Question

The following information pertains to Galaxy Interiors:Further assume the following: Galaxys FCF and earnings will grow at a constant rate of 4% Galaxys equity beta

The following information pertains to Galaxy Interiors:Further assume the following: Galaxys FCF and earnings will grow at a constant rate of 4%

Galaxys equity beta is 0.88 US 3 month

T-bill rate is 3.2%

S&P 500 market return is 6.61%

Currently Galaxy Interiors do not pay dividends.

There are 200 million shares outstanding

FYI, Tax rate = taxes / taxable income

Book value of equity = common stock + retained earnings

B0 = book value per share

Total debt = total current liabilities + total long-term debt

NCS (Net Capital Spending) = change in Fixed assets + depreciation =Ending Fixed assets - Beginning fixed assets + depreciation

Change in NWC (net working capital) = (CA CL ) end (CA CL ) beg FCF (Free cash flow) = EBIT * (1-tax rate) + Depreciation NCS change in NWC

QUESTION #1) Find the Galaxy Interior's current equity value using the Free Cash Flow (FCF) valuation model?

QUESTION #2) Find the Galaxy Interior's current equity value using the Residual Income Model (RIM) valuation ?

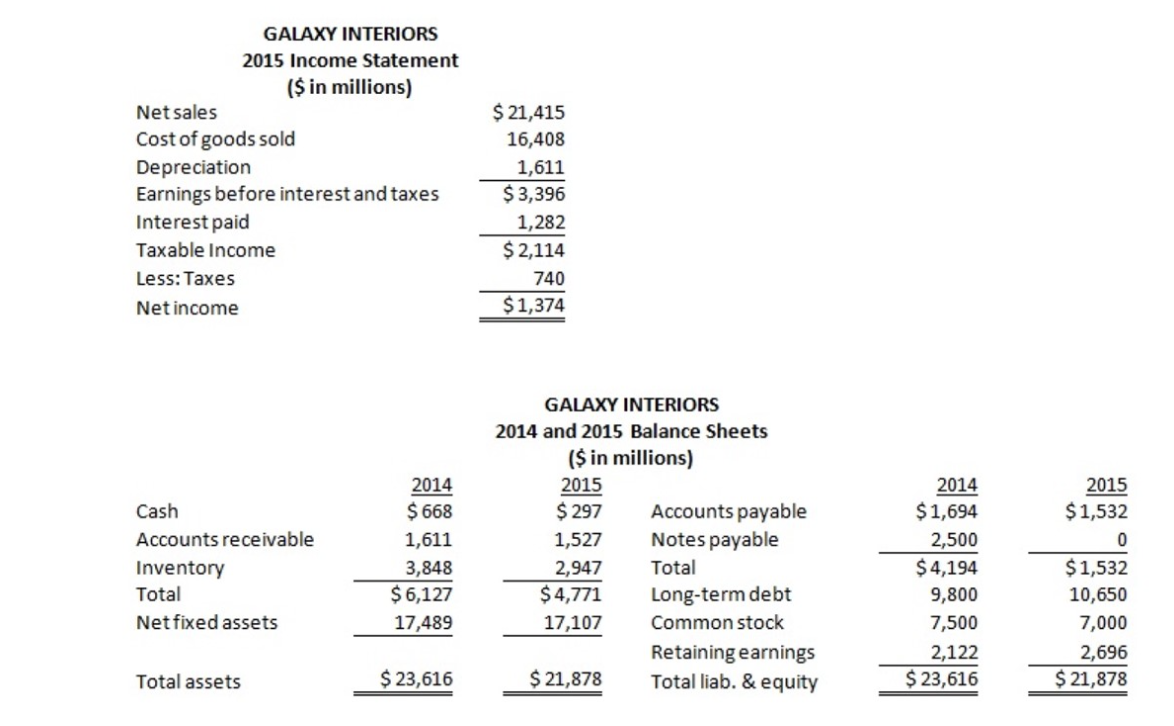

GALAXY INTERIORS 2015 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable Income Less: Taxes Net income $ 21,415 16,408 1,611 $ 3,396 1,282 $ 2,114 740 $1,374 Cash Accounts receivable Inventory Total Net fixed assets 2014 $ 668 1,611 3,848 $ 6,127 17,489 GALAXY INTERIORS 2014 and 2015 Balance Sheets ($ in millions) 2015 $ 297 Accounts payable 1,527 Notes payable 2,947 Total $4,771 Long-term debt 17,107 Common stock Retaining earnings $ 21,878 Total liab. & equity 2014 $1,694 2,500 $4,194 9,800 7,500 2,122 $ 23,616 2015 $1,532 0 $1,532 10,650 7,000 2,696 $ 21,878 Total assets $ 23,616 GALAXY INTERIORS 2015 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable Income Less: Taxes Net income $ 21,415 16,408 1,611 $ 3,396 1,282 $ 2,114 740 $1,374 Cash Accounts receivable Inventory Total Net fixed assets 2014 $ 668 1,611 3,848 $ 6,127 17,489 GALAXY INTERIORS 2014 and 2015 Balance Sheets ($ in millions) 2015 $ 297 Accounts payable 1,527 Notes payable 2,947 Total $4,771 Long-term debt 17,107 Common stock Retaining earnings $ 21,878 Total liab. & equity 2014 $1,694 2,500 $4,194 9,800 7,500 2,122 $ 23,616 2015 $1,532 0 $1,532 10,650 7,000 2,696 $ 21,878 Total assets $ 23,616Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started