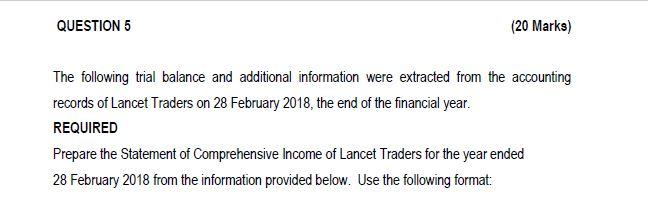

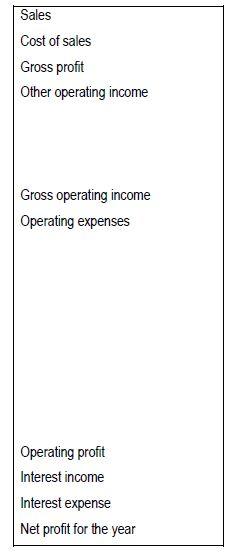

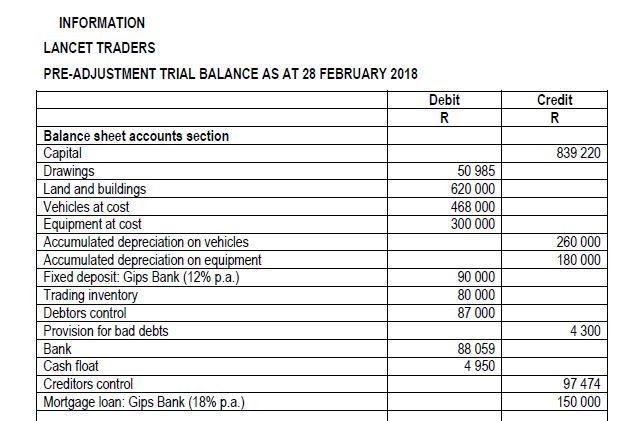

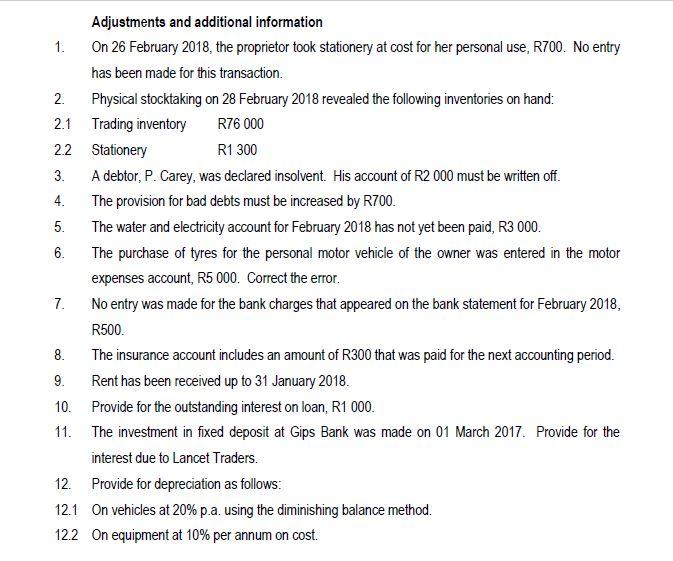

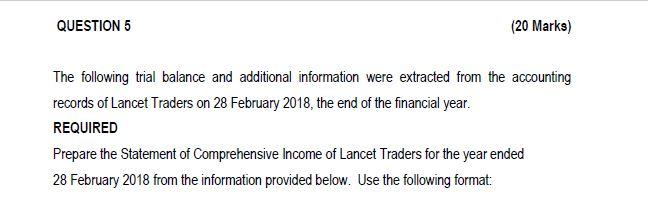

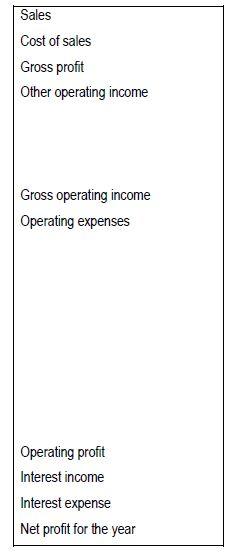

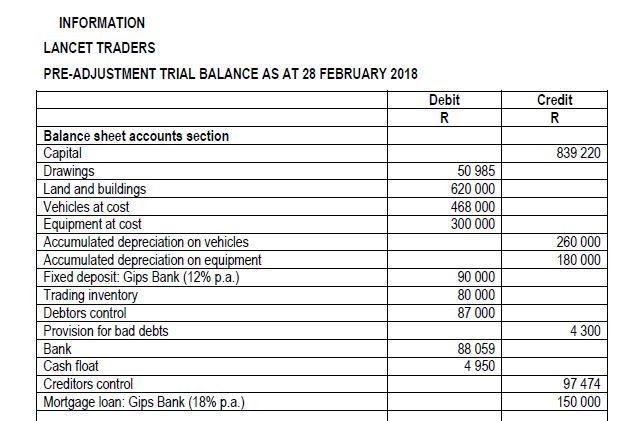

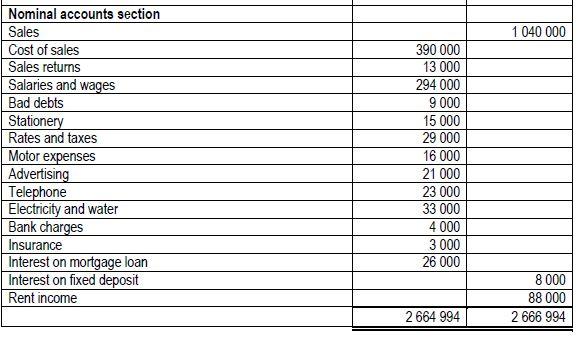

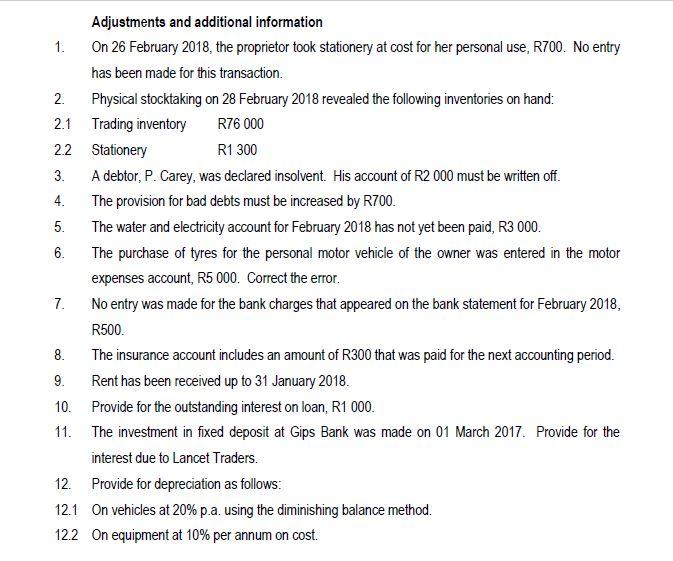

The following trial balance and additional information were extracted from the accounting records of Lancet Traders on 28 February 2018, the end of the financial year. REQUIRED Prepare the Statement of Comprehensive Income of Lancet Traders for the year ended 28 February 2018 from the information provided below. Use the following format: Sales Cost of sales Gross profit Other operating income Gross operating income Operating expenses Operating profit Interest income Interest expense Net profit for the year INFORMATION LANCET TRADERS PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2018 \begin{tabular}{|l|r|r|} \hline Nominal accounts section & & \\ \hline Sales & & 1040000 \\ \hline Cost of sales & 390000 & \\ \hline Sales returns & 13000 & \\ \hline Salaries and wages & 294000 & \\ \hline Bad debts & 9000 & \\ \hline Stationery & 15000 & \\ \hline Rates and taxes & 29000 & \\ \hline Motor expenses & 16000 & \\ \hline Advertising & 21000 & \\ \hline Telephone & 23000 & \\ \hline Electricity and water & 33000 & \\ \hline Bank charges & 4000 & \\ \hline Insurance & 3000 & \\ \hline Interest on mortgage loan & 26000 & \\ \hline Interest on fixed deposit & & \\ \hline Rent income & & 8000 \\ \hline & 2664994 & 2666994 \\ \hline \end{tabular} Adjustments and additional information 1. On 26 February 2018 , the proprietor took stationery at cost for her personal use, R700. No entry has been made for this transaction. 2. Physical stocktaking on 28 February 2018 revealed the following inventories on hand: 2.1 Trading inventory R76000 2.2 Stationery R1 300 3. A debtor, P. Carey, was declared insolvent. His account of R2 000 must be written off. 4. The provision for bad debts must be increased by R700. 5. The water and electricity account for February 2018 has not yet been paid, R3 000 . 6. The purchase of tyres for the personal motor vehicle of the owner was entered in the motor expenses account, R5 000. Correct the error. 7. No entry was made for the bank charges that appeared on the bank statement for February 2018 , R500. 8. The insurance account includes an amount of R300 that was paid for the next accounting period. 9. Rent has been received up to 31 January 2018. 10. Provide for the outstanding interest on loan, R1 000 . 11. The investment in fixed deposit at Gips Bank was made on 01 March 2017. Provide for the interest due to Lancet Traders. 12. Provide for depreciation as follows: 12.1 On vehicles at 20% p.a. using the diminishing balance method. 12.2 On equipment at 10% per annum on cost. The following trial balance and additional information were extracted from the accounting records of Lancet Traders on 28 February 2018, the end of the financial year. REQUIRED Prepare the Statement of Comprehensive Income of Lancet Traders for the year ended 28 February 2018 from the information provided below. Use the following format: Sales Cost of sales Gross profit Other operating income Gross operating income Operating expenses Operating profit Interest income Interest expense Net profit for the year INFORMATION LANCET TRADERS PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2018 \begin{tabular}{|l|r|r|} \hline Nominal accounts section & & \\ \hline Sales & & 1040000 \\ \hline Cost of sales & 390000 & \\ \hline Sales returns & 13000 & \\ \hline Salaries and wages & 294000 & \\ \hline Bad debts & 9000 & \\ \hline Stationery & 15000 & \\ \hline Rates and taxes & 29000 & \\ \hline Motor expenses & 16000 & \\ \hline Advertising & 21000 & \\ \hline Telephone & 23000 & \\ \hline Electricity and water & 33000 & \\ \hline Bank charges & 4000 & \\ \hline Insurance & 3000 & \\ \hline Interest on mortgage loan & 26000 & \\ \hline Interest on fixed deposit & & \\ \hline Rent income & & 8000 \\ \hline & 2664994 & 2666994 \\ \hline \end{tabular} Adjustments and additional information 1. On 26 February 2018 , the proprietor took stationery at cost for her personal use, R700. No entry has been made for this transaction. 2. Physical stocktaking on 28 February 2018 revealed the following inventories on hand: 2.1 Trading inventory R76000 2.2 Stationery R1 300 3. A debtor, P. Carey, was declared insolvent. His account of R2 000 must be written off. 4. The provision for bad debts must be increased by R700. 5. The water and electricity account for February 2018 has not yet been paid, R3 000 . 6. The purchase of tyres for the personal motor vehicle of the owner was entered in the motor expenses account, R5 000. Correct the error. 7. No entry was made for the bank charges that appeared on the bank statement for February 2018 , R500. 8. The insurance account includes an amount of R300 that was paid for the next accounting period. 9. Rent has been received up to 31 January 2018. 10. Provide for the outstanding interest on loan, R1 000 . 11. The investment in fixed deposit at Gips Bank was made on 01 March 2017. Provide for the interest due to Lancet Traders. 12. Provide for depreciation as follows: 12.1 On vehicles at 20% p.a. using the diminishing balance method. 12.2 On equipment at 10% per annum on cost