Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information relates to TTC Corporation (TTC): TTC is evaluating whether to purchase a new production asset. Last year, TTC spent $21,000 on

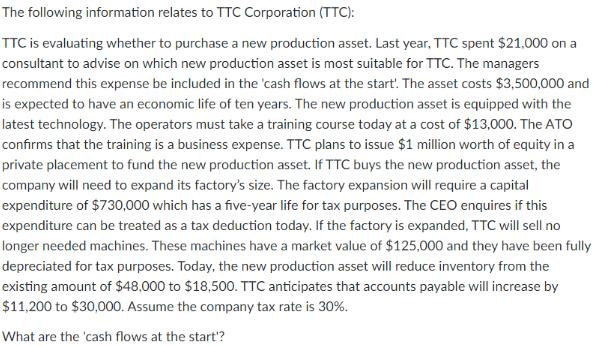

The following information relates to TTC Corporation (TTC): TTC is evaluating whether to purchase a new production asset. Last year, TTC spent $21,000 on a consultant to advise on which new production asset is most suitable for TTC. The managers recommend this expense be included in the 'cash flows at the start. The asset costs $3,500,000 and is expected to have an economic life of ten years. The new production asset is equipped with the latest technology. The operators must take a training course today at a cost of $13,000. The ATO confirms that the training is a business expense. TTC plans to issue $1 million worth of equity in a private placement to fund the new production asset. If TTC buys the new production asset, the company will need to expand its factory's size. The factory expansion will require a capital expenditure of $730,000 which has a five-year life for tax purposes. The CEO enquires if this expenditure can be treated as a tax deduction today. If the factory is expanded, TTC will sell no longer needed machines. These machines have a market value of $125,000 and they have been fully depreciated for tax purposes. Today, the new production asset will reduce inventory from the existing amount of $48,000 to $18,500. TTC anticipates that accounts payable will increase by $11,200 to $30,000. Assume the company tax rate is 30%. What are the 'cash flows at the start'?

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The cash flows at the start refer to the net outflows or investments made at the beginning of a proj...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started