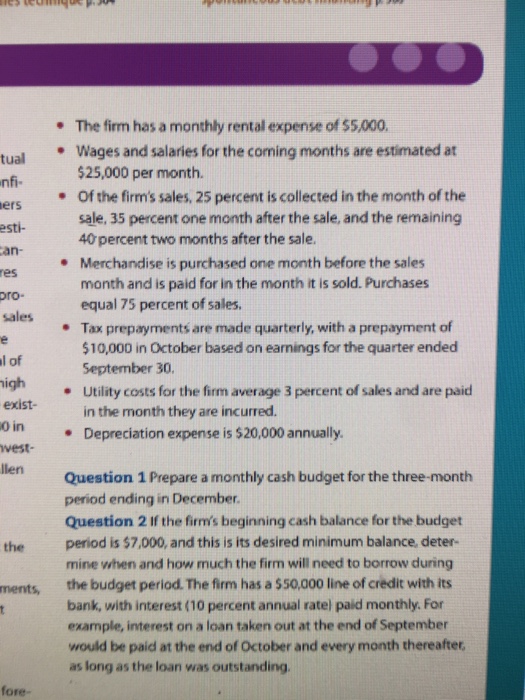

. The firm has a monthly rental expense of $5,000 Wages and salaries for the coming months are estimated at tual nfi- ers esti- an- res ro- sales $25,000 per month. Of the firm's sales, 25 percent is collected in the month of the sale, 35 percent one month after the sale, and the remaining 40 percent two months after the sale. Merchandise is purchased one month before the sales month and is paid for in the month it is sold. Purchases equal 75 percent of sales Tax prepayments are made quarterly, with a prepayment of $10,000 in October based on earnings for the quarter ended September 30. Utility costs for the firm average 3 percent of sales and are paid in the month they are incurred. Depreciation expense is $20,000 annually. . . l of exist o in vest- llen . Question 1 Prepare a monthly cash budget for the three-month period ending in December Question 2 If the firm's beginning cash balance for the budget period is $7,000, and this is its desired minimum balance, deter- mine when and how much the firm will need to borrow during the budget period. The firm has a $50,000 line of credit with its bank, with interest (10 percent annual ratel paid monthly. For example, interest on a loan taken out at the end of September the ments, would be paid at the end of October and every month thereafter as long as the loan was outstanding fore- . The firm has a monthly rental expense of $5,000 Wages and salaries for the coming months are estimated at tual nfi- ers esti- an- res ro- sales $25,000 per month. Of the firm's sales, 25 percent is collected in the month of the sale, 35 percent one month after the sale, and the remaining 40 percent two months after the sale. Merchandise is purchased one month before the sales month and is paid for in the month it is sold. Purchases equal 75 percent of sales Tax prepayments are made quarterly, with a prepayment of $10,000 in October based on earnings for the quarter ended September 30. Utility costs for the firm average 3 percent of sales and are paid in the month they are incurred. Depreciation expense is $20,000 annually. . . l of exist o in vest- llen . Question 1 Prepare a monthly cash budget for the three-month period ending in December Question 2 If the firm's beginning cash balance for the budget period is $7,000, and this is its desired minimum balance, deter- mine when and how much the firm will need to borrow during the budget period. The firm has a $50,000 line of credit with its bank, with interest (10 percent annual ratel paid monthly. For example, interest on a loan taken out at the end of September the ments, would be paid at the end of October and every month thereafter as long as the loan was outstanding fore