Answered step by step

Verified Expert Solution

Question

1 Approved Answer

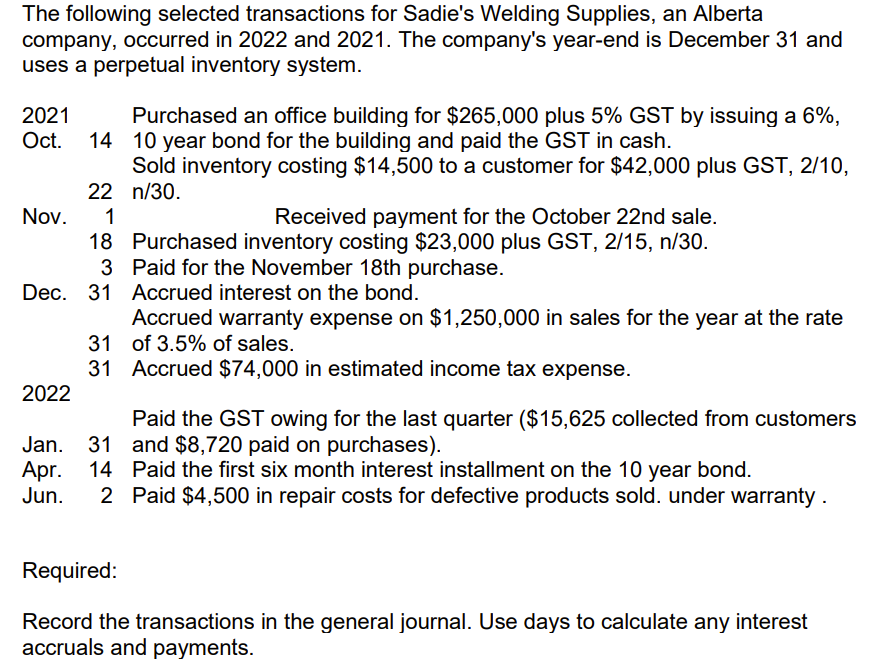

The following selected transactions for Sadie's Welding Supplies, an Alberta company, occurred in 2022 and 2021. The company's year-end is December 31 and uses

The following selected transactions for Sadie's Welding Supplies, an Alberta company, occurred in 2022 and 2021. The company's year-end is December 31 and uses a perpetual inventory system. 2021 Oct. 14 Nov. 22 2022 1 18 3 Dec. 31 31 31 Purchased an office building for $265,000 plus 5% GST by issuing a 6%, 10 year bond for the building and paid the GST in cash. Sold inventory costing $14,500 to a customer for $42,000 plus GST, 2/10, n/30. Received payment for the October 22nd sale. Purchased inventory costing $23,000 plus GST, 2/15, n/30. Paid for the November 18th purchase. Accrued interest on the bond. Accrued warranty expense on $1,250,000 in sales for the year at the rate of 3.5% of sales. Accrued $74,000 in estimated income tax expense. Paid the GST owing for the last quarter ($15,625 collected from customers and $8,720 paid on purchases). Jan. 31 Apr. 14 Paid the first six month interest installment on the 10 year bond. Jun. 2 Paid $4,500 in repair costs for defective products sold. under warranty. Required: Record the transactions in the general journal. Use days to calculate any interest accruals and payments.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Heres a table format representation of the transactions recorded in the general jou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started