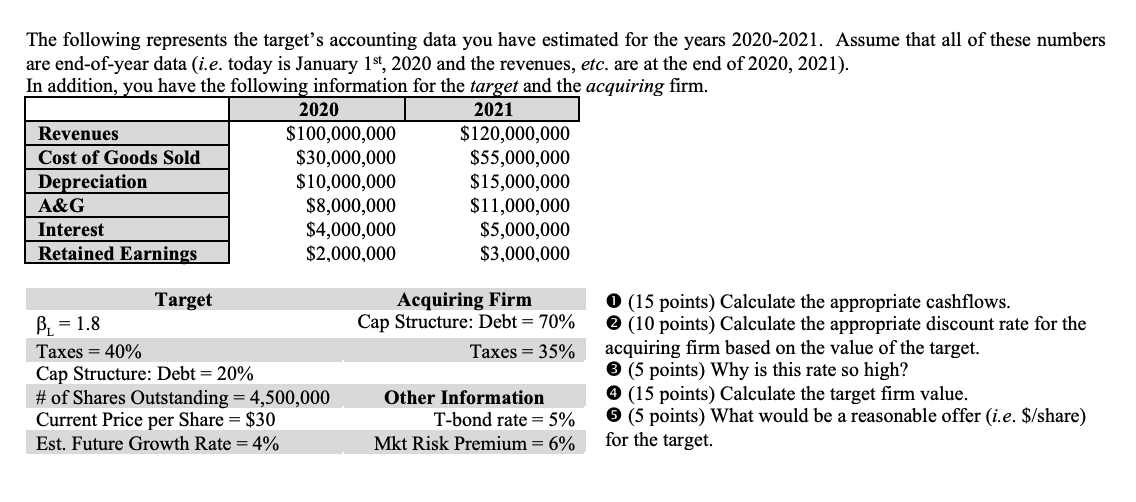

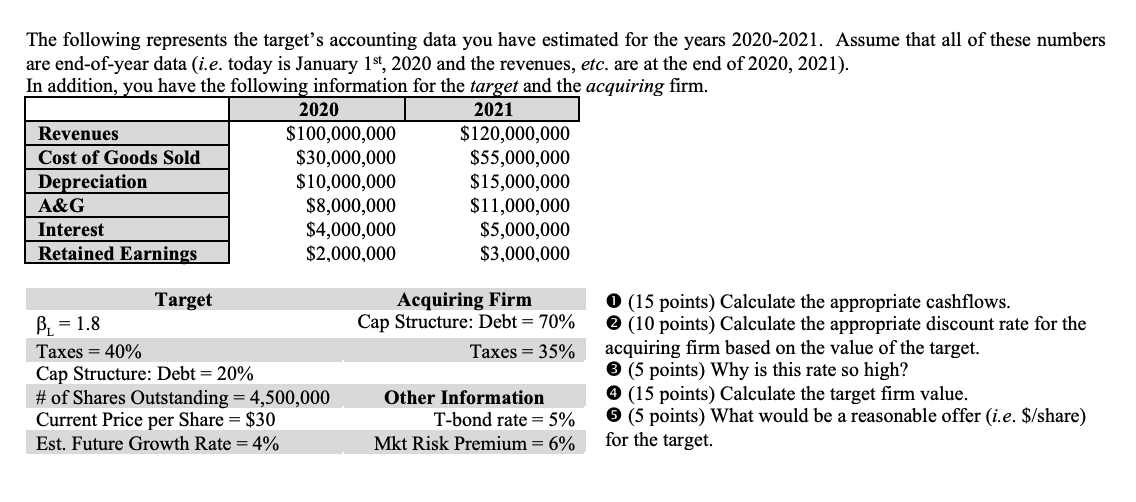

The following represents the target's accounting data you have estimated for the years 2020-2021. Assume that all of these numbers are end-of-year data (i.e. today is January 1st, 2020 and the revenues, etc. are at the end of 2020, 2021). In addition, you have the following information for the target and the acquiring firm. 2020 2021 Revenues $100,000,000 $120,000,000 Cost of Goods Sold $30,000,000 $55,000,000 Depreciation $10,000,000 $15,000,000 A&G $8,000,000 $11,000,000 Interest $4,000,000 $5,000,000 Retained Earnings $2,000,000 $3,000,000 LI-IN- Acquiring Firm Cap Structure: Debt = 70% Taxes = 35% Target B. = 1.8 Taxes = 40% Cap Structure: Debt = 20% # of Shares Outstanding = 4,500,000 Current Price per Share = $30 Est. Future Growth Rate = 4% O (15 points) Calculate the appropriate cashflows. (10 points) Calculate the appropriate discount rate for the acquiring firm based on the value of the target. (5 points) Why is this rate so high? (15 points) Calculate the target firm value. (5 points) What would be a reasonable offer (i.e. $/share) for the target. Other Information T-bond rate = 5% Mkt Risk Premium = 6% The following represents the target's accounting data you have estimated for the years 2020-2021. Assume that all of these numbers are end-of-year data (i.e. today is January 1st, 2020 and the revenues, etc. are at the end of 2020, 2021). In addition, you have the following information for the target and the acquiring firm. 2020 2021 Revenues $100,000,000 $120,000,000 Cost of Goods Sold $30,000,000 $55,000,000 Depreciation $10,000,000 $15,000,000 A&G $8,000,000 $11,000,000 Interest $4,000,000 $5,000,000 Retained Earnings $2,000,000 $3,000,000 LI-IN- Acquiring Firm Cap Structure: Debt = 70% Taxes = 35% Target B. = 1.8 Taxes = 40% Cap Structure: Debt = 20% # of Shares Outstanding = 4,500,000 Current Price per Share = $30 Est. Future Growth Rate = 4% O (15 points) Calculate the appropriate cashflows. (10 points) Calculate the appropriate discount rate for the acquiring firm based on the value of the target. (5 points) Why is this rate so high? (15 points) Calculate the target firm value. (5 points) What would be a reasonable offer (i.e. $/share) for the target. Other Information T-bond rate = 5% Mkt Risk Premium = 6%