Question

The following transactions of Larson Services Inc. occurred during August 2019, its first month of operations. Aug. 1 Issued common stock for $3,000 cash 1

The following transactions of Larson Services Inc. occurred during August 2019, its first month of operations.

Aug. 1 Issued common stock for $3,000 cash

1 Borrowed $10,000 cash from the bank

1 Paid $8,000 cash for a used truck

4 Paid $600 for a oneyear truck insurance policy effective August 1 (record as an asset)

5 Collected $2,000 fees from a client for work to be performed at a later date

7 Billed a client $5,000 for services performed today

9 Paid $250 for supplies purchased and used today

12 Purchased $500 of supplies on credit (record as an asset)

15 Collected $1,000 of the amount billed August 7

16 Paid $200 for advertising in The News during the first two weeks of August 20 Paid $250 of the amount owing for supplies purchased on August 12

25 Paid the following expenses:

rent for August, $350;

salaries, $2,150;

telephone, $50;

truck operating, $250

28 Called clients about payment of the balances owing from August 7

29 Billed a client $6,000 for services performed today, including $1,500 related to cash received August 5

31 Transferred $50 of Augusts prepaid expenses to insurance expense

31 Counted $100 of supplies still on hand (recorded the amount used as an expense).

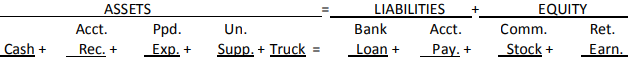

Required: 1. Record the above transactions on a transactions worksheet and calculate the total of each column at the end of August. Use the following headings on your worksheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started