Question

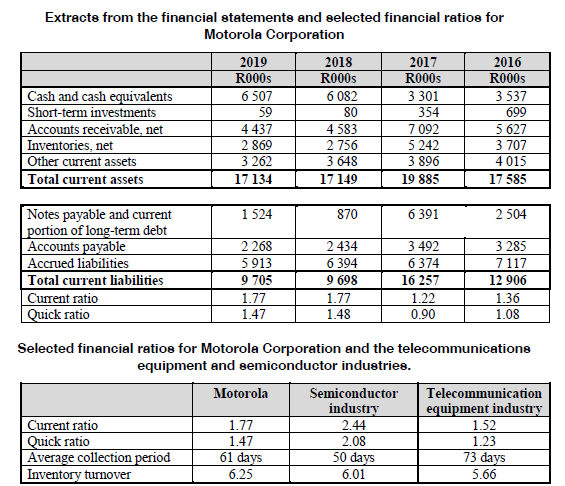

The following information relates to the telecommunication equipment industry and the semiconductor industry. Motorola Corporation is a leading manufacturer and supplier in the telecommunications industry.

The following information relates to the telecommunication equipment industry and the semiconductor industry. Motorola Corporation is a leading manufacturer and supplier in the telecommunications industry. The information provided below includes selected financial information relating to Motorola Corporation together with comparative financial ratios from the two industries. The information provided has been adapted to suit the questions. The telecommunications industry is extremely competitive and includes major corporations such as AT & T Inc., Verizon Communications Inc., Motorola and many others.

4.1. Use the information provided to calculate Motorolas net working capital for each of the years 20162019. (8) 4.2. Discuss Motorolas liquidity position when compared with those of the two industries for the period 20162019. (27)

Extracts from the financial statements and selected financial ratios for Motorola Corporation Cash and cash equivalents Short-term investments Accounts receivable, net Inventories, net Other current assets Total current assets 2019 R000s 6 507 59 4 437 2 869 3 262 17 134 2018 ROOOS 6 082 80 4 583 2756 3 648 17 149 2017 R000s 3 301 354 7092 5242 3 896 19 885 2016 R000s 3537 699 5 627 3707 4015 17 585 1 524 870 6 391 2 504 Notes payable and current portion of long-term debt Accounts payable Accrued liabilities Total current liabilities Current ratio Quick ratio 2 268 5913 9 705 1.77 1.47 2434 6 394 9 698 1.77 1.48 3 492 6 374 16 257 1.22 0.90 3 285 7117 12 906 1.36 1.08 Selected financial ratios for Motorola Corporation and the telecommunications equipment and semiconductor industries. Motorola Semiconductor Telecommunication industry equipment industry Current ratio 1.77 2.44 1.52 Quick ratio 1.47 2.08 1.23 Average collection period 61 days 73 days Inventory turnover 6.25 6.01 5.66 50 daysStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started