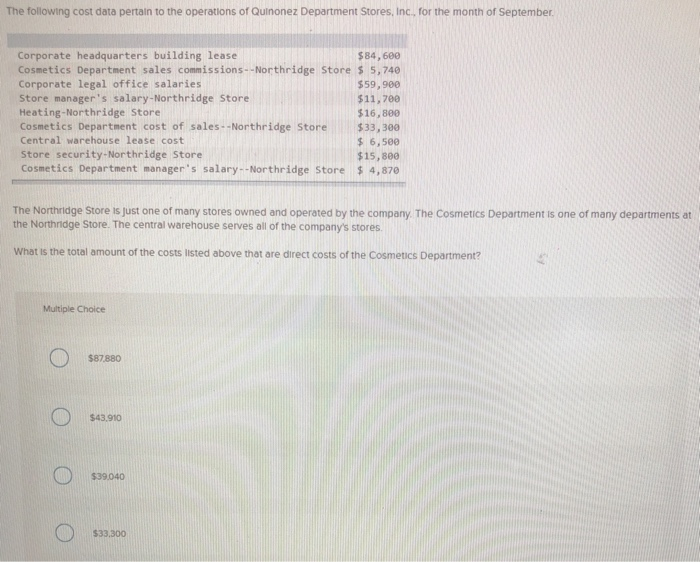

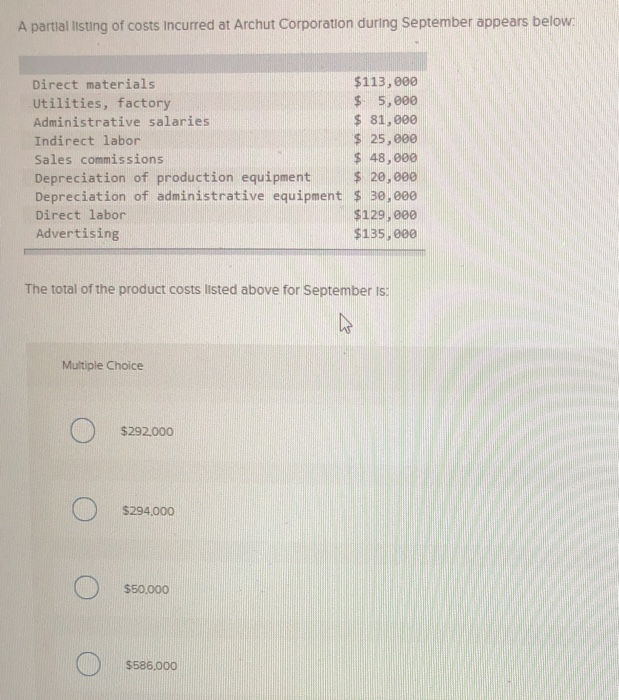

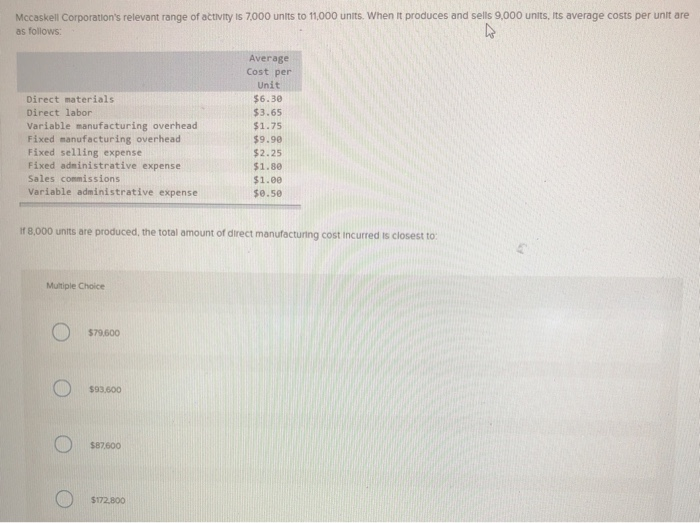

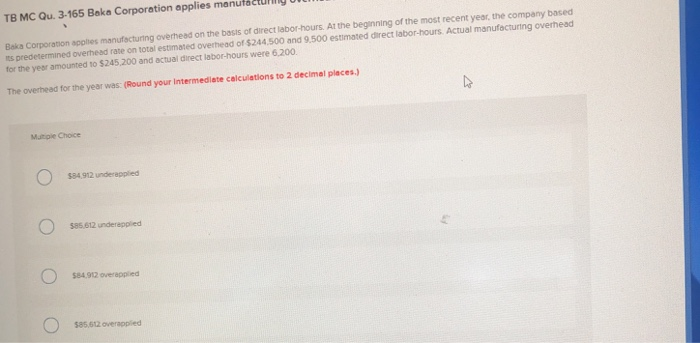

The following cost data pertain to the operations of Quinonez Department Stores, Inc., for the month of September Corporate headquarters building lease $84,600 Cosmetics Department sales commissions -- Northridge Store $ 5,740 Corporate legal office salaries $59,900 Store manager's salary-Northridge Store $11,700 Heating-Northridge Store $16,800 Cosmetics Department cost of sales - - Northridge Store $33,300 Central warehouse lease cost $ 6,500 Store security-Northridge Store $15,800 Cosmetics Department manager's salary-- Northridge Store $ 4,870 The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores What is the total amount of the costs listed above that are direct costs of the Cosmetics Department? Multiple Choice $87.880 o oo O $43.910 O $39.040 O $33,300 A partial listing of costs incurred at Archut Corporation during September appears below. Direct materials $113,000 Utilities, factory S. 5, 600 Administrative salaries $ 81,000 Indirect labor $ 25,000 Sales commissions $ 48,000 Depreciation of production equipment $ 20,000 Depreciation of administrative equipment $ 30,000 Direct labor $129,000 Advertising $135,000 The total of the product costs listed above for September is: Multiple Choice $292.000 294,000 S50,000 $586,000 Mccaskell Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost per Unit $6.30 $3.65 $1.75 $9.90 $2.25 $1.80 $1.00 $0.50 118.000 units are produced, the total amount of direct manufacturing cost incurred is closest to: 1 Multiple Choice O $79,600 O $93.600 O O $87,600 O $172,800 TB MC Qu. 3-165 Baka Corporation applies manufacturiy UILI Baka Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based s predetermined overhead rate on total estimated overhead of $244,500 and 9.500 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $245.200 and actual direct labor-hours were 6,200. The overhead for the year was: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $34.912 underapplied O o $85.612 underapplied O 0 $84.912 overapplied O $85.612 overappled O