Question

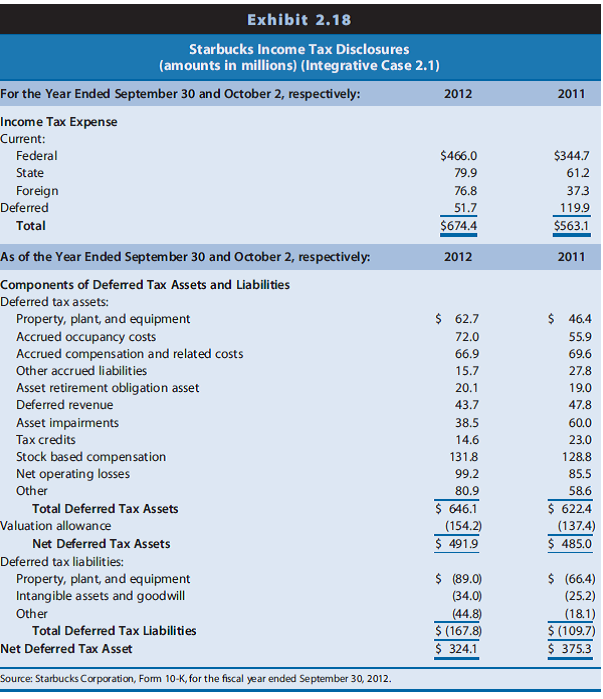

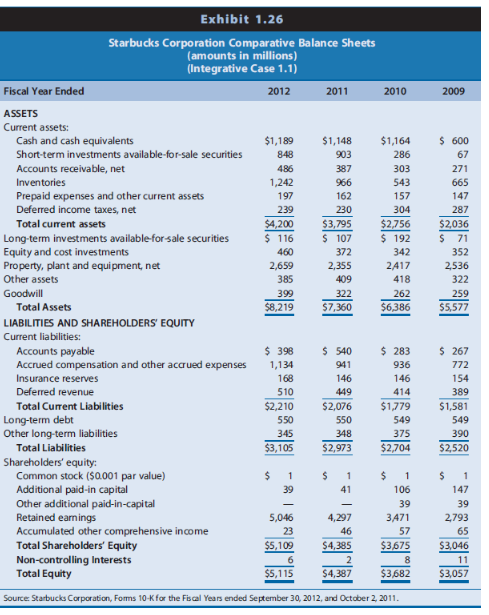

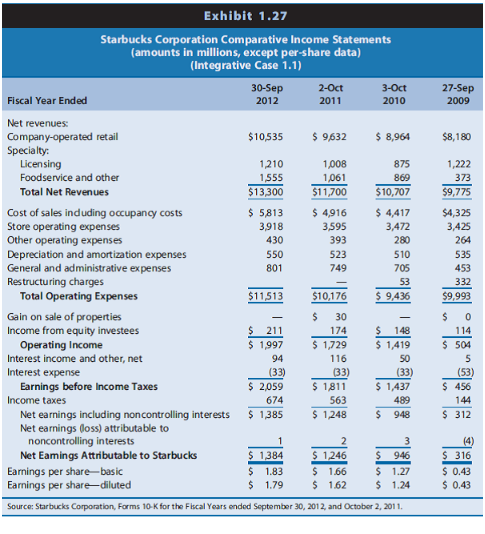

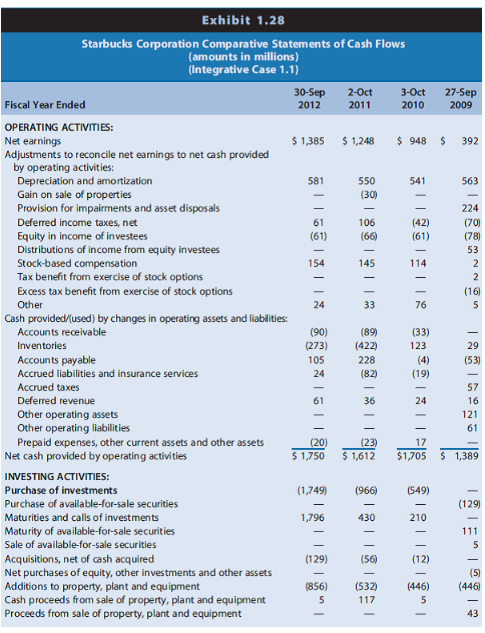

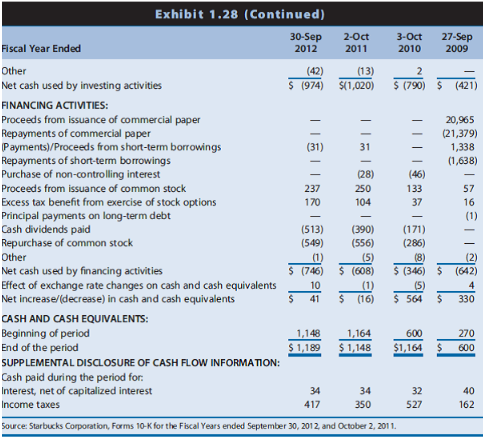

The financial statements of Starbucks Corporation are presented in exhibits 1.26-1.28. The income tax note to those financial statements reveals the information regarding income taxes

The financial statements of Starbucks Corporation are presented in exhibits 1.26-1.28. The income tax note to those financial statements reveals the information regarding income taxes shown in exhibit 2.18.

Questions:

A. Assuming that starbucks had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for 2012? Explain

B. Will the adjustment to net income for deferred taxes to compute cash flow from operations in the statement of cash flows result in an addition or subtraction for 2012.

C. Starbucks rents retail space for its coffee shops. It must recognize rent expense as it uses rental facilities but cannot claim an income tax deduction until it pays cash to the land-lord. Suggest the scenario that would give rise to a deferred tax asset instead of a deferred tax liability related to occupancy cost. (accrued occupancy costs)

D. Starbucks recognizes an expense related to retirement benefits as employees rendered services but cannot claim an income tax deduction until it pays cash to a retirement fund. Why do the deferred taxes for defferred compensation appear as a deferred tax asset ("Accrued compensation and related costs")? Suggest possible reasons why the deferred tax asset decreased slightly between the end of 2011 and the end of 2012.

Exhibit 2.18 Starbucks Income Tax Disclosures (amounts in millions) (Integrative Case 2.1) For the Year Ended September 30 and October 2, respectively: 2012 Income Tax Expense Current: Federal $466.0 State 79.9 Foreign 76.8 Deferred 51.7 Total $674.4 As of the Year Ended September 30 and October 2, respectively 2012 Components of Defemed Tax Assets and Liabilities Deferred tax assets: 62.7 Property, plant, and equipment Accrued occupancy costs 72.0 Accrued compensation and related costs 66.9 Other accrued liabilities 15.7 Asset retirement obligation asset 20.1 Deferred revenue 43.7 Asset impairments 38.5 Tax credits 14.6. Stock based compensation 1318 Net operating losses 99.2 Other 80.9 Total Deferred Tax Assets 646.1 Valuation allowance (154.20 Net Deferred Tax Assets 4919 Deferred tax liabilities: Property, plant, and equipment (89.0) Intangible assets and goodwill Other (44.8) Total Deferred Tax Liabilities (167.8) Net Deferred Tax Asset 324.1 Source: Starbucks Corporation, Form 10-K for the fiscal year ended September 30, 2012. 2011 $344.7 61.2 37.3 119.9 $563.1 2011 46.4 55.9 69.6 27.8 19.0 47.8 60.0 23.0 1288 85.5 58.6 622.4 (137.4) 485.0 (66.4) (25.2) 18.1) (109.7) 375.3 Exhibit 2.18 Starbucks Income Tax Disclosures (amounts in millions) (Integrative Case 2.1) For the Year Ended September 30 and October 2, respectively: 2012 Income Tax Expense Current: Federal $466.0 State 79.9 Foreign 76.8 Deferred 51.7 Total $674.4 As of the Year Ended September 30 and October 2, respectively 2012 Components of Defemed Tax Assets and Liabilities Deferred tax assets: 62.7 Property, plant, and equipment Accrued occupancy costs 72.0 Accrued compensation and related costs 66.9 Other accrued liabilities 15.7 Asset retirement obligation asset 20.1 Deferred revenue 43.7 Asset impairments 38.5 Tax credits 14.6. Stock based compensation 1318 Net operating losses 99.2 Other 80.9 Total Deferred Tax Assets 646.1 Valuation allowance (154.20 Net Deferred Tax Assets 4919 Deferred tax liabilities: Property, plant, and equipment (89.0) Intangible assets and goodwill Other (44.8) Total Deferred Tax Liabilities (167.8) Net Deferred Tax Asset 324.1 Source: Starbucks Corporation, Form 10-K for the fiscal year ended September 30, 2012. 2011 $344.7 61.2 37.3 119.9 $563.1 2011 46.4 55.9 69.6 27.8 19.0 47.8 60.0 23.0 1288 85.5 58.6 622.4 (137.4) 485.0 (66.4) (25.2) 18.1) (109.7) 375.3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started