Answered step by step

Verified Expert Solution

Question

1 Approved Answer

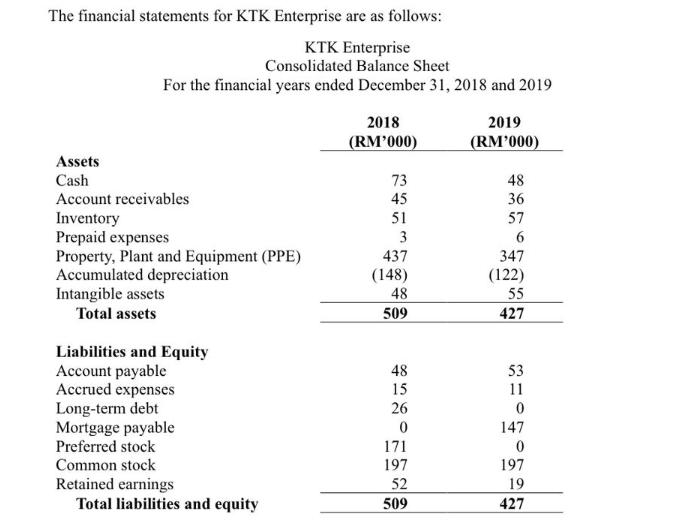

The financial statements for KTK Enterprise are as follows: KTK Enterprise Consolidated Balance Sheet For the financial years ended December 31, 2018 and 2019

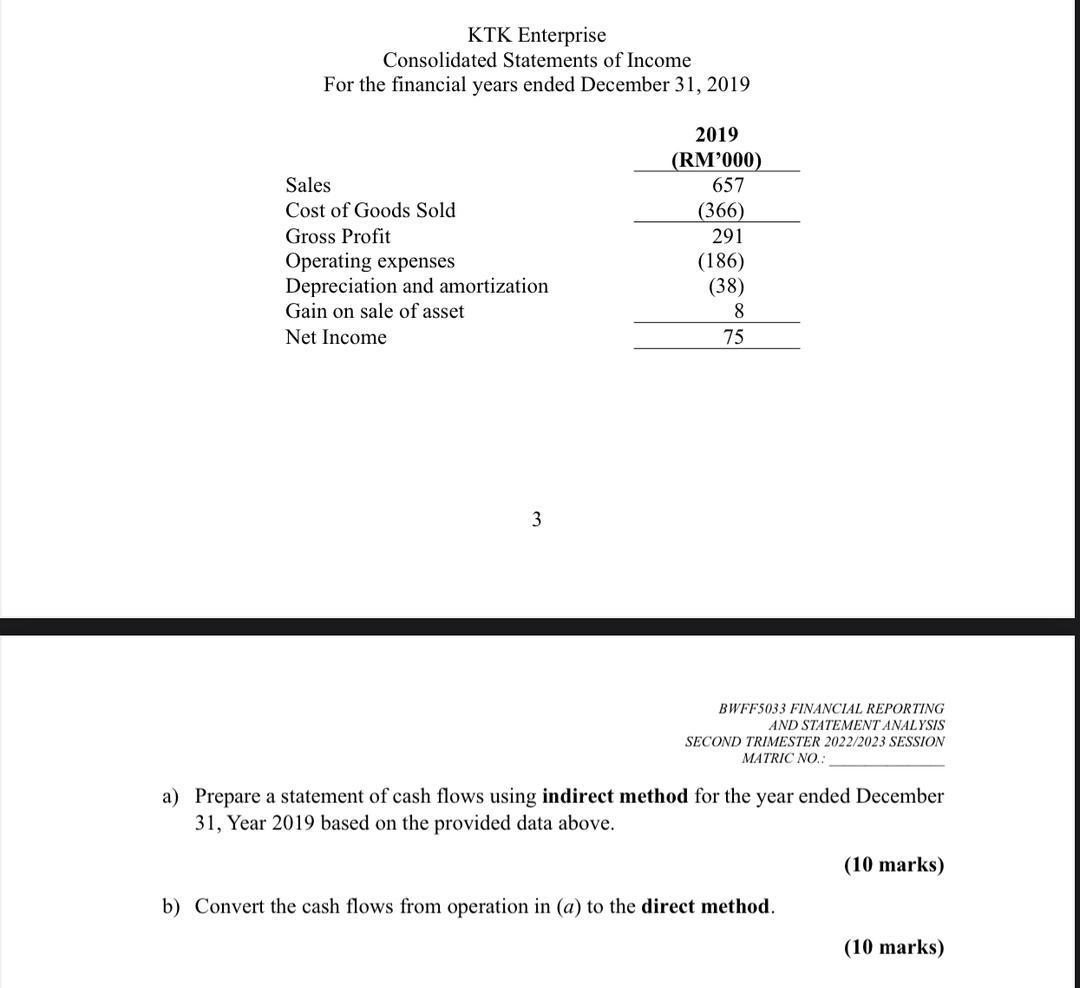

The financial statements for KTK Enterprise are as follows: KTK Enterprise Consolidated Balance Sheet For the financial years ended December 31, 2018 and 2019 Assets Cash Account receivables Inventory Prepaid expenses Property, Plant and Equipment (PPE) Accumulated depreciation Intangible assets Total assets Liabilities and Equity Account payable Accrued expenses Long-term debt Mortgage payable Preferred stock Common stock Retained earnings Total liabilities and equity 2018 (RM'000) 73 45 51 3 437 (148) 48 509 48 15 26 0 171 197 52 509 2019 (RM'000) 48 36 57 6 347 (122) 55 427 53 11 0 147 0 197 19 427 KTK Enterprise Consolidated Statements of Income For the financial years ended December 31, 2019 Sales Cost of Goods Sold Gross Profit Operating expenses Depreciation and amortization Gain on sale of asset Net Income 3 2019 (RM'000) 657 (366) 291 (186) (38) 8 75 BWFFS033 FINANCIAL REPORTING AND STATEMENT ANALYSIS SECOND TRIMESTER 2022/2023 SESSION MATRIC NO.: a) Prepare a statement of cash flows using indirect method for the year ended December 31, Year 2019 based on the provided data above. b) Convert the cash flows from operation in (a) to the direct method. (10 marks) (10 marks)

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Answer To prepare the statement of cash flows using the indirect method for the year ended December ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started