Answered step by step

Verified Expert Solution

Question

1 Approved Answer

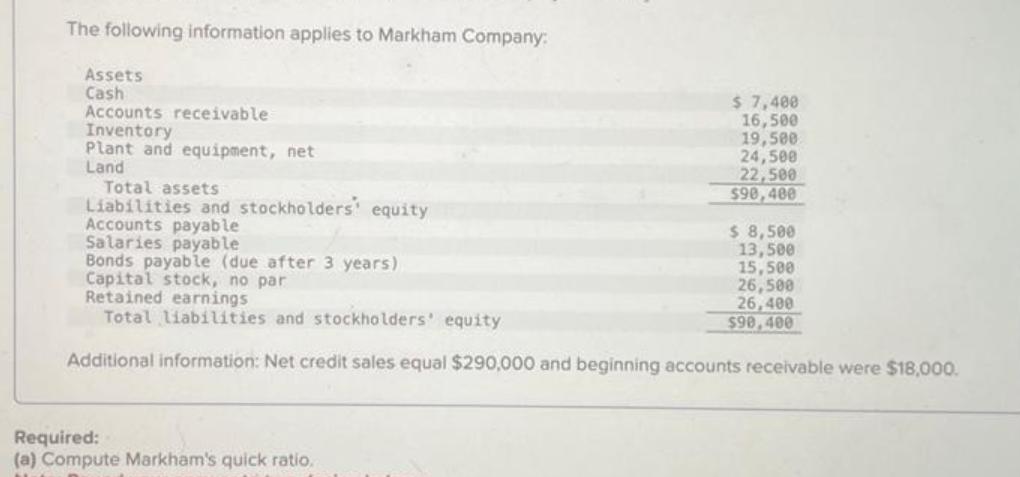

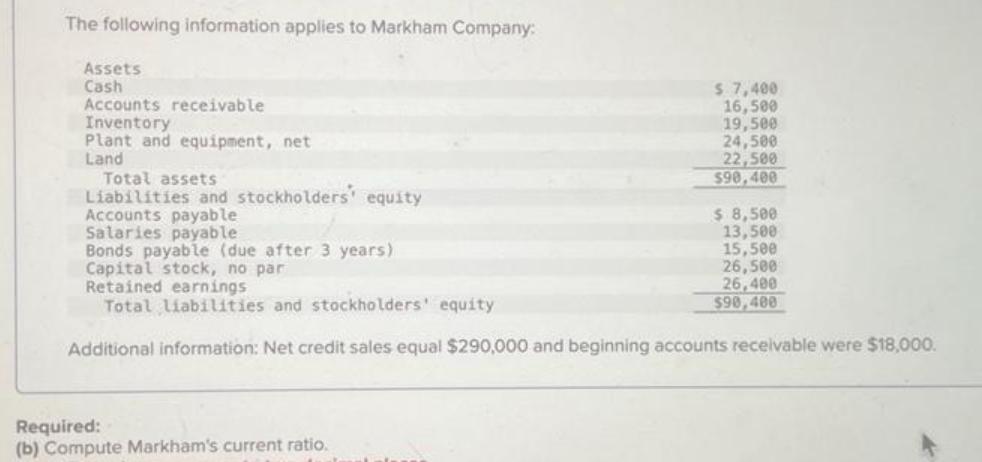

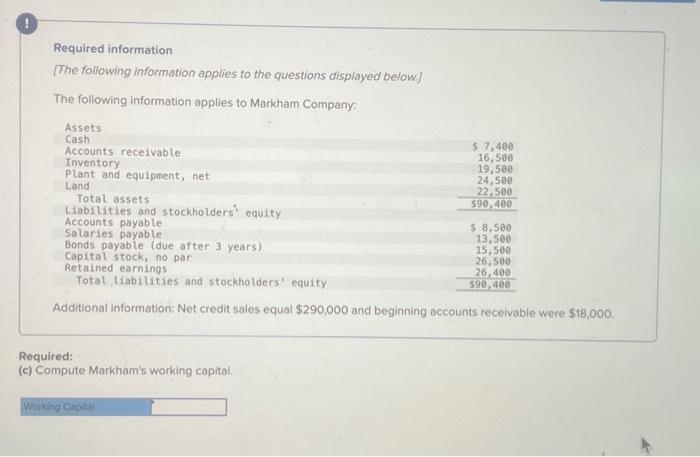

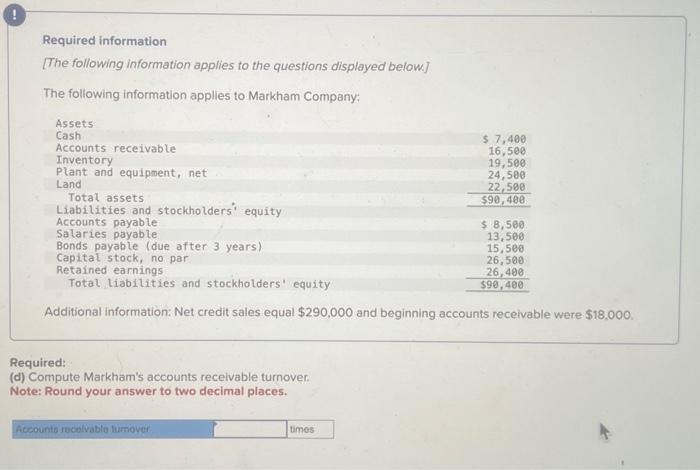

The following information applies to Markham Company: Assets Cash Accounts receivable Inventory Plant and equipment, net Land Total assets Liabilities and stockholders' equity Accounts

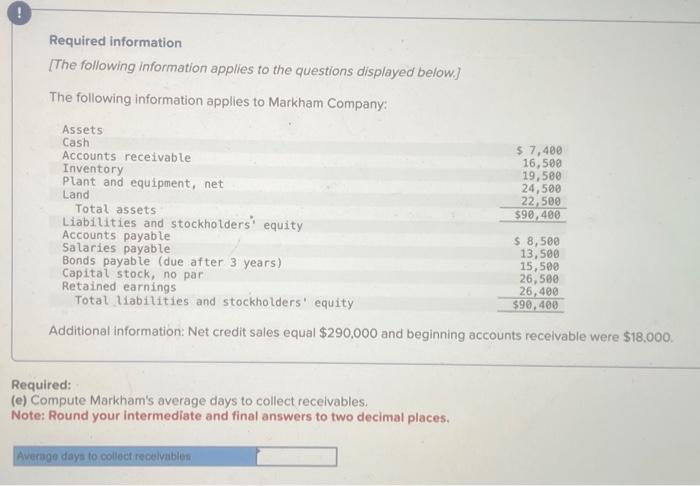

The following information applies to Markham Company: Assets Cash Accounts receivable Inventory Plant and equipment, net Land Total assets Liabilities and stockholders' equity Accounts payable Salaries payable Bonds payable (due after 3 years) Capital stock, no par Retained earnings Total liabilities and stockholders' equity $ 7,400 16,500 19,500 24,500 22,500 $90,400 $ 8,500 13,500 15,500 26,500 26,400 $90,400 Additional information: Net credit sales equal $290,000 and beginning accounts receivable were $18,000. Required: (a) Compute Markham's quick ratio. The following information applies to Markham Company: Assets Cash Accounts receivable Inventory Plant and equipment, net Land Total assets Liabilities and stockholders' equity Accounts payable Salaries payable Bonds payable (due after 3 years) Capital stock, no par Retained earnings Total liabilities and stockholders' equity $ 7,400 16,500 19,500 24,500 22,500 $90,400 $ 8,500 13,500 15,500 26,500 26,400 $90,400 Additional information: Net credit sales equal $290,000 and beginning accounts receivable were $18,000. Required: (b) Compute Markham's current ratio. ! Required information [The following information applies to the questions displayed below.] The following information applies to Markham Company: Assets Cash Accounts receivable Inventory Plant and equipment, net Land Total assets Liabilities and stockholders' equity Accounts payable Salaries payable Bonds payable (due after 3 years) Capital stock, no par Retained earnings Total liabilities and stockholders' equity $ 7,400 16,500 19,500 24,500 22,500 $90,400 $ 8,500 13,500 15,500 26,500 26,400 $90,400 Additional information: Net credit sales equal $290,000 and beginning accounts receivable were $18,000. Required: (c) Compute Markham's working capital. Working Capital Required information [The following information applies to the questions displayed below.] The following information applies to Markham Company: Assets Cash Accounts receivable Inventory Plant and equipment, net Land Total assets Liabilities and stockholders' equity Accounts payable Salaries payable Bonds payable (due after 3 years) Capital stock, no par Retained earnings Total liabilities and stockholders' equity $ 7,400 16,500 19,500 24,500 22,500 $90,400 $ 8,500 13,500 15,500 26,500 26,400 $90,400 Additional information: Net credit sales equal $290,000 and beginning accounts receivable were $18,000. Required: (d) Compute Markham's accounts receivable turnover. Note: Round your answer to two decimal places. Accounts receivable tumover times ! Required information [The following information applies to the questions displayed below.] The following information applies to Markham Company: Assets Cash Accounts receivable Inventory: Plant and equipment, net Land Total assets Liabilities and stockholders' equity Accounts payable Salaries payable Bonds payable (due after 3 years) Capital stock, no par Retained earnings Total liabilities and stockholders' equity $ 7,400 16,500 19,500 24,500 22,500 $90,400 $ 8,500 13,500 15,500 26,500 26,400 $90,400 Additional information: Net credit sales equal $290,000 and beginning accounts receivable were $18,000. Required: (e) Compute Markham's average days to collect receivables. Note: Round your intermediate and final answers to two decimal places. Average days to collect receivables

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started