Answered step by step

Verified Expert Solution

Question

1 Approved Answer

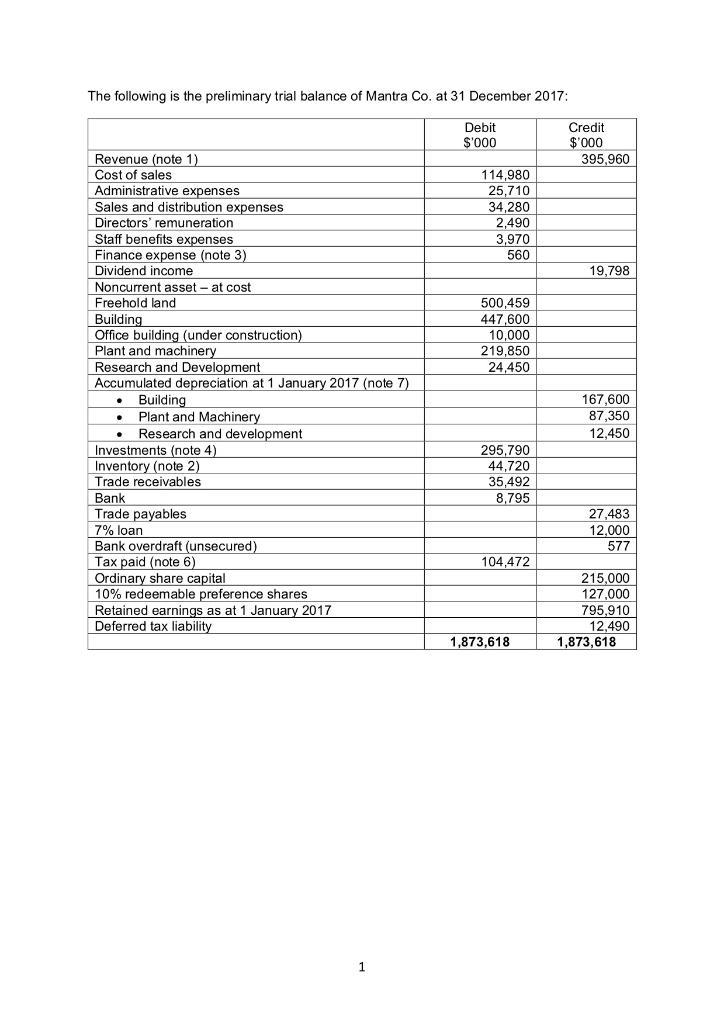

The following is the preliminary trial balance of Mantra Co. at 31 December 2017: Debit $'000 Revenue (note 1) Cost of sales Administrative expenses

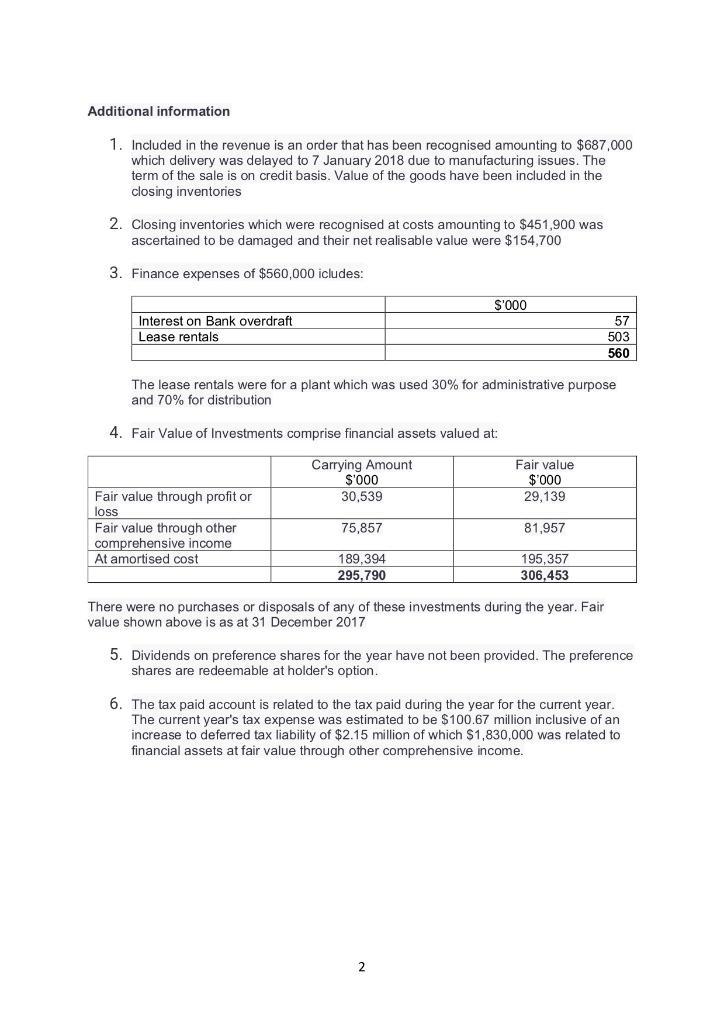

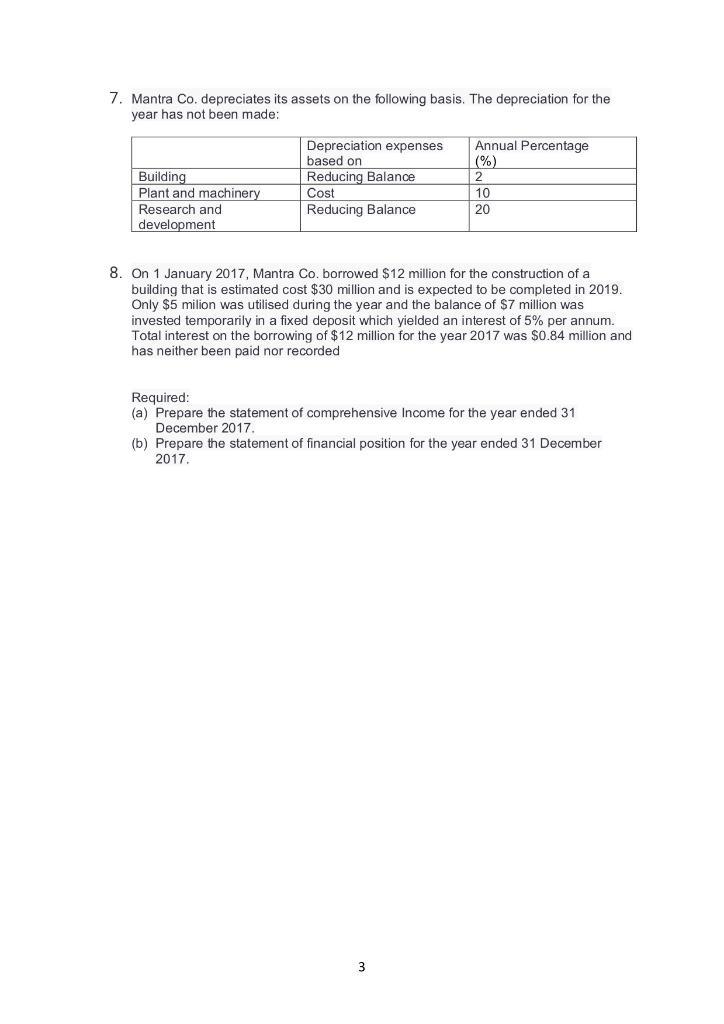

The following is the preliminary trial balance of Mantra Co. at 31 December 2017: Debit $'000 Revenue (note 1) Cost of sales Administrative expenses Sales and distribution expenses Directors' remuneration Staff benefits expenses Finance expense (note 3) Dividend income Divic Noncurrent asset - at cost Freehold land Building Office building (under construction) Plant and machinery Research and Development Accumulated depreciation at 1 January 2017 (note 7) Building Plant and Machinery . Research and development Investments (note 4) Inventory (note 2) Trade receivables Bank Trade payables 170 7% loan Bank overdraft (unsecured) Tax paid (note 6) Ordinary share capital 10% redeemable preference shares. Retained earnings as at 1 January 2017 Deferred tax liability 1 114,980 25,710 34,280 2,490 3,970 560 500,459 447,600 10,000 219,850 24,450 295,790 44,720 35,492 8,795 104,472 1,873,618 Credit $'000 395,960 19,798 167,600 87,350 12,450 27,483 12,000 577 215,000 127,000 795,910 12,490 1,873,618 Additional information 1. Included in the revenue is an order that has been recognised amounting to $687,000 which delivery was delayed to 7 January 2018 due to manufacturing issues. The term of the sale is on credit basis. Value of the goods have been included in the closing inventories 2. Closing inventories which were recognised at costs amounting to $451,900 was ascertained to be damaged and their net realisable value were $154,700 3. Finance expenses of $560,000 icludes: Interest on Bank overdraft Lease rentals Fair value through profit or loss The lease rentals were for a plant which was used 30% for administrative purpose and 70% for distribution 4. Fair Value of Investments comprise financial assets valued at: Fair value through other comprehensive income At amortised cost. Carrying Amount $'000 30,539 75,857 189.394 295,790 $'000 Fair value $'000 29,139 81,957 195,357 306,453 There were no purchases or disposals of any of these investments during the year. Fair value shown above is as at 31 December 2017 2 57 503 560 5. Dividends on preference shares for the year have not been provided. The preference shares are redeemable at holder's option.. 6. The tax paid account is related to the tax paid during the year for the current year. The current year's tax expense was estimated to be $100.67 million inclusive of an increase to deferred tax liability of $2.15 million of which $1,830,000 was related to financial assets at fair value through other comprehensive income. 7. Mantra Co. depreciates its assets on the following basis. The depreciation for the year has not been made: Building Plant and machinery Research and development Depreciation expenses based on Reducing Balance Cost Reducing Balance Annual Percentage (%) 2 10 20 8. On 1 January 2017, Mantra Co. borrowed $12 million for the construction of a building that is estimated cost $30 million and is expected to be completed in 2019. Only $5 milion was utilised during the year and the balance of $7 million was invested temporarily in a fixed deposit which yielded an interest of 5% per annum. Total interest on the borrowing of $12 million for the year 2017 was $0.84 million and has neither been paid nor recorded Required: (a) Prepare the statement of comprehensive Income for the year ended 31 December 2017. 3 (b) Prepare the statement of financial position for the year ended 31 December 2017.

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started