Answered step by step

Verified Expert Solution

Question

1 Approved Answer

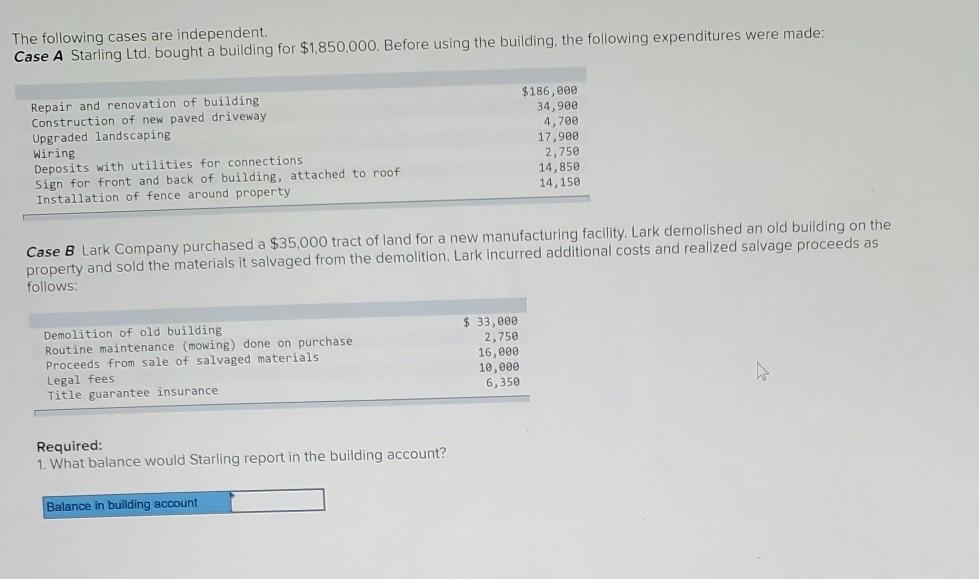

The following cases are independent. Case A Starling Ltd. bought a building for $1,850,000. Before using the building, the following expenditures were made: Repair and

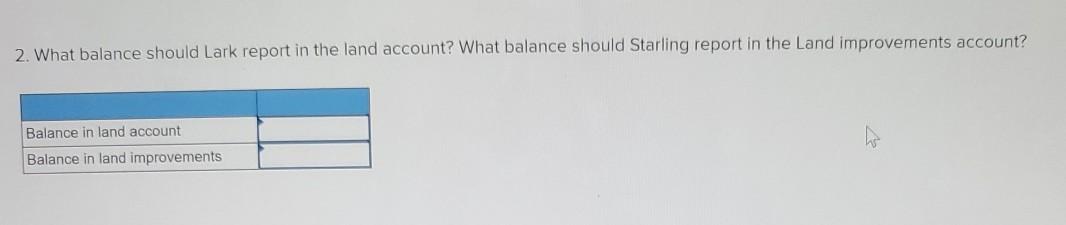

The following cases are independent. Case A Starling Ltd. bought a building for $1,850,000. Before using the building, the following expenditures were made: Repair and renovation of building Construction of new paved driveway Upgraded landscaping Wiring Deposits with utilities for connections Sign for front and back of building, attached to roof Installation of fence around property $186, 80e 34,900 4,789 17,900 2,750 14,850 14,150 Case B Lark Company purchased a $35,000 tract of land for a new manufacturing facility. Lark demolished an old building on the property and sold the materials it salvaged from the demolition. Lark incurred additional costs and realized salvage proceeds as follows: Demolition of old building Routine maintenance (mowing) done on purchase Proceeds from sale of salvaged materials Legal fees Title guarantee insurance $ 33, eee 2,750 16, eee 10, eee 6,350 Required: 1. What balance would Starling report in the building account? Balance in building account 2. What balance should Lark report in the land account? What balance should Starling report in the Land improvements account? Balance in land account Balance in land improvements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started