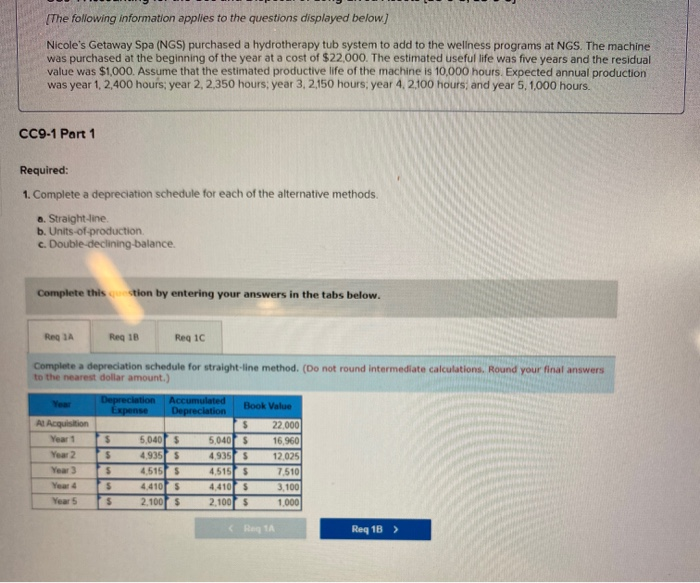

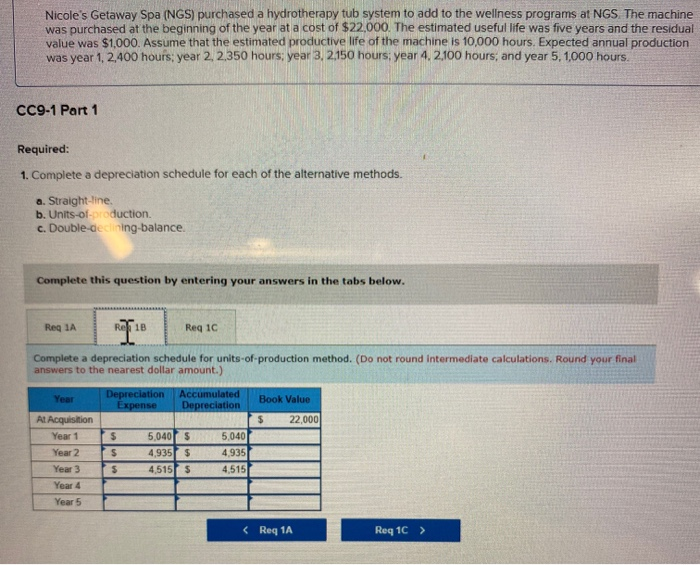

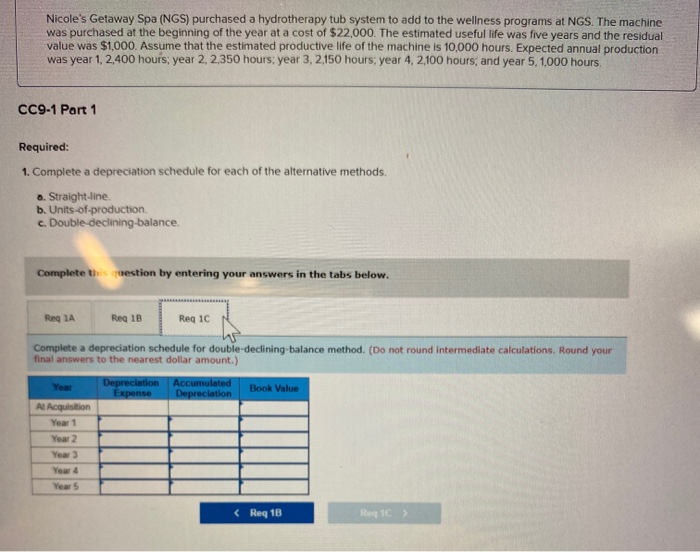

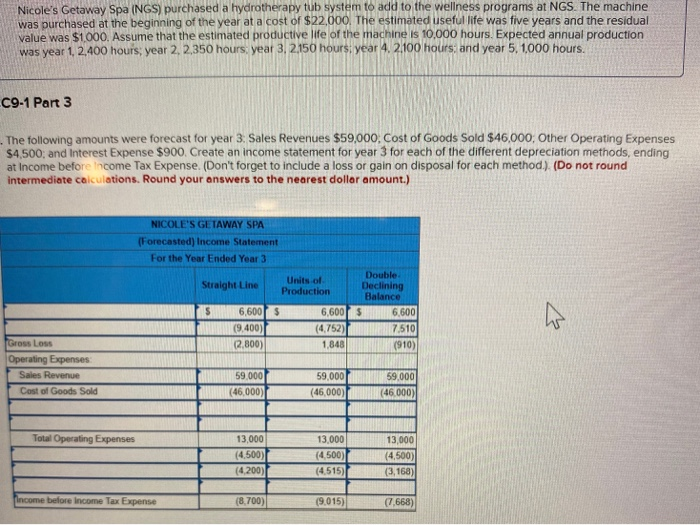

[The following information applies to the questions displayed below) Nicole's Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of the year at a cost of $22,000. The estimated useful life was five years and the residual value was $1,000. Assume that the estimated productive life of the machine is 10,000 hours. Expected annual production was year 1, 2,400 hours, year 2, 2,350 hours, year 3, 2.150 hours: year 4, 2100 hours and year 5.1.000 hours CC9-1 Part 1 Required: 1. Complete a depreciation schedule for each of the alternative methods. a. Straight-line b. Units-of-production c. Double-declining balance. Complete this tion by entering your answers in the tabs below. Reg 1A Req 18 Req1C Complete a depreciation schedule for straight-line method. (Do not round Intermediate calculations. Round your final answers to the nearest dollar amount.) Deprecation Expense Accumulated Depreciation ALA Year 1 Year 2 Year 3 5.0405 4 .9355 S 4.5155 134,4105 $ 2.100 5.040 $ 4.935 S 4.5155 4,4105 2.100 $ 22 000 16,960 12.025 7.510 Year 5 Reg 1B > Nicole's Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS The machine was purchased at the beginning of the year at a cost of $22,000. The estimated useful life was five years and the residual value was $1.000. Assume that the estimated productive life of the machine is 10,000 hours. Expected annual production was year 1, 2,400 hours: year 2, 2,350 hours: year 3, 2,150 hours: year 4.2,100 hours, and year 5, 1,000 hours. CC9-1 Part 1 Required: 1. Complete a depreciation schedule for each of the alternative methods. a. Straight-line b. Units-of-production. c. Double-declining balance. Complete this question by entering your answers in the tabs below. Reg 1A Ref 18 Req 1C Complete a depreciation schedule for units of production method. (Do not round Intermediate calculations. Round your final answers to the nearest dollar amount.) Year Depreciation Expense Accumulated Depreciation Book Value $ 22,000 At Acquisition Year 1 Year 2 Year 3 Year 4 Year 5 $ PS S 4 5,040 $ ,935 $ 4.5155 5,040 4.935 4.515 Nicole's Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of the year at a cost of $22,000. The estimated useful life was five years and the residual value was $1,000. Assume that the estimated productive life of the machine is 10,000 hours. Expected annual production was year 1, 2,400 hours year 2, 2,350 hours, year 3,2,150 hours year 4, 2,100 hours, and year 5. 1.000 hours. CC9-1 Part 1 Required: 1. Complete a depreciation schedule for each of the alternative methods. Straight-line b. Units of production c. Double-declining balance. Complete th e stion by entering your answers in the tabs below. Reg 1A Reg 1B Reg 10 Complete a depreciation schedule for double-declining balance method. (Do not round Intermediate calculations. Round your final answers to the nearest dollar amount.) Year Depreciation Expense Accumulated Depreciation Book Value Al Acquisition Year 1 Year 2 Year 5