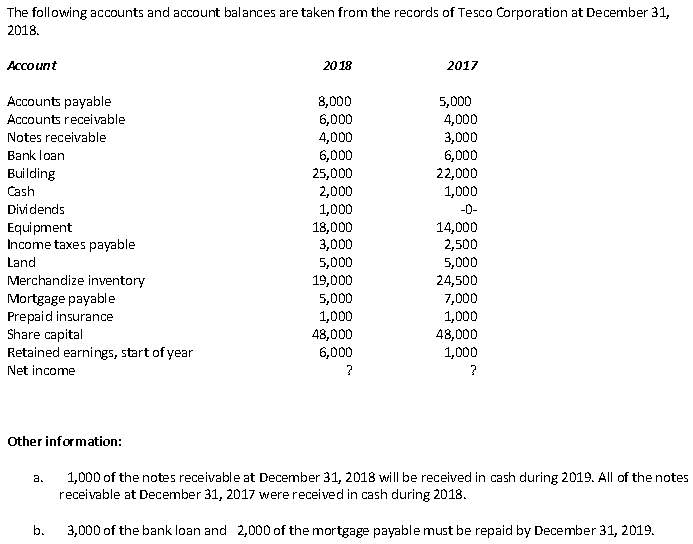

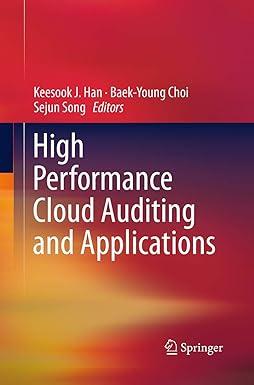

The following accounts and account balances are taken from the records of Tesco Corporation at December 31, 2018. Account 2018 2017 Accounts payable Accounts receivable Notes receivable Bank loan Building Cash Dividends Equipment Income taxes payable Land Merchandize inventory Mortgage payable Prepaid insurance Share capital Retained earnings, start of year Net income 8,000 6,000 4,000 6,000 25,000 2,000 1,000 18,000 3,000 5,000 19,000 5,000 1,000 48,000 6,000 5,000 4,000 3,000 6,000 22,000 1,000 -D- 14,000 2,500 5,000 24,500 7,000 1,000 48,000 1,000 Other information: a. 1,000 of the notes receivable at December 31, 2018 will be received in cash during 2019. All of the notes receivable at December 31, 2017 were received in cash during 2018. b. 3,000 of the bank loan and 2,000 of the mortgage payable must be repaid by December 31, 2019. Assume now that Tesco property, plant, and equipment are combined into one amount on the statement of financial position. Prepare a suitable note to the financial statements. Assume there are no additions to PPE In 2017, and that there is no depreciation calculated for either year. The following accounts and account balances are taken from the records of Tesco Corporation at December 31, 2018. Account 2018 2017 Accounts payable Accounts receivable Notes receivable Bank loan Building Cash Dividends Equipment Income taxes payable Land Merchandize inventory Mortgage payable Prepaid insurance Share capital Retained earnings, start of year Net income 8,000 6,000 4,000 6,000 25,000 2,000 1,000 18,000 3,000 5,000 19,000 5,000 1,000 48,000 6,000 5,000 4,000 3,000 6,000 22,000 1,000 -D- 14,000 2,500 5,000 24,500 7,000 1,000 48,000 1,000 Other information: a. 1,000 of the notes receivable at December 31, 2018 will be received in cash during 2019. All of the notes receivable at December 31, 2017 were received in cash during 2018. b. 3,000 of the bank loan and 2,000 of the mortgage payable must be repaid by December 31, 2019. Assume now that Tesco property, plant, and equipment are combined into one amount on the statement of financial position. Prepare a suitable note to the financial statements. Assume there are no additions to PPE In 2017, and that there is no depreciation calculated for either year