Answered step by step

Verified Expert Solution

Question

1 Approved Answer

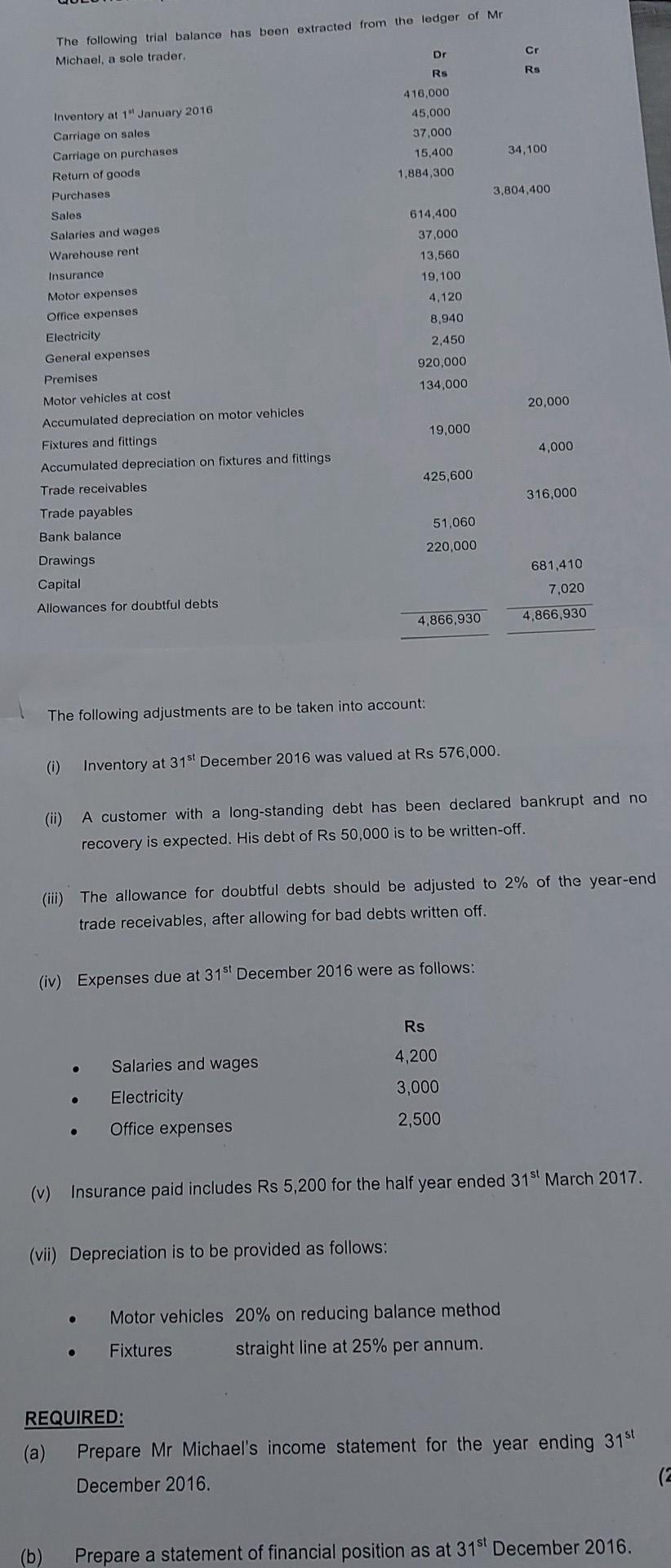

The following adjustments are to be taken into account: (i) Inventory at ( 31^{text {st }} ) December 2016 was valued at Rs 576,000 (ii)

The following adjustments are to be taken into account: (i) Inventory at \\( 31^{\\text {st }} \\) December 2016 was valued at Rs 576,000 (ii) A customer with a long-standing debt has been declared bankrupt and no recovery is expected. His debt of Rs 50,000 is to be written-off. (iii) The allowance for doubtful debts should be adjusted to \2 of the year-end trade receivables, after allowing for bad debts written off. (iv) Expenses due at \\( 31^{\\text {st }} \\) December 2016 were as follows: (v) Insurance paid includes Rs 5,200 for the half year ended \\( 31^{\\text {st }} \\) March 2017. (vii) Depreciation is to be provided as follows: - Motor vehicles \20 on reducing balance method - Fixtures straight line at \25 per annum. REQUIRED: (a) Prepare Mr Michael's income statement for the year ending \\( 31^{\\text {st }} \\) December 2016. (2) (b) Prepare a statement of financial position as at \\( 31^{\\text {st }} \\) December 2016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started