Question

The following are the accounts of Dublon Medical Clinic for December 31, 2020. Professional Fee = Php 500,877.075 Salaries Expense = 25. 756.035 Supplies

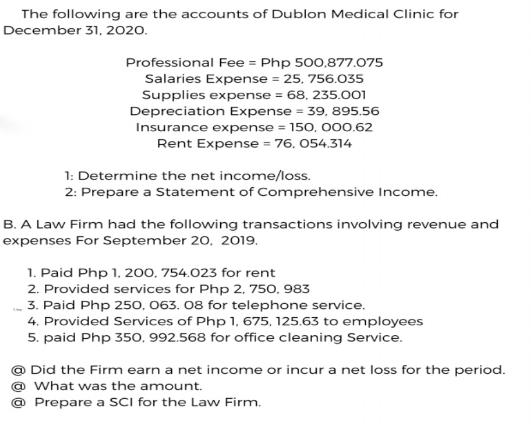

The following are the accounts of Dublon Medical Clinic for December 31, 2020. Professional Fee = Php 500,877.075 Salaries Expense = 25. 756.035 Supplies expense = 68, 235.001 Depreciation Expense = 39, 895.56 Insurance expense = 150, 000.62 Rent Expense = 76. 054.314 1: Determine the net income/loss. 2: Prepare a Statement of Comprehensive Income. B. A Law Firm had the following transactions involving revenue and expenses For September 20, 2019. 1. Paid Php 1, 200, 754.023 for rent 2. Provided services for Php 2, 750, 983 3. Paid Php 250, 063. 08 for telephone service. 4. Provided Services of Php 1, 675, 125.63 to employees 5. paid Php 350, 992.568 for office cleaning Service. Did the Firm earn a net income or incur a net loss for the period. What was the amount. @ Prepare a SCI for the Law Firm.

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John Wild, Ken Shaw, Barbara Chiappett

23rd edition

1259536351, 978-1259536359

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App