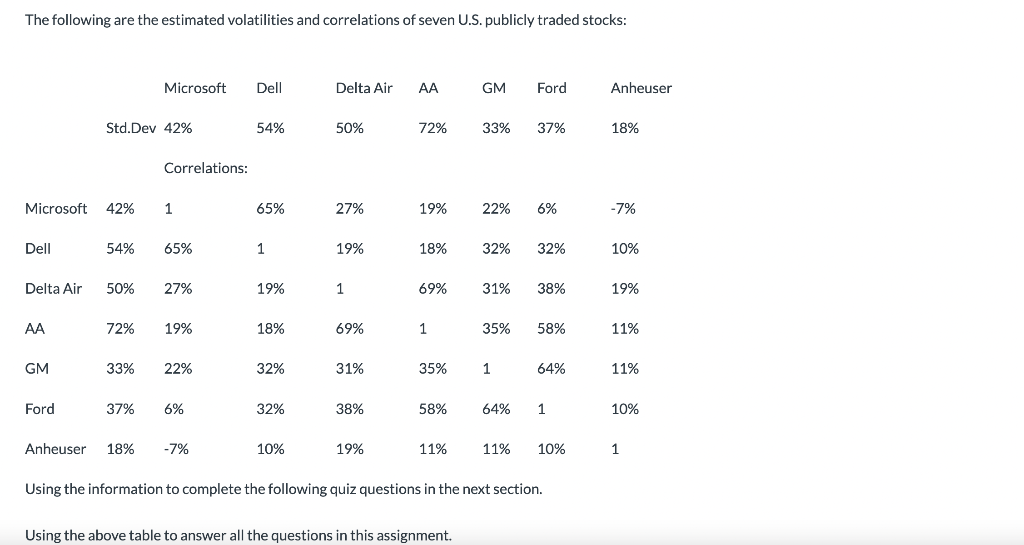

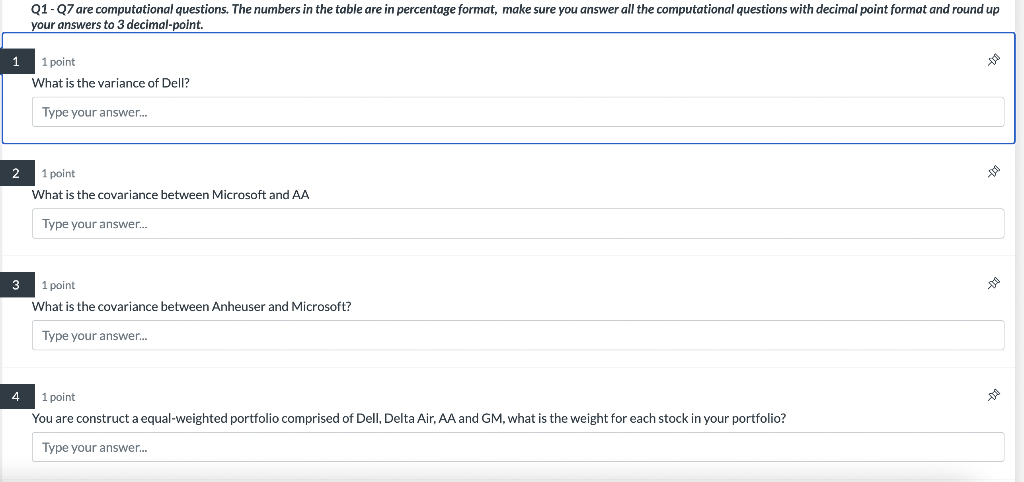

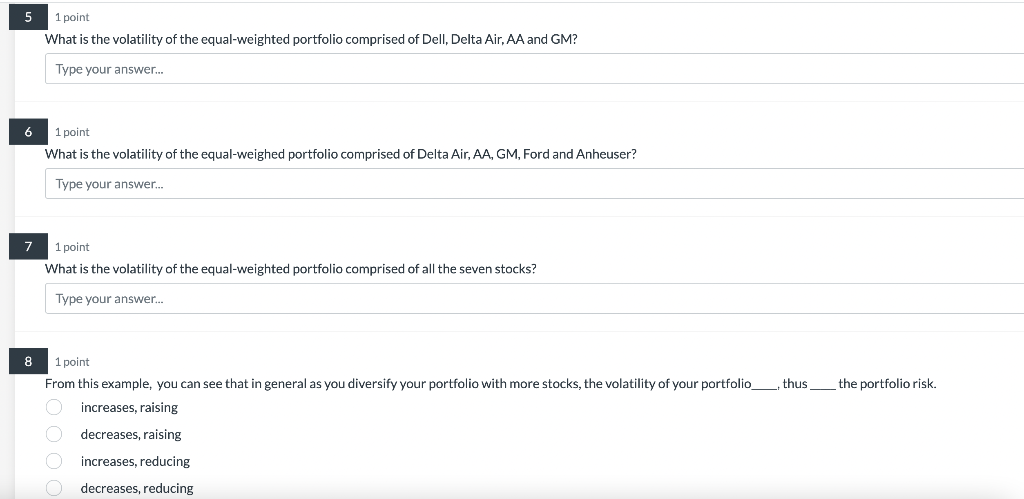

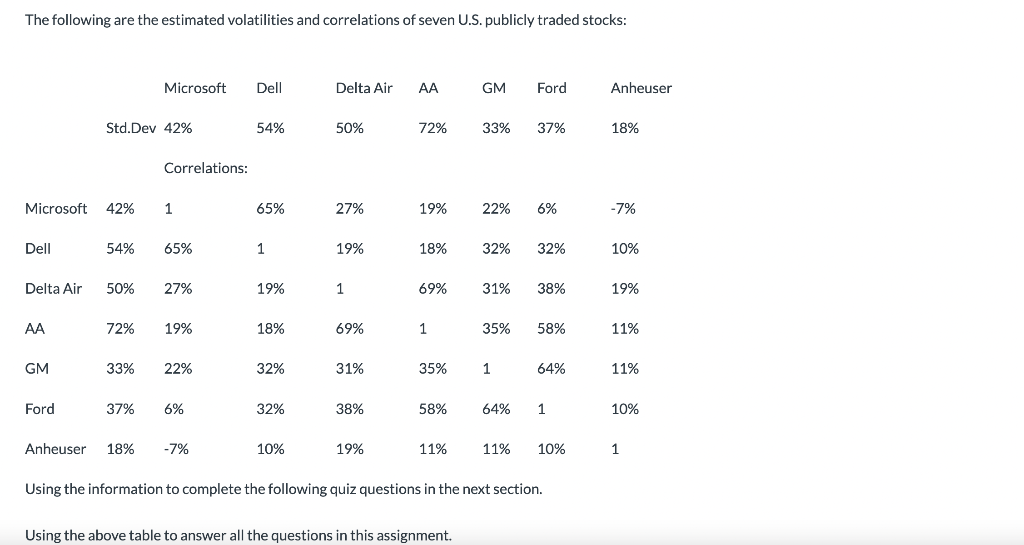

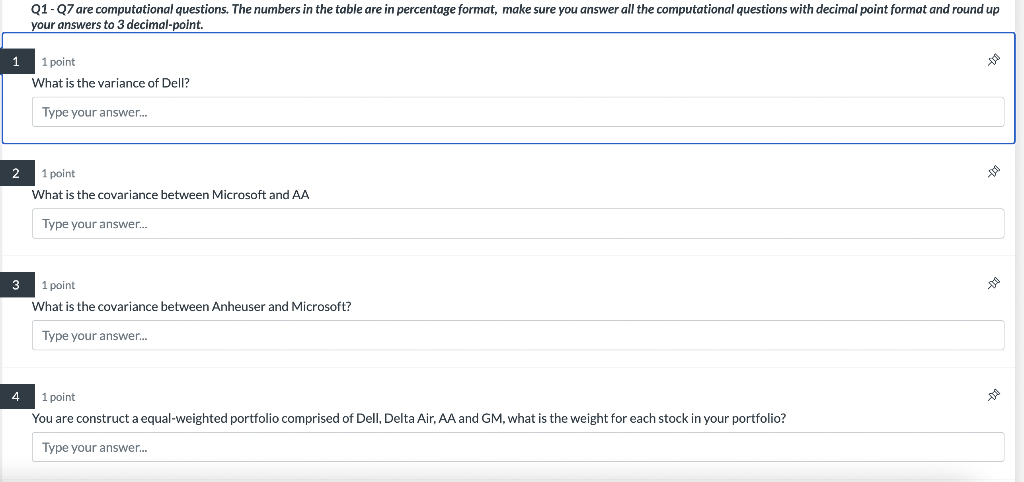

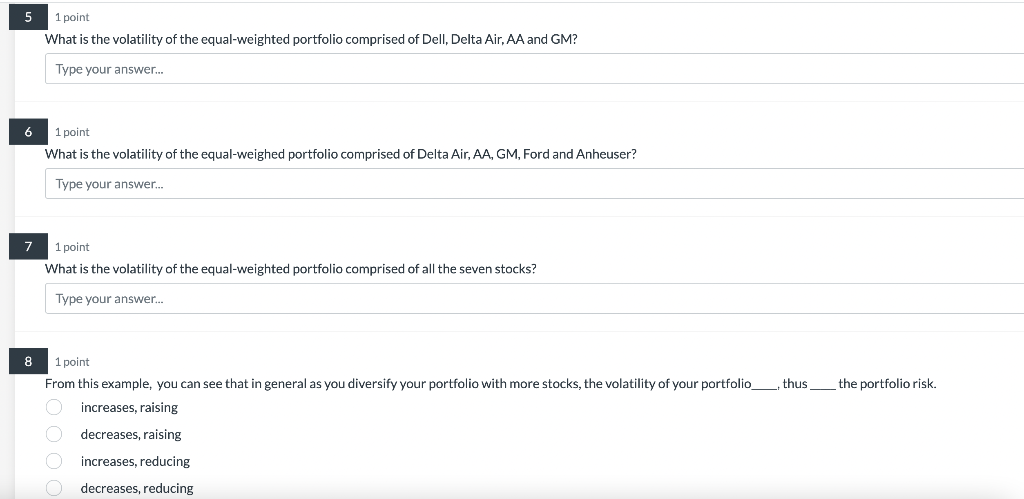

The following are the estimated volatilities and correlations of seven U.S. publicly traded stocks: Using the information to complete the following quiz questions in the next section. Using the above table to answer all the questions in this assignment. Q1 - Q7 are computational questions. The numbers in the table are in percentage format, make sure you answer all the computational questions with decimal point format and round up your answers to 3 decimal-point. 1 point What is the variance of Dell? Type your answer... 1 point What is the covariance between Microsoft and AA Type your answer... 1 point What is the covariance between Anheuser and Microsoft? Type your answer... 41 point You are construct a equal-weighted portfolio comprised of Dell, Delta Air, AA and GM, what is the weight for each stock in your portfolio? Type your answer... 1 point What is the volatility of the equal-weighted portfolio comprised of Dell, Delta Air, AA and GM? Type your answer... 1 point What is the volatility of the equal-weighed portfolio comprised of Delta Air, AA, GM, Ford and Anheuser? Type your answer... 1 point What is the volatility of the equal-weighted portfolio comprised of all the seven stocks? Type your answer... 1 point From this example, you can see that in general as you diversify your portfolio with more stocks, the volatility of your portfolio thus the portfolio risk. increases, raising decreases, raising increases, reducing decreases, reducing The following are the estimated volatilities and correlations of seven U.S. publicly traded stocks: Using the information to complete the following quiz questions in the next section. Using the above table to answer all the questions in this assignment. Q1 - Q7 are computational questions. The numbers in the table are in percentage format, make sure you answer all the computational questions with decimal point format and round up your answers to 3 decimal-point. 1 point What is the variance of Dell? Type your answer... 1 point What is the covariance between Microsoft and AA Type your answer... 1 point What is the covariance between Anheuser and Microsoft? Type your answer... 41 point You are construct a equal-weighted portfolio comprised of Dell, Delta Air, AA and GM, what is the weight for each stock in your portfolio? Type your answer... 1 point What is the volatility of the equal-weighted portfolio comprised of Dell, Delta Air, AA and GM? Type your answer... 1 point What is the volatility of the equal-weighed portfolio comprised of Delta Air, AA, GM, Ford and Anheuser? Type your answer... 1 point What is the volatility of the equal-weighted portfolio comprised of all the seven stocks? Type your answer... 1 point From this example, you can see that in general as you diversify your portfolio with more stocks, the volatility of your portfolio thus the portfolio risk. increases, raising decreases, raising increases, reducing decreases, reducing