Question

The following question should be answered according to the format provided in the questions and all the calculations must be shown. Read the requirements of

The following question should be answered according to the format provided in the questions and all the calculations must be shown. Read the requirements of the question twice and then read the question.

The amounts written in the pension worksheet are written by me but they might be wrong so please double check everything. I am posting this question 2nd time please ensure do not repeat the mistake as in last one. please follow the format. It includes three steps and accordingly pictures are uploaded so kindly zoom in and see all the figures correctly. The journal entry should not be any contra entry, see the 2nd part of question i.e. last image.

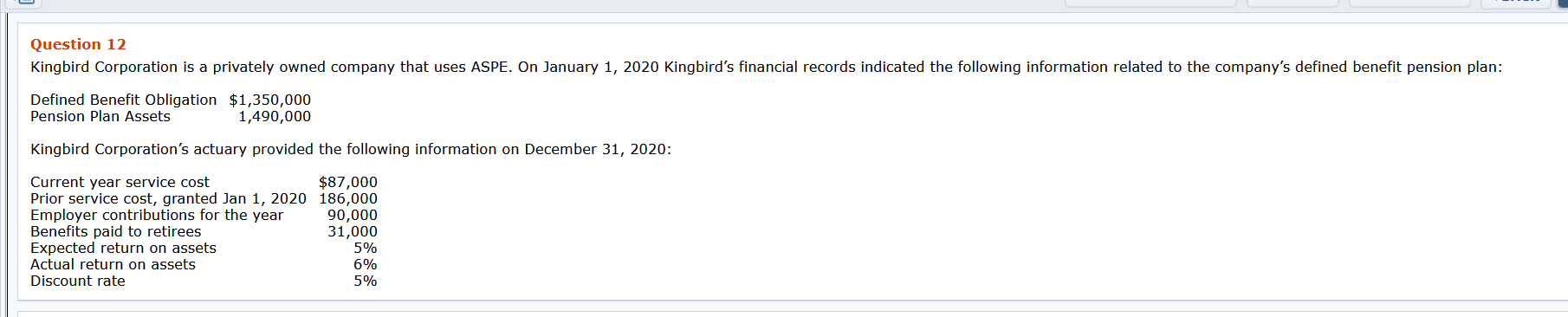

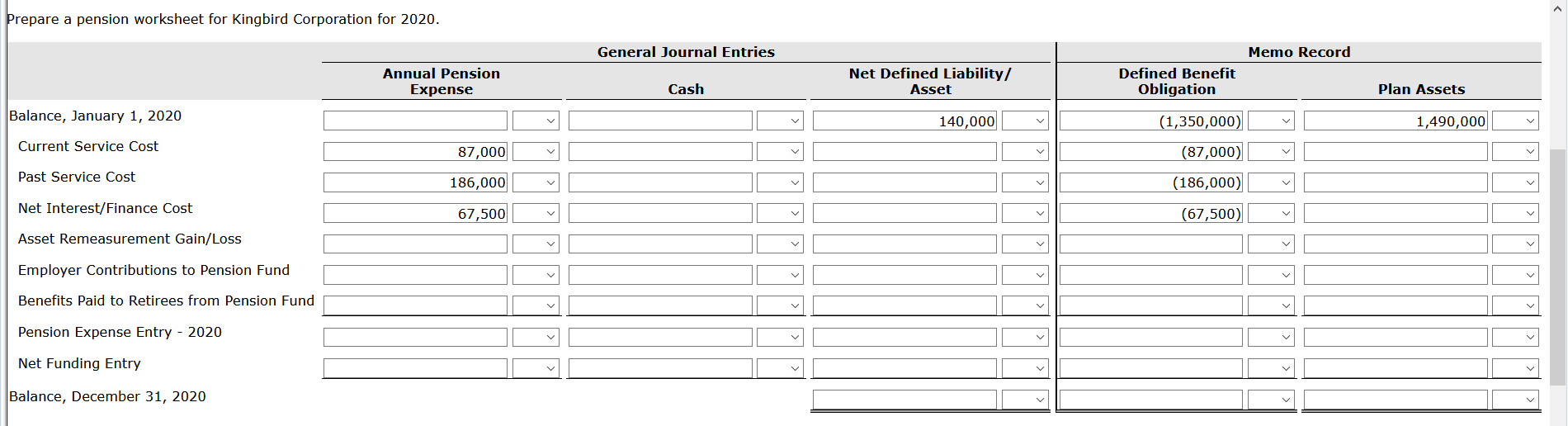

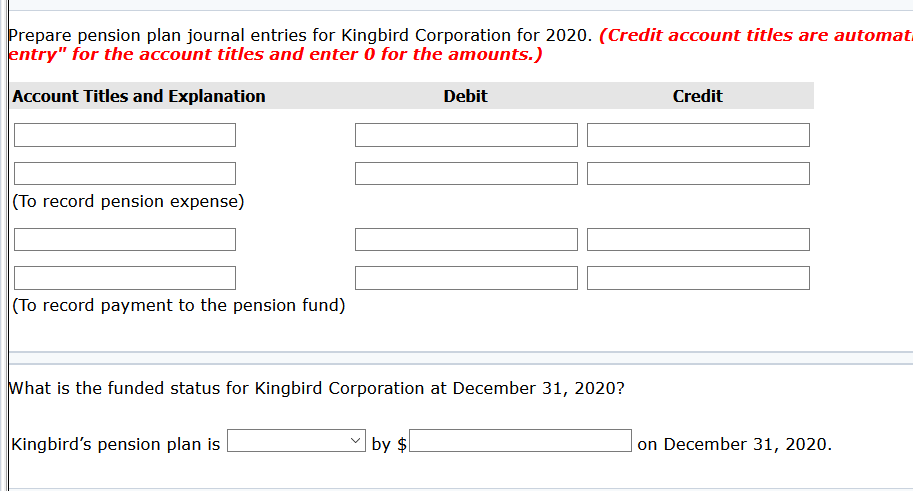

Question 12 Kingbird Corporation is a privately owned company that uses ASPE. On January 1, 2020 Kingbird's financial records indicated the following information related to the company's defined benefit pension plan: Defined Benefit Obligation $1,350,000 Pension Plan Assets 1,490,000 Kingbird Corporation's actuary provided the following information on December 31, 2020: Current year service cost $87,000 Prior service cost, granted Jan 1, 2020 186,000 Employer contributions for the year 90,000 Benefits paid to retirees 31,000 Expected return on assets 5% Actual return on assets Discount rate 5% 6% Prepare a pension worksheet for Kingbird Corporation for 2020. General Journal Entries Memo Record Annual Pension Expense Net Defined Liability/ Asset Cash Defined Benefit Obligation Plan Assets Balance, January 1, 2020 140,000 (1,350,000) 1,490,000 Current Service Cost 87,000 (87,000) (186,000) Past Service Cost 186,000 Net Interest/Finance Cost 67,500 (67,500) Asset Remeasurement Gain/Loss Employer Contributions to Pension Fund Benefits Paid to Retirees from Pension Fund Pension Expense Entry - 2020 Net Funding Entry Balance, December 31, 2020 Prepare pension plan journal entries for Kingbird Corporation for 2020. (Credit account titles are automat entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit (To record pension expense) (To record payment to the pension fund) What is the funded status for Kingbird Corporation at December 31, 2020? Kingbird's pension plan is by $ on December 31, 2020. Question 12 Kingbird Corporation is a privately owned company that uses ASPE. On January 1, 2020 Kingbird's financial records indicated the following information related to the company's defined benefit pension plan: Defined Benefit Obligation $1,350,000 Pension Plan Assets 1,490,000 Kingbird Corporation's actuary provided the following information on December 31, 2020: Current year service cost $87,000 Prior service cost, granted Jan 1, 2020 186,000 Employer contributions for the year 90,000 Benefits paid to retirees 31,000 Expected return on assets 5% Actual return on assets Discount rate 5% 6% Prepare a pension worksheet for Kingbird Corporation for 2020. General Journal Entries Memo Record Annual Pension Expense Net Defined Liability/ Asset Cash Defined Benefit Obligation Plan Assets Balance, January 1, 2020 140,000 (1,350,000) 1,490,000 Current Service Cost 87,000 (87,000) (186,000) Past Service Cost 186,000 Net Interest/Finance Cost 67,500 (67,500) Asset Remeasurement Gain/Loss Employer Contributions to Pension Fund Benefits Paid to Retirees from Pension Fund Pension Expense Entry - 2020 Net Funding Entry Balance, December 31, 2020 Prepare pension plan journal entries for Kingbird Corporation for 2020. (Credit account titles are automat entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit (To record pension expense) (To record payment to the pension fund) What is the funded status for Kingbird Corporation at December 31, 2020? Kingbird's pension plan is by $ on December 31, 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started