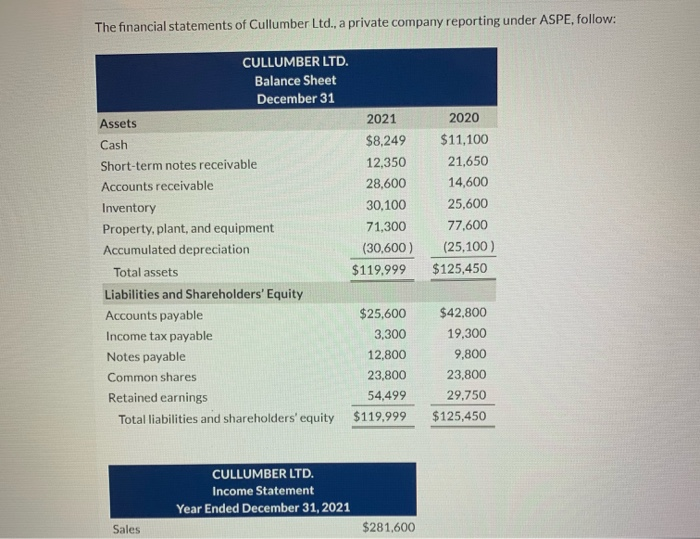

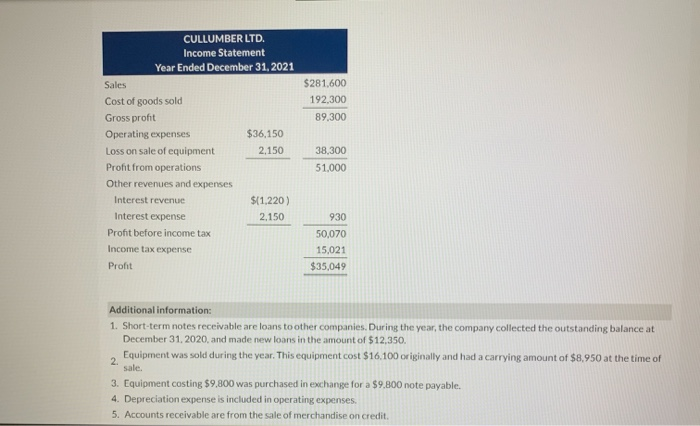

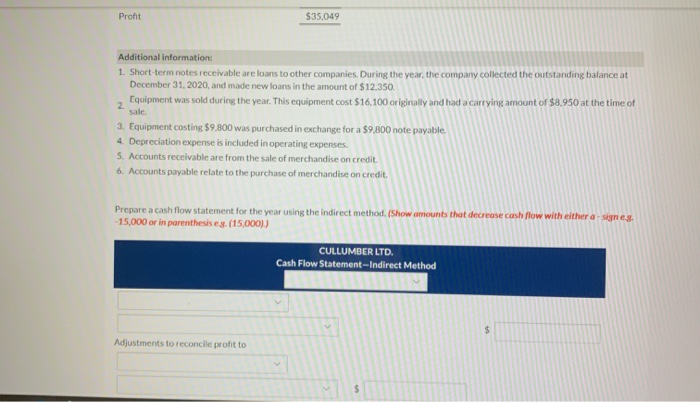

The financial statements of Cullumber Ltd., a private company reporting under ASPE, follow: 2020 CULLUMBER LTD. Balance Sheet December 31 Assets 2021 Cash $8,249 Short-term notes receivable 12,350 Accounts receivable 28,600 Inventory 30,100 Property, plant, and equipment 71,300 Accumulated depreciation (30,600) Total assets $119.999 Liabilities and Shareholders' Equity Accounts payable $25,600 Income tax payable 3,300 Notes payable 12,800 Common shares 23,800 Retained earnings 54,499 Total liabilities and shareholders' equity $119.999 $11,100 21.650 14,600 25,600 77.600 (25,100) $125,450 $42,800 19,300 9,800 23,800 29,750 $125,450 CULLUMBER LTD. Income Statement Year Ended December 31, 2021 Sales $281,600 CULLUMBER LTD. Income Statement Year Ended December 31, 2021 $281,600 192,300 89.300 $36,150 2,150 38,300 51,000 Sales Cost of goods sold Gross proht Operating expenses Loss on sale of equipment Profit from operations Other revenues and expenses Interest revenue Interest expense Profit before income tax Income tax expense Proht $(1.220) 2.150 930 50,070 15,021 $35,049 Additional information: 1. Short-term notes receivable are loans to other companies. During the year, the company collected the outstanding balance at December 31, 2020, and made new loans in the amount of $12,350. Equipment was sold during the year. This equipment cost $16,100 originally and had a carrying amount of $8,950 at the time of sale. 3. Equipment costing $9,800 was purchased in exchange for a $9,800 note payable. 4. Depreciation expense is included in operating expenses. 5. Accounts receivable are from the sale of merchandise on credit 2 Profit $35,049 Additional information: 1. Short-term notes receivable are loans to other companies. During the year, the company collected the outstanding balance at December 31, 2020, and made new loans in the amount of $12.350. Equipment was sold during the year. This equipment cost $16,100 originally and had a carrying amount of $8.950 at the time of 2. 3. Equipment costing $9,800 was purchased in exchange for a $9,800 note payable 4. Depreciation expense is included in operating expenses. 5. Accounts receivable are from the sale of merchandise on credit. 6. Accounts payable relate to the purchase of merchandise on credit. sale Prepare a cash flow statement for the year using the indirect method. (Show amounts that decrease cash flow with either a signeg. -15,000 or in parenthesis es (15,0001) CULLUMBER LTD. Cash Flow Statement-Indirect Method Adjustments to reconcile profitto