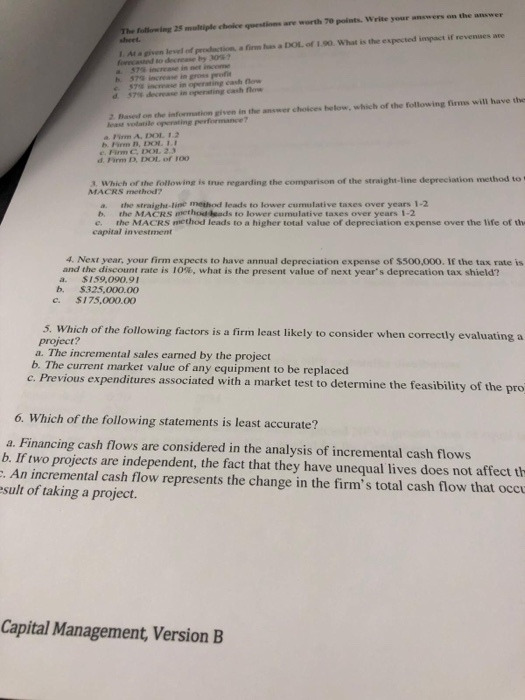

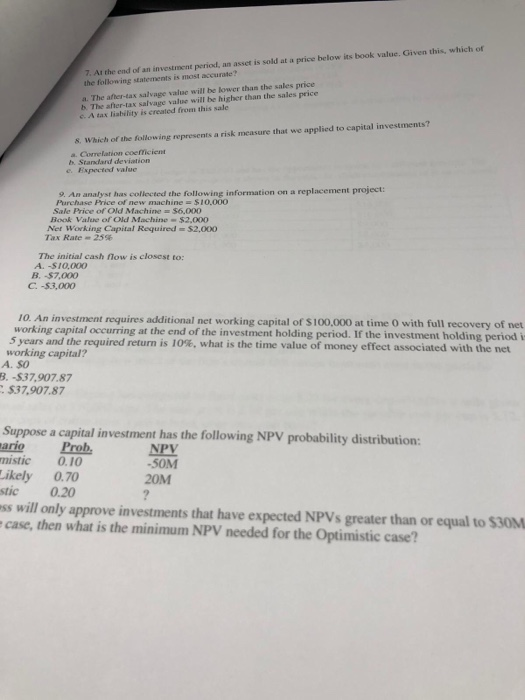

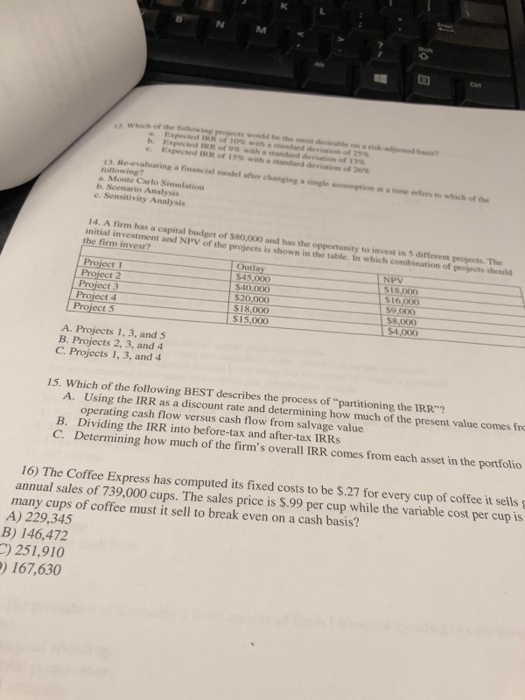

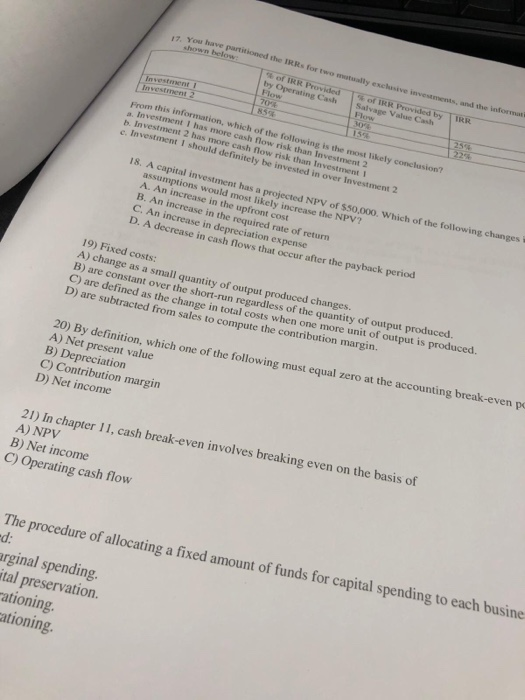

The folowing 25 multiple choice questions are worth 70 points. Write your answers on the answer sheet. l. At a given leel of presdaction, a firm has a DOL of 1.90. What is the expected impact if revenues are 57% increase in net h 579 increase in gross of in operating cash flw 2. Based on the information given in the answer choices elow, which of the following firms will have the a Pim A.DOL 1.2 d. Firm D, DOL of 100 1. Which of the following is true regarding the comparison of the straight-line depreciation method to MACRS method? a. the straight-ine method leads to lower cumulative taxes over years 1-2 b, the MACRS nethod beads to lower cumulative taxes over years 1-2 e. the MACRS method leads to a higher total value of depreciation expense over the life of th capital investment 4. Next year, your firm expects to have annual depreciation expense of $500,000. If the tax rate is and the discount rate is 10%, what is the present value of next year's deprecation tax shield a. $159.090.91 b. $325,000.00 e. $175,000.00 5. Which of the following factors is a firm least likely to consider when correctly evaluating a project? a. The incremental sales earned by the projedt b. The current market value of any equipment to be replaced c. Previou s expenditures associated with a market test to determine the feasibility of the pro 6. Which of the following statements is least accurate? a. Financing cash flows are considered in the analysis of incremental cash flows b. If two projects are independent, the fact that they have unequal lives does not affect th An incremental cash flow represents the change in the firm's total cash flow that occu sult of taking a project. Capital Management, Version B value. Given this, which of the end of an investment period, an asset is sold at a price below its book the following statements is most accurate? a. The afher-tax salvage valuc will be lower than the sales price b. The after-tax salvage value will be higher than the sales price e. tax liability is created from this sale 8. Which of the following represents a risk measure that we applied to capital investments? a. Correlation coefficient b. Standard deviation e. Expected value 9. An analyst has coflected the following information on a replacement project Purchase Price of new machine Sio,000 Sale Price of Old Machine $6,000 Book Value of Old Machine $2,000 Net Working Capital Required $2,000 Tax Rate 25% The initial cash flow is closest to: A. -$10,000 B.-$7,000 C. -$3,000 10. An investment requires additional net working capital of S100,000 at time O with full recovery of net working capital occurring at the end of the investment holding period. If the investment holding period i 5 years and therequired return is 10%, what is the time value of money effect associated with the net working capital? A. so B. -$37907.87 $37,907.87 Suppose a capital investment has the following NPV probability distribution: ario Prob mistic 0.10 NPY 50M 20M Likely 0.70 stic 0.20 ss will only approve investments that have expected NPVs greater than or equal to $30M case, then what is the minimum NPV needed for the Optimistic case? You have partitioned the IRRs for two matualy exclusive invesasments, and the informat i by Operating Cash Salvage Value Cash From this information, which of the following is the most likely concho nvestment I has more cash flow risk than Investment 2 b. Investment 2 has more cash flow risk than Investment I e. Invest tment I should definitely be invested in over In vestment 2 18. A capital investment has a projected NPV of $50,000. Which of the following changes i assumptions would most lik A. A B. An increase C. An increase in depreciation expense D. A decrease in cash flows that occur after the payback period ely increase the NPV? n increase in the upfront cost in the required rate of return 19) Fixed costs: A) chan ge as a small quantity of output produced changes. B) are constant over the short-run regardless of the quantity of output produced. C) are defined as the change in total costs when one more unit of output is produced. D) are subtracted from sales to compute the contribution margin. 20) By definition, which one of the following must equal zero at the accounting break-even po A) Net present value B) Depreciation C) Contribution margin D) Net income 21) In chapter 11, cash break-even involves breaking even on the basis of A) NPV B) Net income C) Operating cash flow The procedure of allocating a fixed amount of funds for capital spending to each busine d: rginal spending. tal preservation. ationing. ationing