Question

The following information was compiled from the companys fixed asset register: Description Date purchased Notes Cost Price (VAT excluded) R Factory 1 1 July 2001

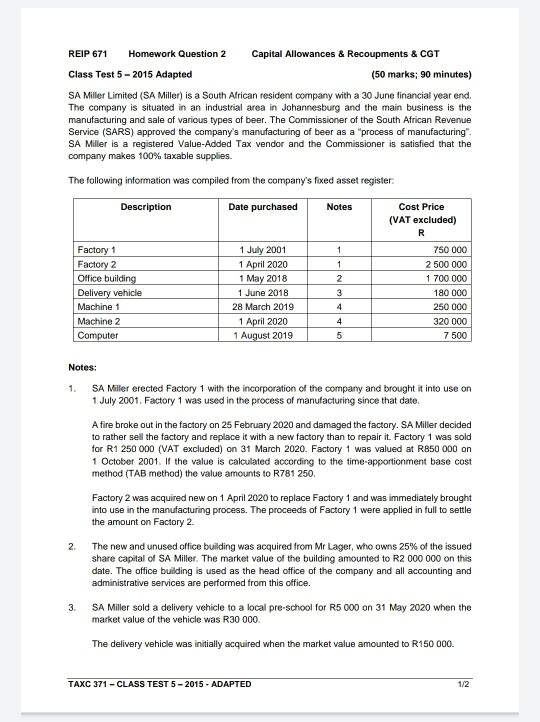

The following information was compiled from the companys fixed asset register: Description Date purchased Notes Cost Price (VAT excluded) R Factory 1 1 July 2001 1 750 000 Factory 2 1 April 2020 1 2 500 000 Office building 1 May 2018 2 1 700 000 Delivery vehicle 1 June 2018 3 180 000 Machine 1 28 March 2019 4 250 000 Machine 2 1 April 2020 4 320 000 Computer 1 August 2019 5 7 500 Notes: 1. SA Miller erected Factory 1 with the incorporation of the company and brought it into use on 1 July 2001. Factory 1 was used in the process of manufacturing since that date. A fire broke out in the factory on 25 February 2020 and damaged the factory. SA Miller decided to rather sell the factory and replace it with a new factory than to repair it. Factory 1 was sold for R1 250 000 (VAT excluded) on 31 March 2020. Factory 1 was valued at R850 000 on 1 October 2001. If the value is calculated according to the time-apportionment base cost method (TAB method) the value amounts to R781 250. Factory 2 was acquired new on 1 April 2020 to replace Factory 1 and was immediately brought into use in the manufacturing process. The proceeds of Factory 1 were applied in full to settle the amount on Factory 2. 2. The new and unused office building was acquired from Mr Lager, who owns 25% of the issued share capital of SA Miller. The market value of the building amounted to R2 000 000 on this date. The office building is used as the head office of the company and all accounting and administrative services are performed from this office. 3. SA Miller sold a delivery vehicle to a local pre-school for R5 000 on 31 May 2020 when the

4. Machine 1, which was acquired new and unused and was used in the manufacturing process, was destroyed in the fire on 25 February 2020. The insurance claim received with regards to Machine 1 amounted to R150 000 (VAT excluded). SA Miller applied the proceeds from the insurance claim received for Machine 1 in full to buy Machine 2, a second hand machine, to replace Machine 1. Machine 2 was brought into use immediately in the process of manufacturing. The market value of Machine 2 was R350 000 on the date of acquisition. 5. SA Miller donates the computer to a recognised public benefit organisation in terms of section 30 of the Income Tax Act on 30 June 2020 and obtains the required receipt. The market value of the computer at the date of the donation amounted to R8 000. The computer was replaced during July 2020. 6. Write-off periods acceptable to SARS based on the Binding General Ruling No. 7: 6.1 Computer Equipment 3 years 6.2 Delivery vehicles 4 years 6.3 Machinery 10 years 7. You may assume that SA Millers profit before tax before any of the fixed asset transactions were recorded amounted to R1 230 600. REQUIRED Marks Calculate the normal tax implications for SA Miller Limited with regards to all of the above transactions. All items must be indicated with a reference to the relevant reasons for each item, very clearly in column format. You may assume that the taxpayer would elect to apply all options available to reduce its tax liability for the 2020 year of assessment as low as possible. You may ignore any VAT consequences.

Capital Allowances & Recoupments & CGT REIP 671 Homework Question 2 Class Test 5 - 2015 Adapted (50 marks; 90 minutes) SA Miller Limited (SA Miller) is a South African resident company with a 30 June financial year end. The company is situated in an industrial area in Johannesburg and the main business is the manufacturing and sale of various types of beer. The Commissioner of the South African Revenue Service (SARS) approved the company's manufacturing of beer as a "process of manufacturing SA Miller is a registered Value Added Tax vendor and the Commissioner is satisfied that the company makes 100% taxable supplies. The following information was compiled from the company's fixed asset register: Description Date purchased Notes Cost Price (VAT excluded) Factory 1 Factory 2 Office building Delivery vehicle Machine 1 Machine 2 Computer 1 July 2001 1 April 2020 1 May 2018 1 June 2018 28 March 2019 1 April 2020 1 August 2019 750 000 2500.000 1 700 000 180 000 250 000 320 000 7500 5 Notes: 1. SA Miller erected Factory 1 with the incorporation of the company and brought it into use on 1 July 2001, Factory 1 was used in the process of manufacturing since that date A fire broke out in the factory on 25 February 2020 and damaged the factory. SA Miller decided to rather sell the factory and replace it with a new factory than to repair it. Factory 1 was sold for R1 250 000 (VAT excluded) on 31 March 2020. Factory 1 was valued at R850 000 on 1 October 2001. If the value is calculated according to the time-apportionment base cost method (TAB method) the value amounts to R781 250. Factory 2 was acquired new on 1 April 2020 to replace Factory 1 and was immediately brought into use in the manufacturing process. The proceeds of Factory 1 were applied in full to settle the amount on Factory 2 The new and unused office building was acquired from Mr Lager, who owns 25% of the issued share capital of SA Miller. The market value of the building amounted to R2 000 000 on this date. The office building is used as the head office of the company and all accounting and administrative services are performed from this office. SA Miller sold a delivery vehicle to a local pre-school for R5 000 on 31 May 2020 when the market value of the vehicle was R30 000 The delivery vehicle was initially acquired when the market value amounted to R150 000 TAXC 371 - CLASS TEST 5 - 2015 - ADAPTED Capital Allowances & Recoupments & CGT REIP 671 Homework Question 2 Class Test 5 - 2015 Adapted (50 marks; 90 minutes) SA Miller Limited (SA Miller) is a South African resident company with a 30 June financial year end. The company is situated in an industrial area in Johannesburg and the main business is the manufacturing and sale of various types of beer. The Commissioner of the South African Revenue Service (SARS) approved the company's manufacturing of beer as a "process of manufacturing SA Miller is a registered Value Added Tax vendor and the Commissioner is satisfied that the company makes 100% taxable supplies. The following information was compiled from the company's fixed asset register: Description Date purchased Notes Cost Price (VAT excluded) Factory 1 Factory 2 Office building Delivery vehicle Machine 1 Machine 2 Computer 1 July 2001 1 April 2020 1 May 2018 1 June 2018 28 March 2019 1 April 2020 1 August 2019 750 000 2500.000 1 700 000 180 000 250 000 320 000 7500 5 Notes: 1. SA Miller erected Factory 1 with the incorporation of the company and brought it into use on 1 July 2001, Factory 1 was used in the process of manufacturing since that date A fire broke out in the factory on 25 February 2020 and damaged the factory. SA Miller decided to rather sell the factory and replace it with a new factory than to repair it. Factory 1 was sold for R1 250 000 (VAT excluded) on 31 March 2020. Factory 1 was valued at R850 000 on 1 October 2001. If the value is calculated according to the time-apportionment base cost method (TAB method) the value amounts to R781 250. Factory 2 was acquired new on 1 April 2020 to replace Factory 1 and was immediately brought into use in the manufacturing process. The proceeds of Factory 1 were applied in full to settle the amount on Factory 2 The new and unused office building was acquired from Mr Lager, who owns 25% of the issued share capital of SA Miller. The market value of the building amounted to R2 000 000 on this date. The office building is used as the head office of the company and all accounting and administrative services are performed from this office. SA Miller sold a delivery vehicle to a local pre-school for R5 000 on 31 May 2020 when the market value of the vehicle was R30 000 The delivery vehicle was initially acquired when the market value amounted to R150 000 TAXC 371 - CLASS TEST 5 - 2015 - ADAPTED

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started