,125; Check 6138 to Kate Shade for $4,200. Teresa signs an $35,000 18-month 7% note for a new inventory system she plans on buying in January. The bank deposits the money into the business checking account. At November 30 - 1. Total the special journals as of November 30, 2021, using good form: solid underline below the last transaction, use the description "Total" on the line after the last transaction in November, dated the last day of November, enter the total, and double underline the total. 2. Post each column total to the general ledger account (listed at the top of the column). Date the entry as of the last day of the month. Reference the special journal page number and enter the amount. Update the balance in the account for the posting. Reference the general ledger account number where the total was posted in the line below each total. Post and reference one amount at a time. 3. Prepare a schedule of accounts receivable and a schedule of accounts payable as of November 30, 2021 to check the accuracy of the subsidiary ledgers. Compare the totals with the balances of the Accounts Receivable account and the Accounts Payable account in the general ledger. 4. Prepare a trial balance in the first two columns of a 10-column worksheet to confirm the accuracy of the general ledger. Use each general ledger balance as of November 30 Make sure that the total debits and the total credits are equal. 5. Journalize the following adjusting entries to the General Journal. (Inventory is adjusted at the end of the year and will be adjusted at December 31.) a.) From experience with similar businesses, the previous accountant had estimated that 1.0 percent of the firm's net credit sales would result in uncollectible accounts. Record an adjustment for the expected loss from uncollectible accounts for the month of November. b.) On November 30, an inventory of the supplies showed that items costing $3630 were on hand. Record an adjustment for the supplies used in November. c.) In October the firm purchased a six-month insurance policy for $8,400 for November through April for next year. Record an adjustment for the expired insurance for November. d.) On October 1, 2021, the firm purchased equipment for $83,000. The equipment was estimated to have a useful life of five years and a salvage value of $12,500. 6. Post the adjusting entries to the general ledger. Date the entry as of the last day of the month. Reference the general journal page number and enter the amount. Update the balance in the account for the posting. Reference the general ledger account number in the Post. Ref. column for each amount. Post and reference one amount at a time. 7. Prepare the Adjustments section of the worksheet using the adjusting transactions. Total and confirm the debits equal the credits. 8. Prepare the Adjusted Trial Balance section of the worksheet. Review each account that the balances are in the normal balance column for that account. Total the and confirm the debits equal the credits. 9. Prepare the Income Statement section of the worksheet and calculate the net income or net loss for December. 10. Prepare the Balance Sheet section of the worksheet. 11. Compare the check figures and resolve errors.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started