Question

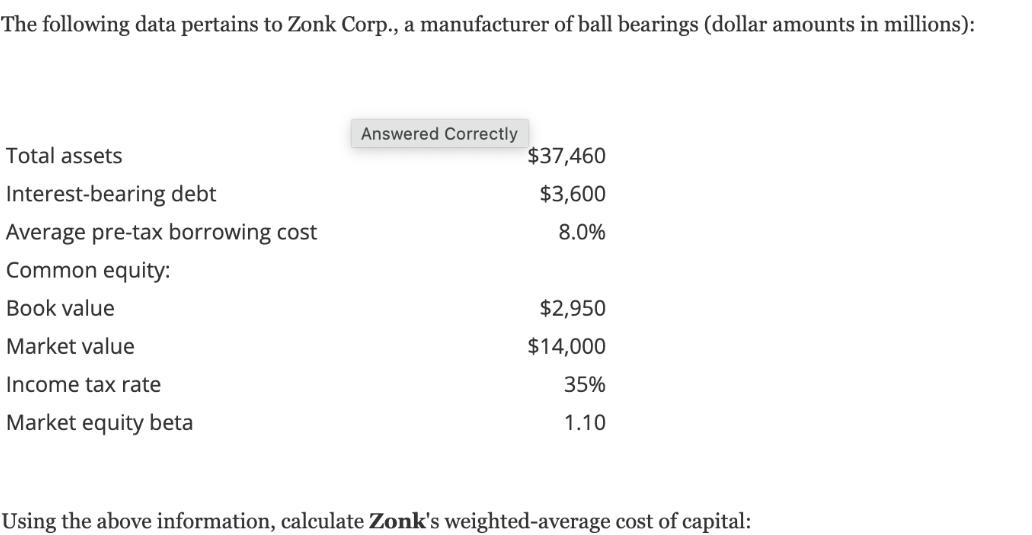

The following data pertains to Zonk Corp., a manufacturer of ball bearings (dollar amounts in millions): Total assets Interest-bearing debt Average pre-tax borrowing cost

The following data pertains to Zonk Corp., a manufacturer of ball bearings (dollar amounts in millions): Total assets Interest-bearing debt Average pre-tax borrowing cost Common equity: Book value Market value Income tax rate Market equity beta Answered Correctly $37,460 $3,600 8.0% $2,950 $14,000 35% 1.10 Using the above information, calculate Zonk's weighted-average cost of capital:

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the weightedaverage cost of capital WACC we need to determine the cost of each componen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M Wahlen, Stephen P Baginskl, Mark T Bradshaw

7th Edition

9780324789423, 324789416, 978-0324789416

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App