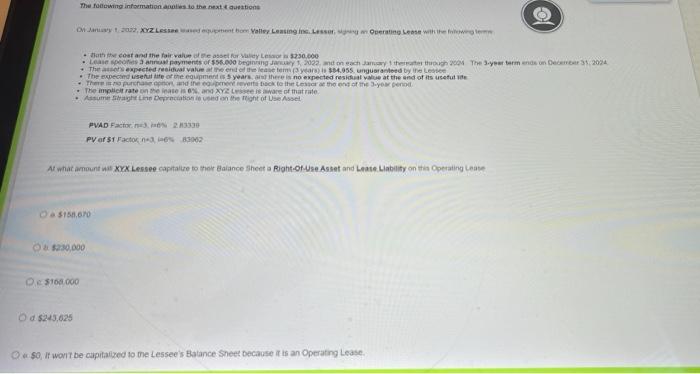

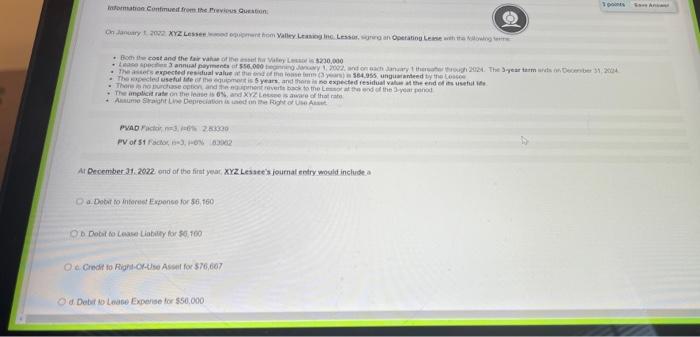

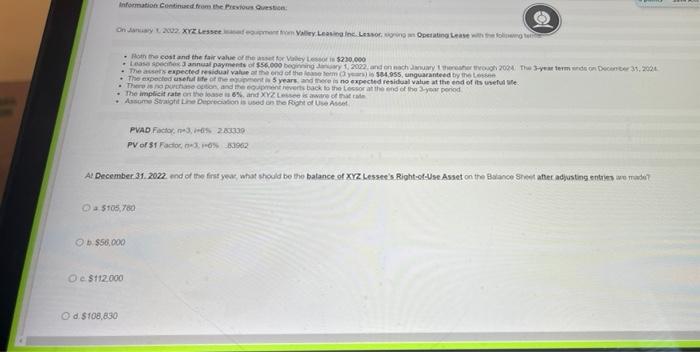

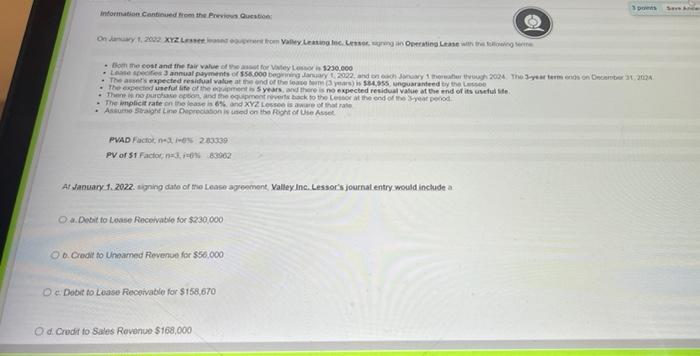

The following information and to the next stone on XYZ Lesse we boer Valley Leating in Operating Lease with the the cost and the fair value of lease for Sale Les 230,000 Loane pe payments of $56.000 beginning Jay2022. non each any the though the year term and on December 2004 The expected rahvaland that years) $81.955. unguaranteed by the . The expected sul life of the equipment is 5 years, there is no expected residual value at the end of its useful The page and come back to the enter the end of the your period . The imple rate on the case is on Yeware of thatate Asumight Deprecated on the right of Use Asset PVAD Factor. 2.3530 PV or Factone eos 50 At what amount w XXXLessee captature to their Balance sheet a Right-of-use Asset and Lente Liability on this Operating Lan a $15.00 a $230,000 De 100.000 Od $243,625 O. $0, it wont be capitalized to me Lessee's Balance Sheet Decause it is an Operating Lease formation Continue from the Previous Question Onwry 2 XYZ LESS anunt hom Valley. Le Lesses, we an Operating new Bom cost and their way 3230,000 3 annual payment of 556.000 2. hy h292. The year term wobe 1204 expected residual value in 564956 unged the loc The led useful items years, and the expected residual the end of is what we The order and introvert back to the Lord of the year The amplit rate on the less, and XYZ w of that Am Straight Deprecios en Rights PAD actor 3, 2.300 PV or strid, 2 At December 31, 2022 end of the fint your XYZ Lessee's journal entry would include a Da. Dobar to interest Expence for $6.100 O Dobit to Lose Liabitly for 55.900 O Credit to Rights Asset for 576,607 Od Debit to Lose Expense for $50,000 Information continued from the Prius Question on Jawy 2002.XYZ Les mer om he Lesione. Les noms Operating tease wait Ho the cost and the fair value of the Royale $230,000 Les spons annual payments of $56.000 beggy 1 2022 anden nach my oh 2004 The year term on Decanter 1.2004 The expected residual value hond of the nel 584.955, unguaranteed by these The expected side of the years, and there is no expected residual value at the end of its useful There is no pretion and reverts back to the sort the end of the year period The implicit rate at the 6% and XYZ List Assom Str Depreciation is used on the Right of Use PVAD Factor 3, 2230 PV of S1 Factors 1962 Al December 31, 2022 end of the first you what should be the balance of XYZ Lessee's Right-of-Use Asset on the Balance Steater adjusting entries we made? O $105,780 b $55,000 O $112.000 $108,830 information continued from the Position On nay. 202 XYZpromo Lening c. wongan Orang Lewe - tomme cost and the fair value of the storey Les 1230.000 Lei 3 annual payments of $56.000 by 2022 and nach wie vor 2004 The Beatments on December 2004 The expected residual value at the end of the factory) is $84.955 unguaranteed by the The expected useful life of them is 5 years, and there is no expected residuale at the end of its Thanno purchase and the introvert back to the Lort the end of the year period The implicitrate on the basis and XYZ LO is aware of the . Acum Straight Line Depreciation is used on the right of Use Asset PVAD Factor, 280539 PV of st Factor 3.83962 Ai Sawary 1, 2022. signing date of the Lease agronment Valley Inc. Lesso's journal entry would include a a. Dobit to Loose Receivable for $230,000 O.Credit to Unnamed Revenue for $50.000 De Dobit to Lease Receivable for $158,670 Od Credit to Sales Revenue $168,000