Answered step by step

Verified Expert Solution

Question

1 Approved Answer

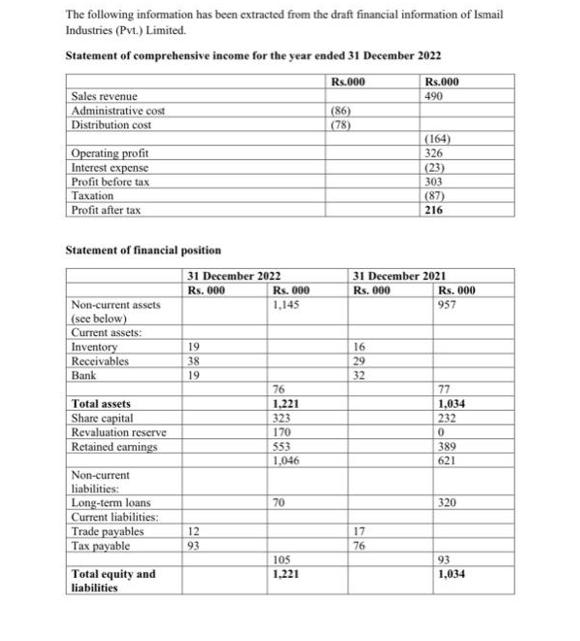

The following information has been extracted from the draft financial information of Ismail Industries (Pvt.) Limited. Statement of comprehensive income for the year ended

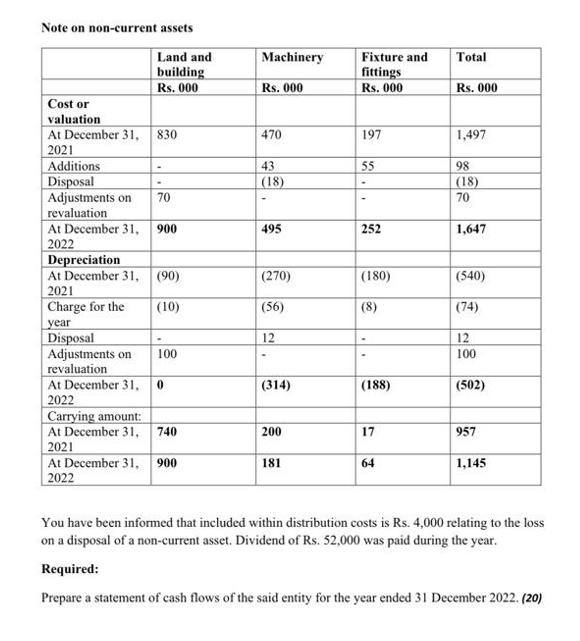

The following information has been extracted from the draft financial information of Ismail Industries (Pvt.) Limited. Statement of comprehensive income for the year ended 31 December 2022 Rs.000 Sales revenue Administrative cost Distribution cost Operating profit Interest expense Profit before tax Taxation Profit after tax Statement of financial position Non-current assets (see below) Current assets: Inventory Receivables Bank Total assets Share capital Revaluation reserve Retained earnings Non-current liabilities: Long-term loans Current liabilities: Trade payables Tax payable Total equity and liabilities 31 December 2022 Rs. 000 689 19 38 19 12 93 Rs. 000 1,145 76 1,221 323 170 553 1,046 70 105 1,221 (86) (78) 16 29 32 Rs.000 490 17 76 (164) 326 31 December 2021 Rs. 000 (23) 303 (87) 216 Rs.000 957 77 1,034 232 0 389 621 320 93 1,034 Note on non-current assets Cost or valuation Land and building Rs. 000 At December 31, 830 2021 Additions Disposal Adjustments on 70 revaluation At December 31, 900 2022 Depreciation At December 31, (90) 2021 Charge for the (10) year Disposal Adjustments on 100 revaluation At December 31, 0 2022 Carrying amount: At December 31, 740 2021 At December 31, 900 2022 Machinery Rs. 000 470 43 (18) 495 (270) (56) 12 . (314) 200 181 Fixture and fittings Rs. 000 197 55 252 (180) (8) (188) 17 64 Total Rs. 000 1,497 98 (18) 70 1,647 (540) (74) 12 100 (502) 957 1,145 You have been informed that included within distribution costs is Rs. 4,000 relating to the loss on a disposal of a non-current asset. Dividend of Rs. 52,000 was paid during the year. Required: Prepare a statement of cash flows of the said entity for the year ended 31 December 2022. (20)

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer Cash Flow Statement Particulars Amount Rs000 Amount Rs000 Amount R s000 Cash From Operating Activities Retained Earnings 553 Opening Balance of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started