Question

The following balances were extracted from the accounting records of Moshupi Ltd as at 1 January 2020. R Debit/ (Credit) Ordinary shares ................................................................................................................ (2 400

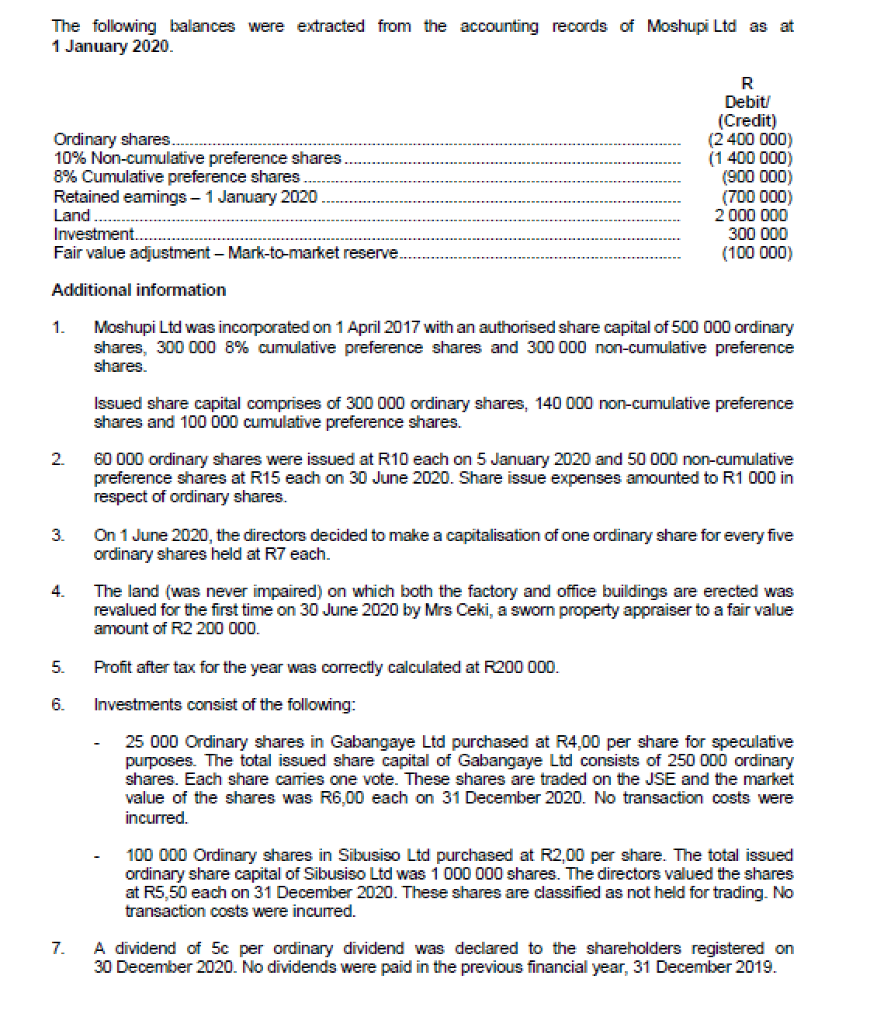

The following balances were extracted from the accounting records of Moshupi Ltd as at 1 January 2020. R Debit/ (Credit) Ordinary shares ................................................................................................................ (2 400 000) 10% Non-cumulative preference shares .......................................................................... (1 400 000) 8% Cumulative preference shares ................................................................................... (900 000) Retained earnings 1 January 2020 ............................................................................... (700 000) Land ................................................................................................................................ 2 000 000 Investment ........................................................................................................................ 300 000 Fair value adjustment Mark-to-market reserve .............................................................. (100 000) Additional information 1. Moshupi Ltd was incorporated on 1 April 2017 with an authorised share capital of 500 000 ordinary shares, 300 000 8% cumulative preference shares and 300 000 non-cumulative preference shares. Issued share capital comprises of 300 000 ordinary shares, 140 000 non-cumulative preference shares and 100 000 cumulative preference shares. 2. 60 000 ordinary shares were issued at R10 each on 5 January 2020 and 50 000 non-cumulative preference shares at R15 each on 30 June 2020. Share issue expenses amounted to R1 000 in respect of ordinary shares. 3. On 1 June 2020, the directors decided to make a capitalisation of one ordinary share for every five ordinary shares held at R7 each. 4. The land (was never impaired) on which both the factory and office buildings are erected was revalued for the first time on 30 June 2020 by Mrs Ceki, a sworn property appraiser to a fair value amount of R2 200 000. 5. Profit after tax for the year was correctly calculated at R200 000. 6. Investments consist of the following: - 25 000 Ordinary shares in Gabangaye Ltd purchased at R4,00 per share for speculative purposes. The total issued share capital of Gabangaye Ltd consists of 250 000 ordinary shares. Each share carries one vote. These shares are traded on the JSE and the market value of the shares was R6,00 each on 31 December 2020. No transaction costs were incurred. - 100 000 Ordinary shares in Sibusiso Ltd purchased at R2,00 per share. The total issued ordinary share capital of Sibusiso Ltd was 1 000 000 shares. The directors valued the shares at R5,50 each on 31 December 2020. These shares are classified as not held for trading. No transaction costs were incurred. 7. A dividend of 5c per ordinary dividend was declared to the shareholders registered on 30 December 2020. No dividends were paid in the previous financial year, 31 December 2019.

The following balances were extracted from the accounting records of Moshupi Ltd as at 1 January 2020. R Debit/ (Credit) Ordinary shares ................................................................................................................ (2 400 000) 10% Non-cumulative preference shares .......................................................................... (1 400 000) 8% Cumulative preference shares ................................................................................... (900 000) Retained earnings 1 January 2020 ............................................................................... (700 000) Land ................................................................................................................................ 2 000 000 Investment ........................................................................................................................ 300 000 Fair value adjustment Mark-to-market reserve .............................................................. (100 000) Additional information 1. Moshupi Ltd was incorporated on 1 April 2017 with an authorised share capital of 500 000 ordinary shares, 300 000 8% cumulative preference shares and 300 000 non-cumulative preference shares. Issued share capital comprises of 300 000 ordinary shares, 140 000 non-cumulative preference shares and 100 000 cumulative preference shares. 2. 60 000 ordinary shares were issued at R10 each on 5 January 2020 and 50 000 non-cumulative preference shares at R15 each on 30 June 2020. Share issue expenses amounted to R1 000 in respect of ordinary shares. 3. On 1 June 2020, the directors decided to make a capitalisation of one ordinary share for every five ordinary shares held at R7 each. 4. The land (was never impaired) on which both the factory and office buildings are erected was revalued for the first time on 30 June 2020 by Mrs Ceki, a sworn property appraiser to a fair value amount of R2 200 000. 5. Profit after tax for the year was correctly calculated at R200 000. 6. Investments consist of the following: - 25 000 Ordinary shares in Gabangaye Ltd purchased at R4,00 per share for speculative purposes. The total issued share capital of Gabangaye Ltd consists of 250 000 ordinary shares. Each share carries one vote. These shares are traded on the JSE and the market value of the shares was R6,00 each on 31 December 2020. No transaction costs were incurred. - 100 000 Ordinary shares in Sibusiso Ltd purchased at R2,00 per share. The total issued ordinary share capital of Sibusiso Ltd was 1 000 000 shares. The directors valued the shares at R5,50 each on 31 December 2020. These shares are classified as not held for trading. No transaction costs were incurred. 7. A dividend of 5c per ordinary dividend was declared to the shareholders registered on 30 December 2020. No dividends were paid in the previous financial year, 31 December 2019.

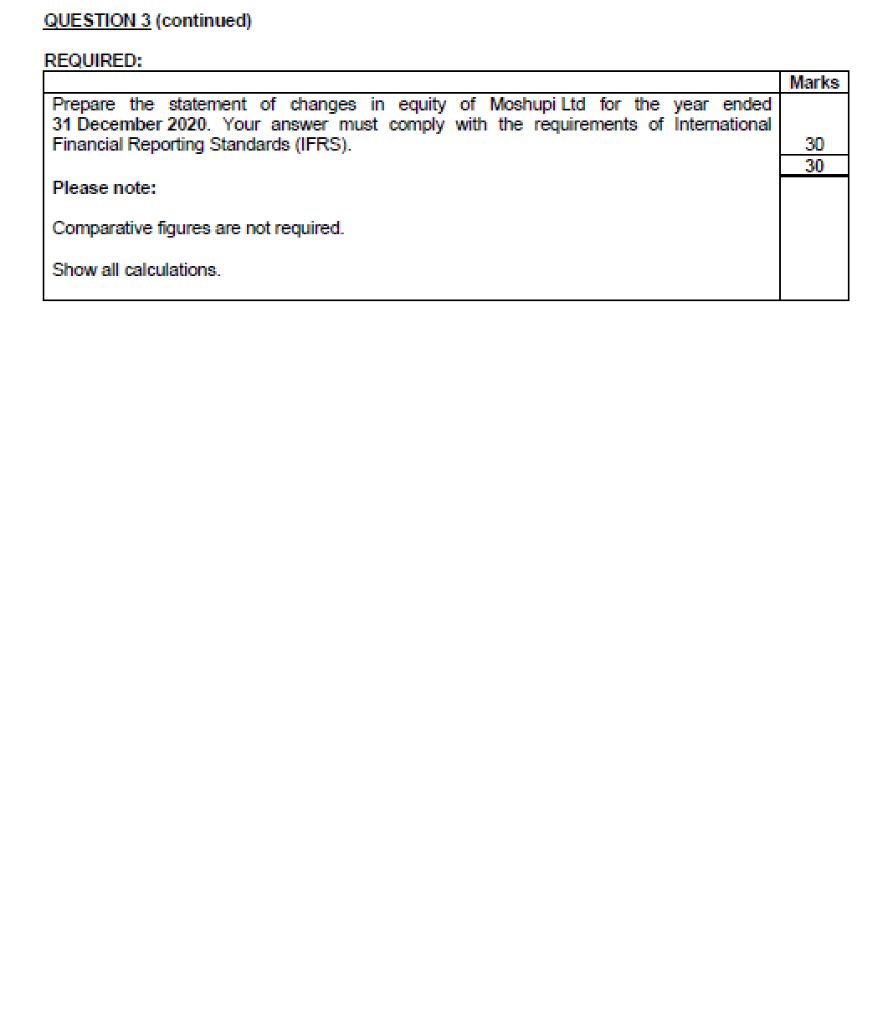

QUESTION 3 (continued) REQUIRED: Marks Prepare the statement of changes in equity of Moshupi Ltd for the year ended 31 December 2020. Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). 30 30 Please note: Comparative figures are not required. Show all calculations.

NEXT QUESTION 4:

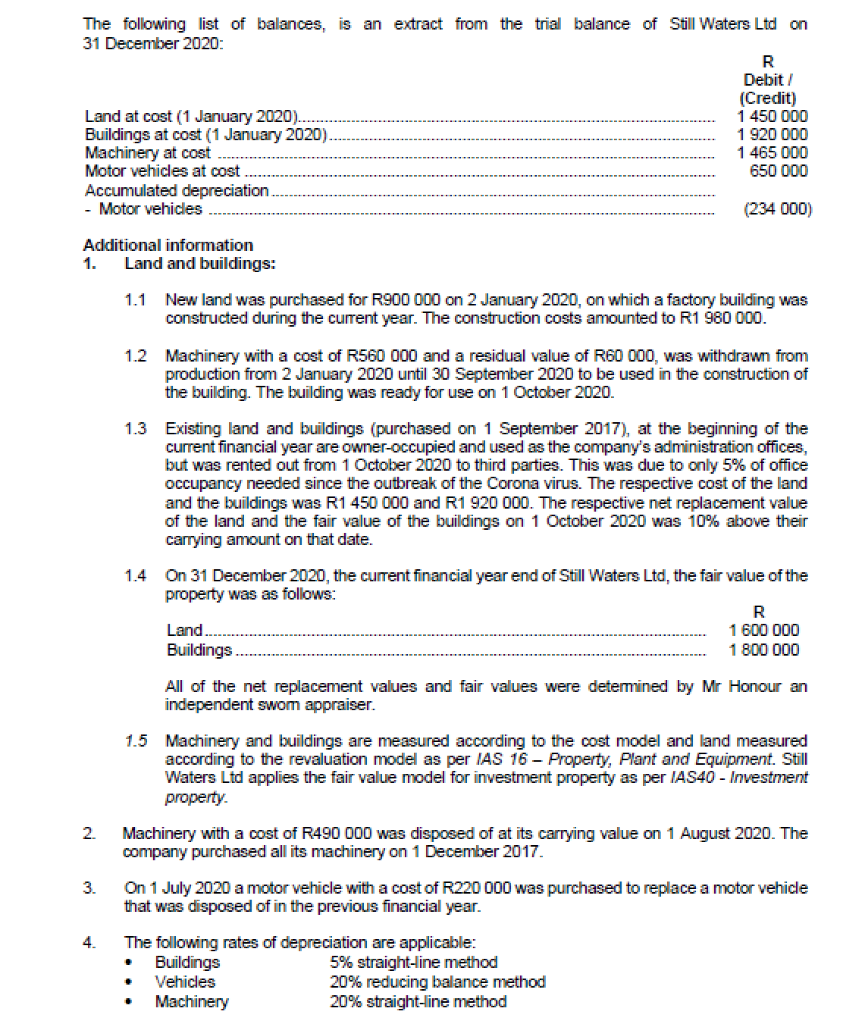

The following list of balances, is an extract from the trial balance of Still Waters Ltd on 31 December 2020: Land at cost (1 January 2020) .............................................................................................. Buildings at cost (1 January 2020) ....................................................................................... Machinery at cost ................................................................................................................ Motor vehicles at cost .......................................................................................................... Accumulated depreciation .................................................................................................... - Motor vehicles .................................................................................................................. R Debit / (Credit) 1 450 000 1 920 000 1 465 000 650 000 (234 000) Additional information 1. Land and buildings: 1.1 New land was purchased for R900 000 on 2 January 2020, on which a factory building was constructed during the current year. The construction costs amounted to R1 980 000. 1.2 Machinery with a cost of R560 000 and a residual value of R60 000, was withdrawn from production from 2 January 2020 until 30 September 2020 to be used in the construction of the building. The building was ready for use on 1 October 2020. 1.3 Existing land and buildings (purchased on 1 September 2017), at the beginning of the current financial year are owner-occupied and used as the companys administration offices, but was rented out from 1 October 2020 to third parties. This was due to only 5% of office occupancy needed since the outbreak of the Corona virus. The respective cost of the land and the buildings was R1 450 000 and R1 920 000. The respective net replacement value of the land and the fair value of the buildings on 1 October 2020 was 10% above their carrying amount on that date. 1.4 On 31 December 2020, the current financial year end of Still Waters Ltd, the fair value of the property was as follows: R Land ................................................................................................................. Buildings .......................................................................................................... 1 600 000 1 800 000 All of the net replacement values and fair values were determined by Mr Honour an independent sworn appraiser. 1.5 Machinery and buildings are measured according to the cost model and land measured according to the revaluation model as per IAS 16 Property, Plant and Equipment. Still Waters Ltd applies the fair value model for investment property as per IAS40 - Investment property. 2. Machinery with a cost of R490 000 was disposed of at its carrying value on 1 August 2020. The company purchased all its machinery on 1 December 2017. 3. On 1 July 2020 a motor vehicle with a cost of R220 000 was purchased to replace a motor vehicle that was disposed of in the previous financial year. 4. The following rates of depreciation are applicable: Buildings 5% straight-line method Vehicles 20% reducing balance method Machinery 20% straight-line method

The following list of balances, is an extract from the trial balance of Still Waters Ltd on 31 December 2020: Land at cost (1 January 2020) .............................................................................................. Buildings at cost (1 January 2020) ....................................................................................... Machinery at cost ................................................................................................................ Motor vehicles at cost .......................................................................................................... Accumulated depreciation .................................................................................................... - Motor vehicles .................................................................................................................. R Debit / (Credit) 1 450 000 1 920 000 1 465 000 650 000 (234 000) Additional information 1. Land and buildings: 1.1 New land was purchased for R900 000 on 2 January 2020, on which a factory building was constructed during the current year. The construction costs amounted to R1 980 000. 1.2 Machinery with a cost of R560 000 and a residual value of R60 000, was withdrawn from production from 2 January 2020 until 30 September 2020 to be used in the construction of the building. The building was ready for use on 1 October 2020. 1.3 Existing land and buildings (purchased on 1 September 2017), at the beginning of the current financial year are owner-occupied and used as the companys administration offices, but was rented out from 1 October 2020 to third parties. This was due to only 5% of office occupancy needed since the outbreak of the Corona virus. The respective cost of the land and the buildings was R1 450 000 and R1 920 000. The respective net replacement value of the land and the fair value of the buildings on 1 October 2020 was 10% above their carrying amount on that date. 1.4 On 31 December 2020, the current financial year end of Still Waters Ltd, the fair value of the property was as follows: R Land ................................................................................................................. Buildings .......................................................................................................... 1 600 000 1 800 000 All of the net replacement values and fair values were determined by Mr Honour an independent sworn appraiser. 1.5 Machinery and buildings are measured according to the cost model and land measured according to the revaluation model as per IAS 16 Property, Plant and Equipment. Still Waters Ltd applies the fair value model for investment property as per IAS40 - Investment property. 2. Machinery with a cost of R490 000 was disposed of at its carrying value on 1 August 2020. The company purchased all its machinery on 1 December 2017. 3. On 1 July 2020 a motor vehicle with a cost of R220 000 was purchased to replace a motor vehicle that was disposed of in the previous financial year. 4. The following rates of depreciation are applicable: Buildings 5% straight-line method Vehicles 20% reducing balance method Machinery 20% straight-line method

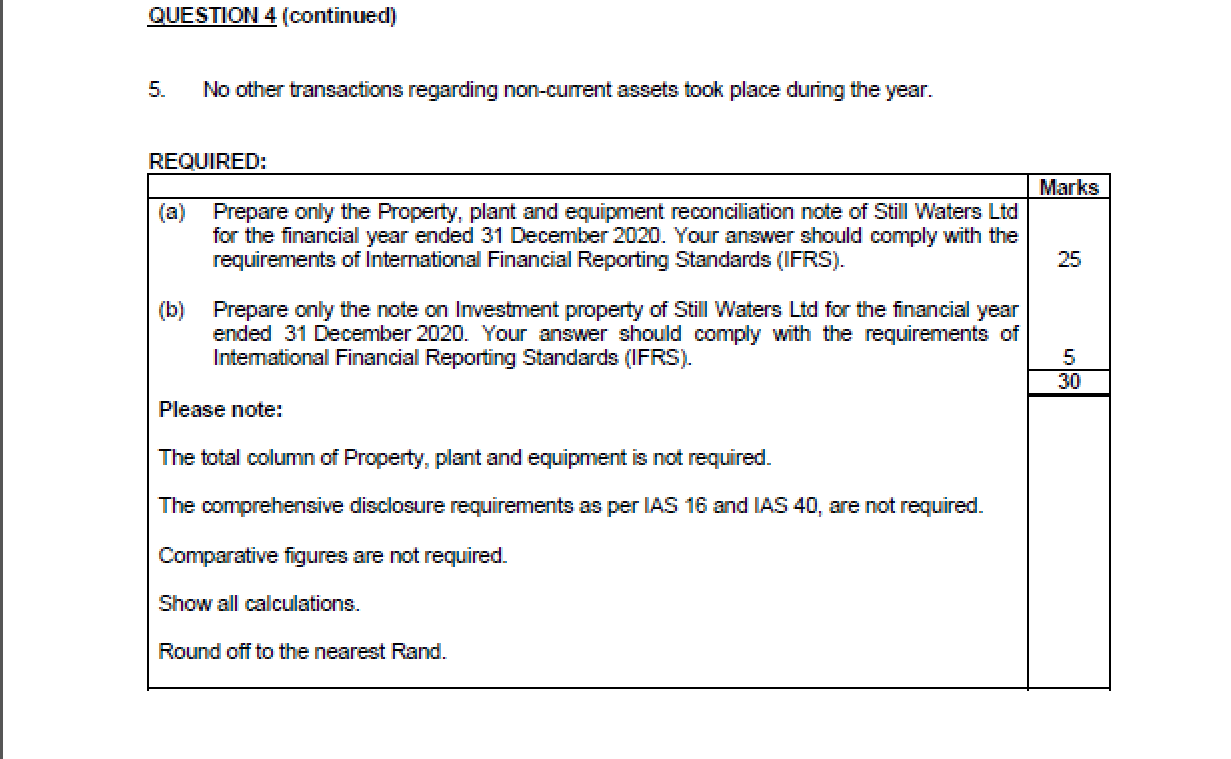

5. No other transactions regarding non-current assets took place during the year. REQUIRED: Marks (a) Prepare only the Property, plant and equipment reconciliation note of Still Waters Ltd for the financial year ended 31 December 2020. Your answer should comply with the requirements of International Financial Reporting Standards (IFRS). (b) Prepare only the note on Investment property of Still Waters Ltd for the financial year ended 31 December 2020. Your answer should comply with the requirements of International Financial Reporting Standards (IFRS). 25 5 30 Please note: The total column of Property, plant and equipment is not required. The comprehensive disclosure requirements as per IAS 16 and IAS 40, are not required. Comparative figures are not required. Show all calculations. Round off to the nearest Rand.

The following balances were extracted from the accounting records of Moshupi Ltd as at 1 January 2020. Ordinary shares 10% Non-cumulative preference shares 8% Cumulative preference shares Retained eamings - 1 January 2020 Land Investment.. Fair value adjustment - Mark-to-market reserve. R Debiti (Credit) (2 400 000) (1 400 000) (900 000) (700 000) 2 000 000 300 000 (100 000) Additional information 1. Moshupi Ltd was incorporated on 1 April 2017 with an authorised share capital of 500 000 ordinary shares, 300 000 8% cumulative preference shares and 300 000 non-cumulative preference shares. Issued share capital comprises of 300 000 ordinary shares, 140 000 non-cumulative preference shares and 100 000 cumulative preference shares. 2. 60 000 ordinary shares were issued at R10 each on 5 January 2020 and 50 000 non-cumulative preference shares at R15 each on 30 June 2020. Share issue expenses amounted to R1 000 in respect of ordinary shares. 3. On 1 June 2020, the directors decided to make a capitalisation of one ordinary share for every five ordinary shares held at R7 each. 4 The land (was never impaired) on which both the factory and office buildings are erected was revalued for the first time on 30 June 2020 by Mrs Ceki, a sworn property appraiser to a fair value amount of R2 200 000. 5. Profit after tax for the year was correctly calculated at R200 000. 6. Investments consist of the following: 25 000 Ordinary shares in Gabangaye Ltd purchased at R4,00 per share for speculative purposes. The total issued share capital of Gabangaye Ltd consists of 250 000 ordinary shares. Each share carries one vote. These shares are traded on the JSE and the market value of the shares was R6,00 each on 31 December 2020. No transaction costs were incurred. 100 000 Ordinary shares in Sibusiso Ltd purchased at R2,00 per share. The total issued ordinary share capital of Sibusiso Ltd was 1 000 000 shares. The directors valued the shares at R5,50 each on 31 December 2020. These shares are classified as not held for trading. No transaction costs were incurred. 7. A dividend of 5c per ordinary dividend was declared to the shareholders registered on 30 December 2020. No dividends were paid in the previous financial year, 31 December 2019. QUESTION 3 (continued) REQUIRED: Marks Prepare the statement of changes in equity of Moshupi Ltd for the year ended 31 December 2020. Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). 30 30 Please note: Comparative figures are not required. Show all calculations. The following list of balances, is an extract from the trial balance of Still Waters Ltd on 31 December 2020: R Debit/ (Credit) Land at cost (1 January 2020). 1 450 000 Buildings at cost (1 January 2020) 1 920 000 Machinery at cost 1 465 000 Motor vehicles at cost 650 000 Accumulated depreciation - Motor vehicles (234 000) Additional information 1. Land and buildings: 1.1 New land was purchased for R900 000 on 2 January 2020, on which a factory building was constructed during the current year. The construction costs amounted to R1 980 000. 1.2 Machinery with a cost of R560 000 and a residual value of R60 000, was withdrawn from production from 2 January 2020 until 30 September 2020 to be used in the construction of the building. The building was ready for use on 1 October 2020. 1.3 Existing land and buildings (purchased on 1 September 2017), at the beginning of the current financial year are owner-occupied and used as the company's administration offices, but was rented out from 1 October 2020 to third parties. This was due to only 5% of office occupancy needed since the outbreak of the Corona virus. The respective cost of the land and the buildings was R1 450 000 and R1 920 000. The respective net replacement value of the land and the fair value of the buildings on 1 October 2020 was 10% above their carrying amount on that date. 1.4 On 31 December 2020, the current financial year end of Still Waters Ltd, the fair value of the property was as follows: R Land. 1 600 000 Buildings 1 800 000 All of the net replacement values and fair values were determined by Mr Honour an independent swom appraiser. 1.5 Machinery and buildings are measured according to the cost model and land measured according to the revaluation model as per IAS 16 - Property, Plant and Equipment. Still Waters Ltd applies the fair value model for investment property as per IAS40 - Investment property. 2. Machinery with a cost of R490 000 was disposed of at its carrying value on 1 August 2020. The company purchased all its machinery on 1 December 2017. 3. On 1 July 2020 a motor vehicle with a cost of R220 000 was purchased to replace a motor vehicle that was disposed of in the previous financial year. 4. The following rates of depreciation are applicable: Buildings 5% straight-line method Vehicles 20% reducing balance method Machinery 20% straight-line method QUESTION 4 (continued) 5. No other transactions regarding non-current assets took place during the year. REQUIRED: Marks (a) Prepare only the Property, plant and equipment reconciliation note of Still Waters Ltd for the financial year ended 31 December 2020. Your answer should comply with the requirements of International Financial Reporting Standards (IFRS). 25 (b) Prepare only the note on Investment property of Still Waters Ltd for the financial year ended 31 December 2020. Your answer should comply with the requirements of Interational Financial Reporting Standards (IFRS). 5 30 Please note: The total column of Property, plant and equipment is not required. The comprehensive disclosure requirements as per IAS 16 and IAS 40, are not required. Comparative figures are not required. Show all calculations. Round off to the nearest Rand. The following balances were extracted from the accounting records of Moshupi Ltd as at 1 January 2020. Ordinary shares 10% Non-cumulative preference shares 8% Cumulative preference shares Retained eamings - 1 January 2020 Land Investment.. Fair value adjustment - Mark-to-market reserve. R Debiti (Credit) (2 400 000) (1 400 000) (900 000) (700 000) 2 000 000 300 000 (100 000) Additional information 1. Moshupi Ltd was incorporated on 1 April 2017 with an authorised share capital of 500 000 ordinary shares, 300 000 8% cumulative preference shares and 300 000 non-cumulative preference shares. Issued share capital comprises of 300 000 ordinary shares, 140 000 non-cumulative preference shares and 100 000 cumulative preference shares. 2. 60 000 ordinary shares were issued at R10 each on 5 January 2020 and 50 000 non-cumulative preference shares at R15 each on 30 June 2020. Share issue expenses amounted to R1 000 in respect of ordinary shares. 3. On 1 June 2020, the directors decided to make a capitalisation of one ordinary share for every five ordinary shares held at R7 each. 4 The land (was never impaired) on which both the factory and office buildings are erected was revalued for the first time on 30 June 2020 by Mrs Ceki, a sworn property appraiser to a fair value amount of R2 200 000. 5. Profit after tax for the year was correctly calculated at R200 000. 6. Investments consist of the following: 25 000 Ordinary shares in Gabangaye Ltd purchased at R4,00 per share for speculative purposes. The total issued share capital of Gabangaye Ltd consists of 250 000 ordinary shares. Each share carries one vote. These shares are traded on the JSE and the market value of the shares was R6,00 each on 31 December 2020. No transaction costs were incurred. 100 000 Ordinary shares in Sibusiso Ltd purchased at R2,00 per share. The total issued ordinary share capital of Sibusiso Ltd was 1 000 000 shares. The directors valued the shares at R5,50 each on 31 December 2020. These shares are classified as not held for trading. No transaction costs were incurred. 7. A dividend of 5c per ordinary dividend was declared to the shareholders registered on 30 December 2020. No dividends were paid in the previous financial year, 31 December 2019. QUESTION 3 (continued) REQUIRED: Marks Prepare the statement of changes in equity of Moshupi Ltd for the year ended 31 December 2020. Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). 30 30 Please note: Comparative figures are not required. Show all calculations. The following list of balances, is an extract from the trial balance of Still Waters Ltd on 31 December 2020: R Debit/ (Credit) Land at cost (1 January 2020). 1 450 000 Buildings at cost (1 January 2020) 1 920 000 Machinery at cost 1 465 000 Motor vehicles at cost 650 000 Accumulated depreciation - Motor vehicles (234 000) Additional information 1. Land and buildings: 1.1 New land was purchased for R900 000 on 2 January 2020, on which a factory building was constructed during the current year. The construction costs amounted to R1 980 000. 1.2 Machinery with a cost of R560 000 and a residual value of R60 000, was withdrawn from production from 2 January 2020 until 30 September 2020 to be used in the construction of the building. The building was ready for use on 1 October 2020. 1.3 Existing land and buildings (purchased on 1 September 2017), at the beginning of the current financial year are owner-occupied and used as the company's administration offices, but was rented out from 1 October 2020 to third parties. This was due to only 5% of office occupancy needed since the outbreak of the Corona virus. The respective cost of the land and the buildings was R1 450 000 and R1 920 000. The respective net replacement value of the land and the fair value of the buildings on 1 October 2020 was 10% above their carrying amount on that date. 1.4 On 31 December 2020, the current financial year end of Still Waters Ltd, the fair value of the property was as follows: R Land. 1 600 000 Buildings 1 800 000 All of the net replacement values and fair values were determined by Mr Honour an independent swom appraiser. 1.5 Machinery and buildings are measured according to the cost model and land measured according to the revaluation model as per IAS 16 - Property, Plant and Equipment. Still Waters Ltd applies the fair value model for investment property as per IAS40 - Investment property. 2. Machinery with a cost of R490 000 was disposed of at its carrying value on 1 August 2020. The company purchased all its machinery on 1 December 2017. 3. On 1 July 2020 a motor vehicle with a cost of R220 000 was purchased to replace a motor vehicle that was disposed of in the previous financial year. 4. The following rates of depreciation are applicable: Buildings 5% straight-line method Vehicles 20% reducing balance method Machinery 20% straight-line method QUESTION 4 (continued) 5. No other transactions regarding non-current assets took place during the year. REQUIRED: Marks (a) Prepare only the Property, plant and equipment reconciliation note of Still Waters Ltd for the financial year ended 31 December 2020. Your answer should comply with the requirements of International Financial Reporting Standards (IFRS). 25 (b) Prepare only the note on Investment property of Still Waters Ltd for the financial year ended 31 December 2020. Your answer should comply with the requirements of Interational Financial Reporting Standards (IFRS). 5 30 Please note: The total column of Property, plant and equipment is not required. The comprehensive disclosure requirements as per IAS 16 and IAS 40, are not required. Comparative figures are not required. Show all calculations. Round off to the nearest RandStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started