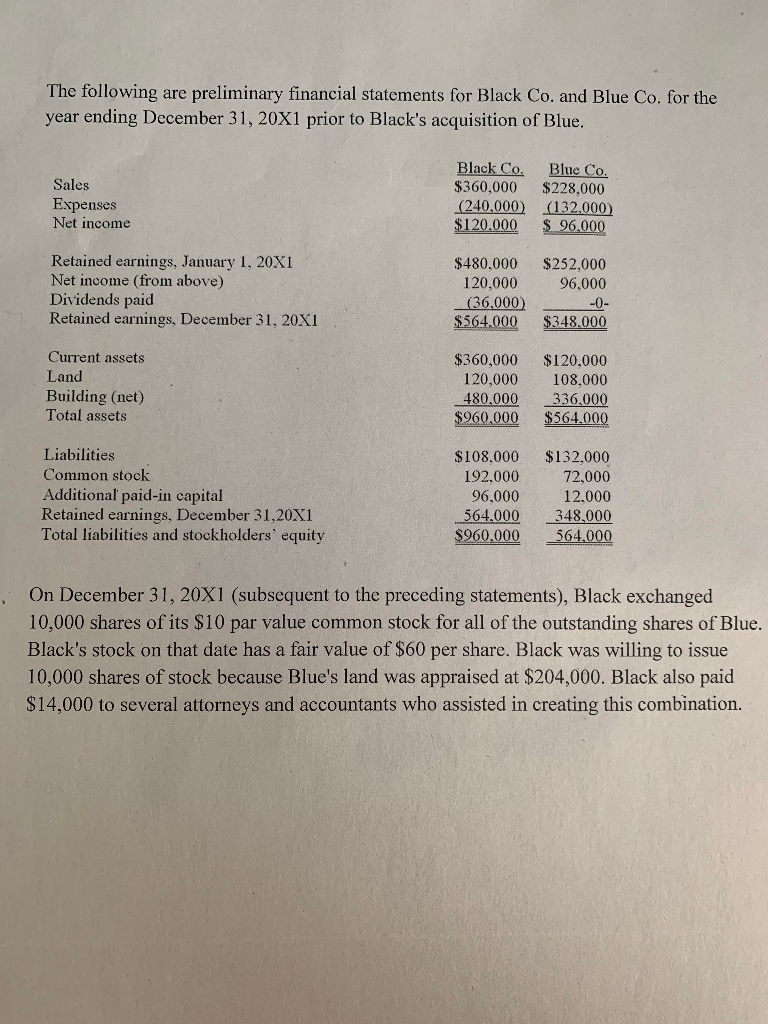

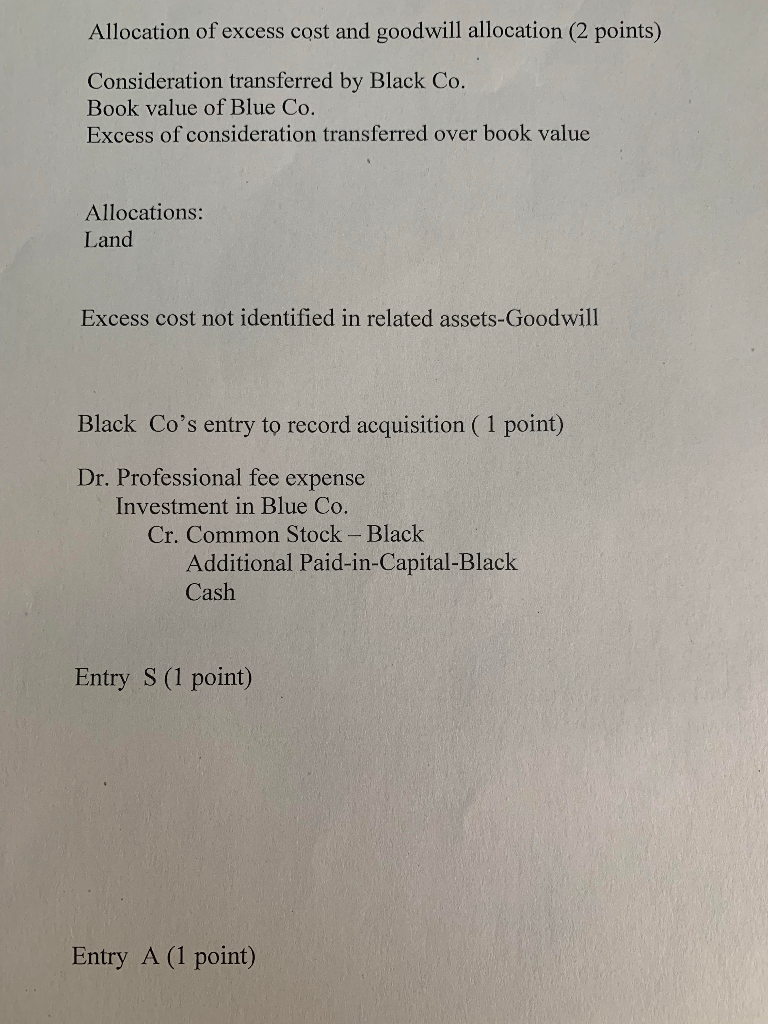

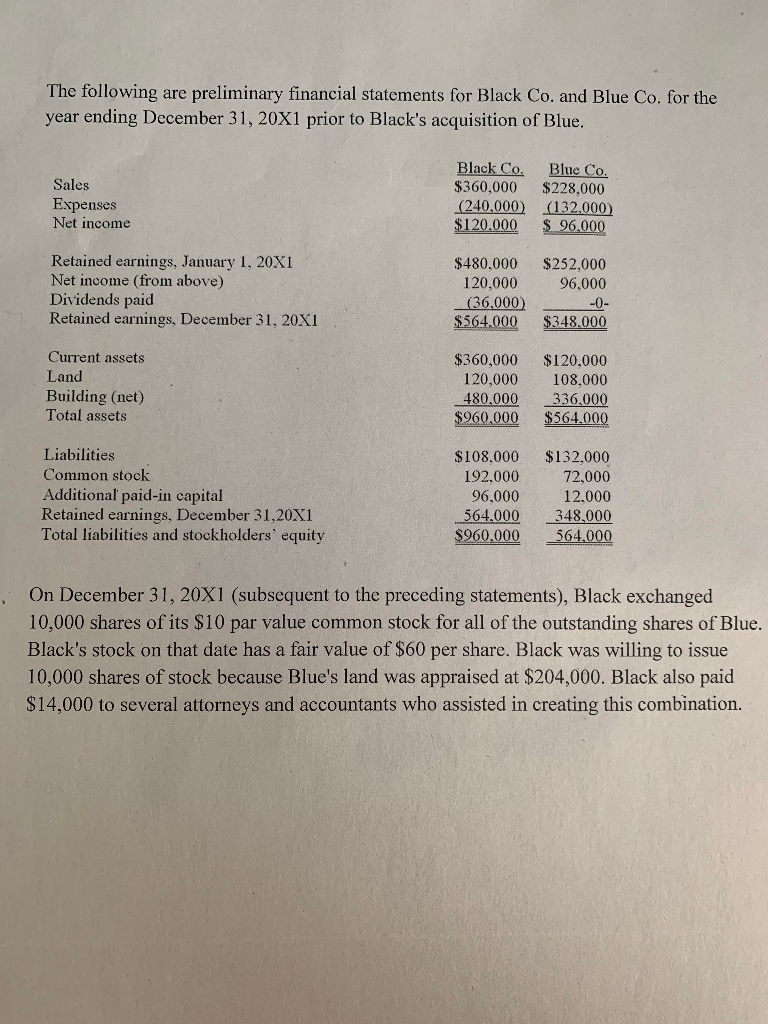

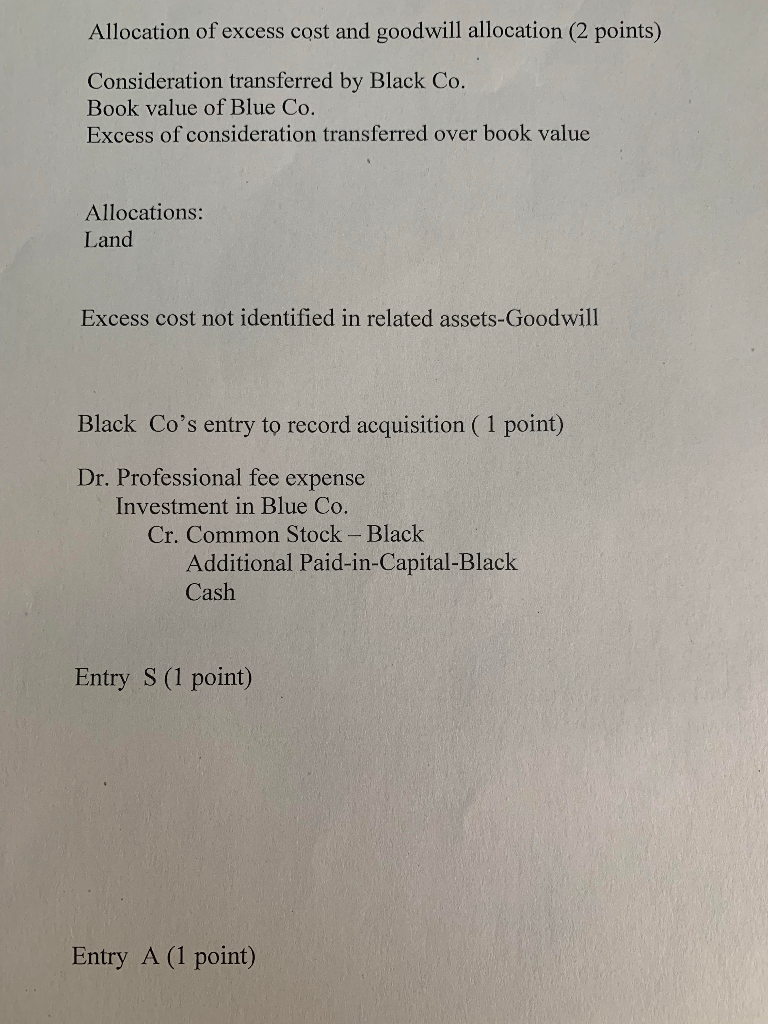

The following are preliminary financial statements for Black Co. and Blue Co. for the year ending December 31, 20X1 prior to Black's acquisition of Blue. Sales Expenses Net income Black Co. $360,000 (240,000) $120.000 Blue Co. $228,000 (132,000) $ 96,000 Retained earnings, January 1, 20X1 Net income (from above) Dividends paid Retained earnings, December 31, 20X1 $252,000 96,000 $480.000 120,000 (36,000) $564.000 -0- $348.000 Current assets Land Building (net) Total assets $360,000 120,000 480.000 $960,000 $120,000 108.000 336,000 $564.000 Liabilities Common stock Additional paid-in capital Retained earnings, December 31,20X1 Total liabilities and stockholders' equity $108,000 192.000 96,000 564.000 $960.000 $132,000 72,000 12.000 348,000 564.000 On December 31, 20X1 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $60 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination. Allocation of excess cost and goodwill allocation (2 points) Consideration transferred by Black Co. Book value of Blue Co. Excess of consideration transferred over book value Allocations: Land Excess cost not identified in related assets-Goodwill Black Co's entry to record acquisition ( 1 point) Dr. Professional fee expense Investment in Blue Co. Cr. Common Stock - Black Additional Paid-in-Capital-Black Cash Entry S (1 point) Entry A (1 point) The following are preliminary financial statements for Black Co. and Blue Co. for the year ending December 31, 20X1 prior to Black's acquisition of Blue. Sales Expenses Net income Black Co. $360,000 (240,000) $120.000 Blue Co. $228,000 (132,000) $ 96,000 Retained earnings, January 1, 20X1 Net income (from above) Dividends paid Retained earnings, December 31, 20X1 $252,000 96,000 $480.000 120,000 (36,000) $564.000 -0- $348.000 Current assets Land Building (net) Total assets $360,000 120,000 480.000 $960,000 $120,000 108.000 336,000 $564.000 Liabilities Common stock Additional paid-in capital Retained earnings, December 31,20X1 Total liabilities and stockholders' equity $108,000 192.000 96,000 564.000 $960.000 $132,000 72,000 12.000 348,000 564.000 On December 31, 20X1 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $60 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination. Allocation of excess cost and goodwill allocation (2 points) Consideration transferred by Black Co. Book value of Blue Co. Excess of consideration transferred over book value Allocations: Land Excess cost not identified in related assets-Goodwill Black Co's entry to record acquisition ( 1 point) Dr. Professional fee expense Investment in Blue Co. Cr. Common Stock - Black Additional Paid-in-Capital-Black Cash Entry S (1 point) Entry A (1 point)