Answered step by step

Verified Expert Solution

Question

1 Approved Answer

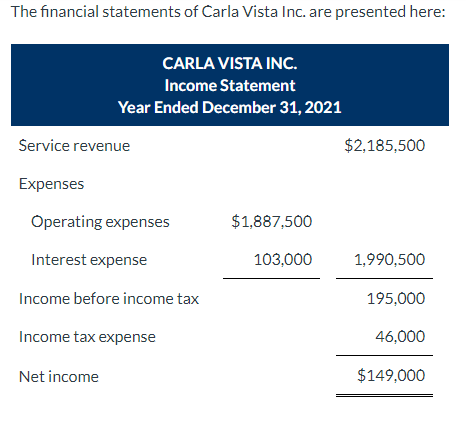

The financial statements of Carla Vista Inc. are presented here: CARLA VISTA INC. Income Statement Year Ended December 31, 2021 Service revenue $2,185,500 Expenses

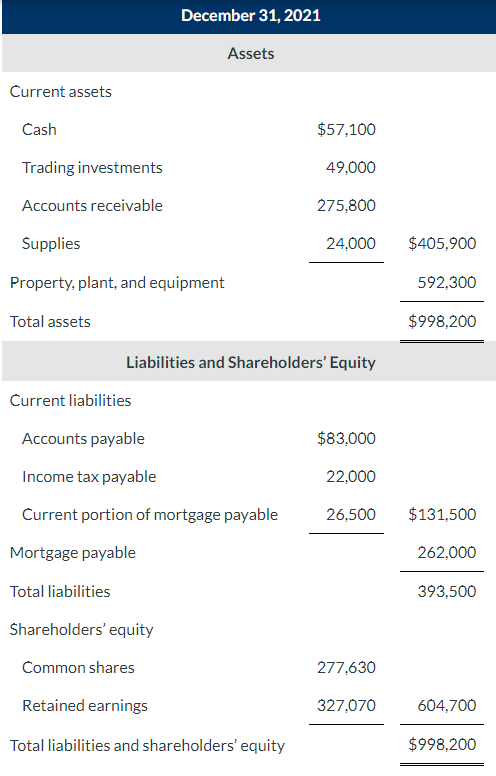

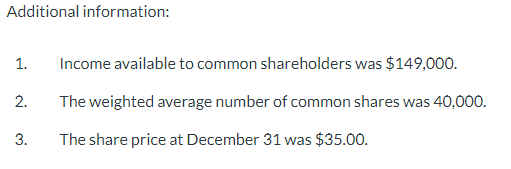

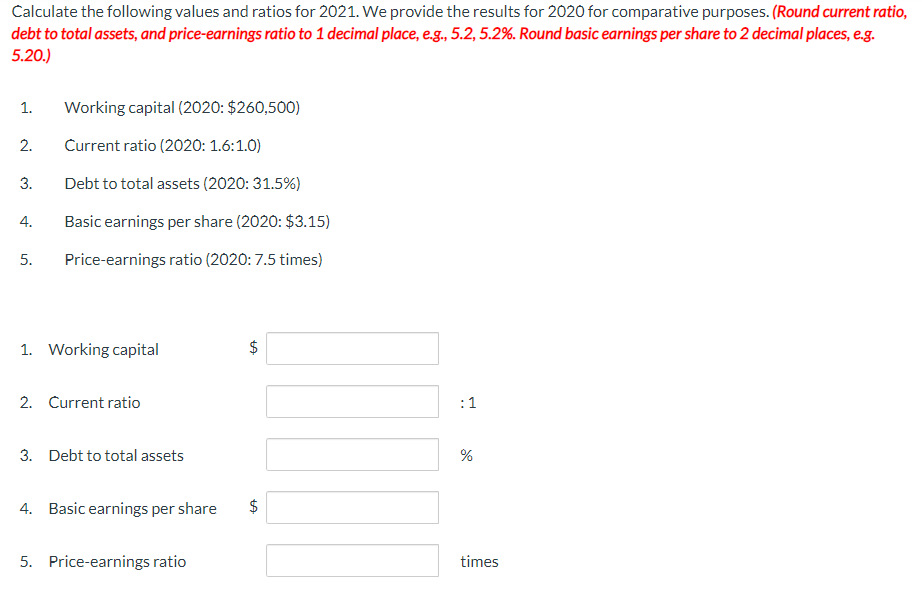

The financial statements of Carla Vista Inc. are presented here: CARLA VISTA INC. Income Statement Year Ended December 31, 2021 Service revenue $2,185,500 Expenses Operating expenses $1,887,500 Interest expense 103,000 1,990,500 Income before income tax 195,000 Income tax expense 46,000 Net income $149,000 Current assets Cash Trading investments Accounts receivable Supplies December 31, 2021 Property, plant, and equipment Total assets Assets $57,100 49,000 275,800 24,000 $405,900 592,300 $998,200 Liabilities and Shareholders' Equity Current liabilities Accounts payable $83,000 Income tax payable 22,000 Current portion of mortgage payable 26,500 $131,500 Mortgage payable 262,000 Total liabilities 393,500 Shareholders' equity Common shares 277,630 Retained earnings 327,070 604,700 Total liabilities and shareholders' equity $998,200 Additional information: 1. Income available to common shareholders was $149,000. 2. The weighted average number of common shares was 40,000. 3. The share price at December 31 was $35.00. Calculate the following values and ratios for 2021. We provide the results for 2020 for comparative purposes. (Round current ratio, debt to total assets, and price-earnings ratio to 1 decimal place, e.g., 5.2, 5.2%. Round basic earnings per share to 2 decimal places, e.g. 5.20.) 1. Working capital (2020: $260,500) 2. Current ratio (2020: 1.6:1.0) 3. Debt to total assets (2020: 31.5%) 4. Basic earnings per share (2020: $3.15) 5. Price-earnings ratio (2020: 7.5 times) 1. Working capital 2. Current ratio 3. Debt to total assets 4. Basic earnings per share 5. Price-earnings ratio LA $ $ :1 % do times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started