Answered step by step

Verified Expert Solution

Question

1 Approved Answer

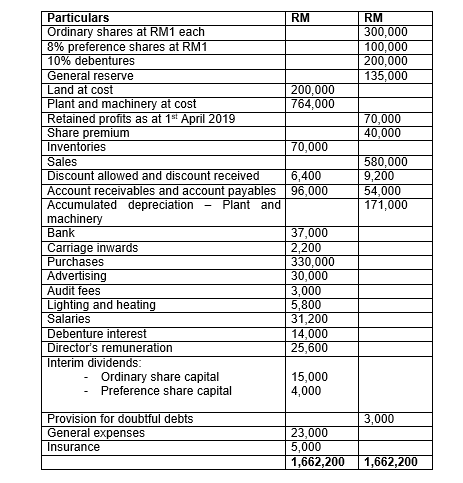

The following trial balance was extracted from the book of Yoodoo Bhd. as at 31 st March 2020. Required to prepare: (a) Statement of Profit

The following trial balance was extracted from the book of Yoodoo Bhd. as at 31st March 2020.

Required to prepare:

(a) Statement of Profit and Loss for the year ended 31st March 2020. (15 marks)

(b) Statement of Changes in Equity for the year ended 31st March 2020. (10 marks)

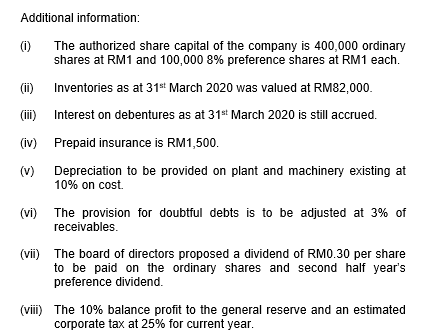

RM 300,000 100,000 200,000 135,000 70,000 40,000 Particulars RM Ordinary shares at RM1 each 8% preference shares at RM1 10% debentures General reserve Land at cost 200,000 Plant and machinery at cost 764,000 Retained profits as at 15 April 2019 Share premium Inventories 70,000 Sales Discount allowed and discount received 6,400 Account receivables and account payables 96,000 Accumulated depreciation Plant and machinery Bank 37,000 Carriage inwards 2,200 Purchases 330,000 Advertising 30,000 Audit fees 3,000 Lighting and heating 5,800 Salaries 31,200 Debenture interest 14,000 Director's remuneration 25,600 Interim dividends: - Ordinary share capital 15,000 Preference share capital 4,000 580,000 9,200 54,000 171,000 3,000 Provision for doubtful debts General expenses Insurance 23,000 5,000 1,662,200 1,662,200 Additional information: (0) The authorized share capital of the company is 400,000 ordinary shares at RM1 and 100,000 8% preference shares at RM1 each. (ii) Inventories as at 31st March 2020 was valued at RM82,000. Interest on debentures as at 31st March 2020 is still accrued. (iv) Prepaid insurance is RM1,500. (v) Depreciation to be provided on plant and machinery existing at 10% on cost. (vi) The provision for doubtful debts is to be adjusted at 3% of receivables. (vii) The board of directors proposed a dividend of RM0.30 per share to be paid on the ordinary shares and second half year's preference dividend. (viii) The 10% balance profit to the general reserve and an estimated corporate tax at 25% for current yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started