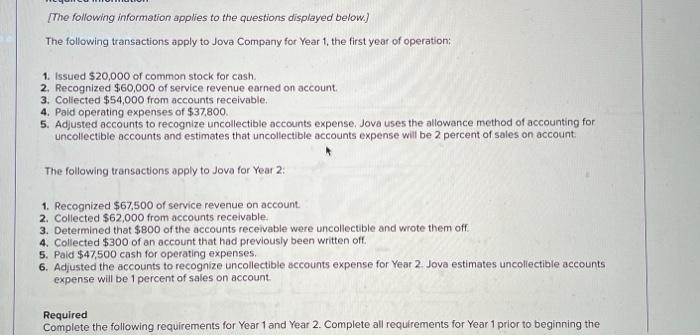

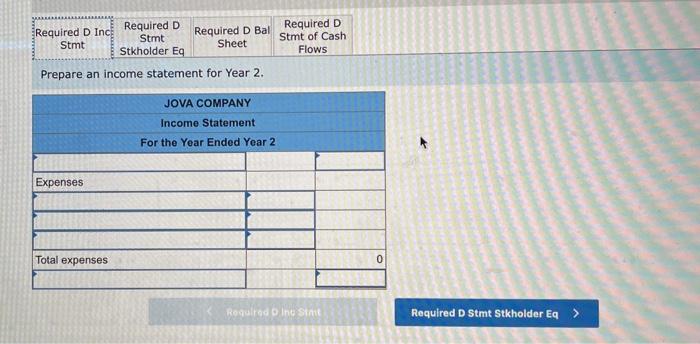

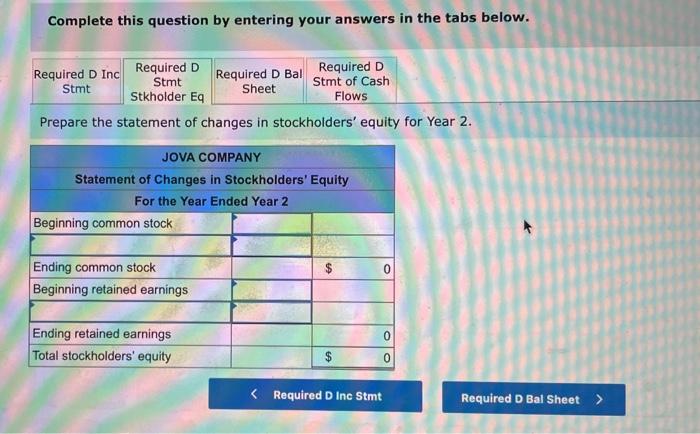

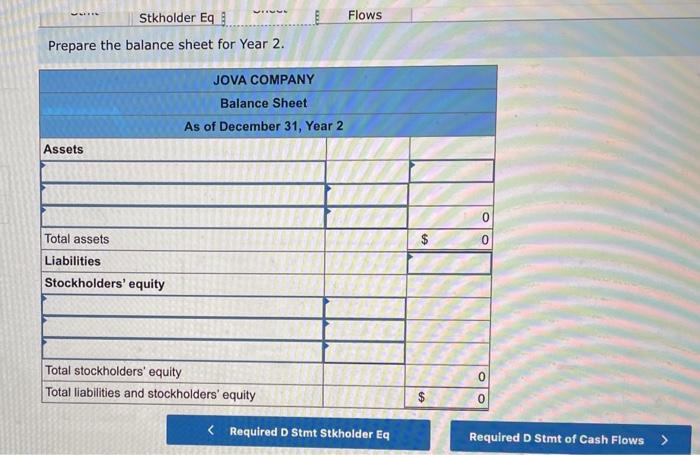

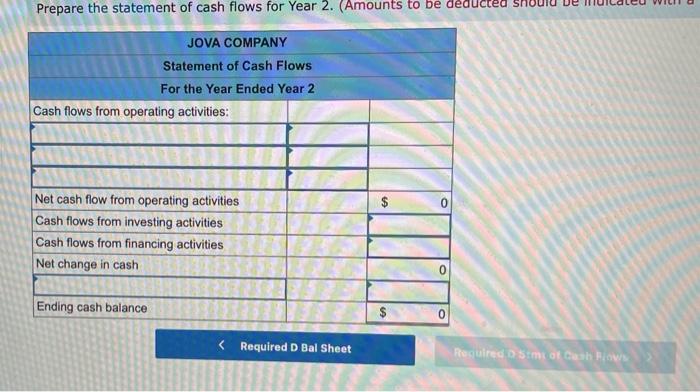

[The following information applies to the questions displayed below.) The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $20,000 of common stock for cash 2. Recognized $60,000 of service revenue earned on account 3. Collected $54,000 from accounts receivable. 4. Paid operating expenses of $37,800 5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account The following transactions apply to Jova for Year 2: 1. Recognized $67,500 of service revenue on account. 2. Collected $62,000 from accounts receivable. 3. Determined that $800 of the accounts receivable were uncollectible and wrote them off 4. Collected $300 of an account that had previously been written off 5. Pald $47,500 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 1 percent of sales on account Required Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the Required D Inc Required D Required D Bal Stmt Stmt Stkholder Eq Sheet Prepare an income statement for Year 2. Required D Stmt of Cash Flows JOVA COMPANY Income Statement For the Year Ended Year 2 Expenses Total expenses 0 Required Dino Sim Required D stmt Stkholder Eq> Complete this question by entering your answers in the tabs below. Required D Inc Required D Required D Bal Required D Stmt Stmt Sheet Stmt of Cash Stkholder Eq Flows Prepare the statement of changes in stockholders' equity for Year 2. JOVA COMPANY Statement of Changes in Stockholders' Equity For the Year Ended Year 2 Beginning common stock 0 Ending common stock Beginning retained earnings 0 Ending retained earnings Total stockholders' equity $ 0 Prepare the statement of cash flows for Year 2. (Amounts to be deducted JOVA COMPANY Statement of Cash Flows For the Year Ended Year 2 Cash flows from operating activities: $ 0 Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash 0 Ending cash balance 0