Answered step by step

Verified Expert Solution

Question

1 Approved Answer

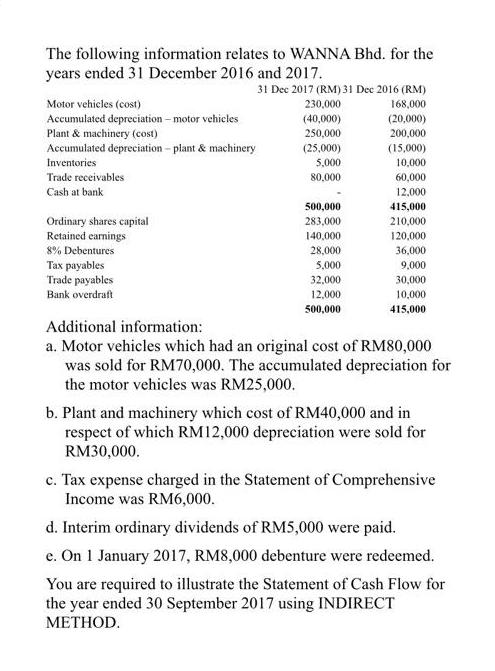

The following information relates to WANNA Bhd. for the years ended 31 December 2016 and 2017. 31 Dec 2017 (RM) 31 Dec 2016 (RM)

The following information relates to WANNA Bhd. for the years ended 31 December 2016 and 2017. 31 Dec 2017 (RM) 31 Dec 2016 (RM) Motor vehicles (cost) Accumulated depreciation - motor vehicles Plant & machinery (cost) Accumulated depreciation - plant & machinery Inventories Trade receivables Cash at bank Ordinary shares capital Retained earnings 8% Debentures Tax payables Trade payables Bank overdraft 230,000 (40,000) 250,000 (25,000) 5,000 80,000 500,000 283,000 140,000 28,000 5,000 32,000 12,000 500,000 168,000 (20,000) 200,000 (15,000) 10,000 60,000 12,000 415,000 210,000 120,000 36,000 9,000 30,000 10,000 415,000 Additional information: a. Motor vehicles which had an original cost of RM80,000 was sold for RM70,000. The accumulated depreciation for the motor vehicles was RM25,000. b. Plant and machinery which cost of RM40,000 and in respect of which RM12,000 depreciation were sold for RM30,000. c. Tax expense charged in the Statement of Comprehensive Income was RM6,000. d. Interim ordinary dividends of RM5,000 were paid. e. On 1 January 2017, RM8,000 debenture were redeemed. You are required to illustrate the Statement of Cash Flow for the year ended 30 September 2017 using INDIRECT METHOD.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started