Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The given information is all I have posted By the way, I have just known how to do it. Thank you anyway A project will

The given information is all I have posted By the way, I have just known how to do it. Thank you anyway

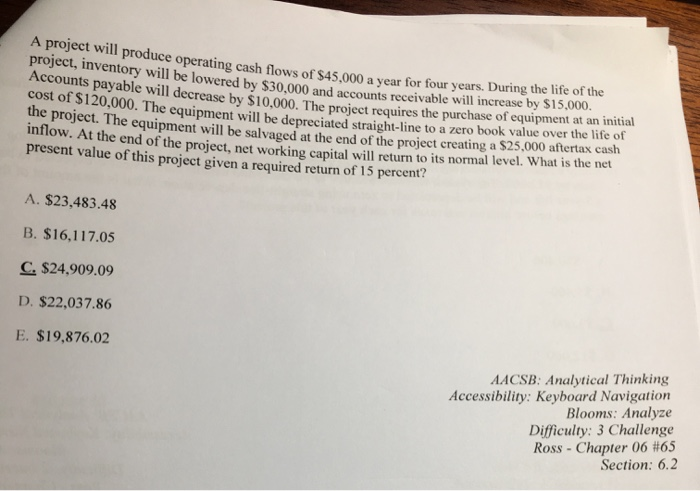

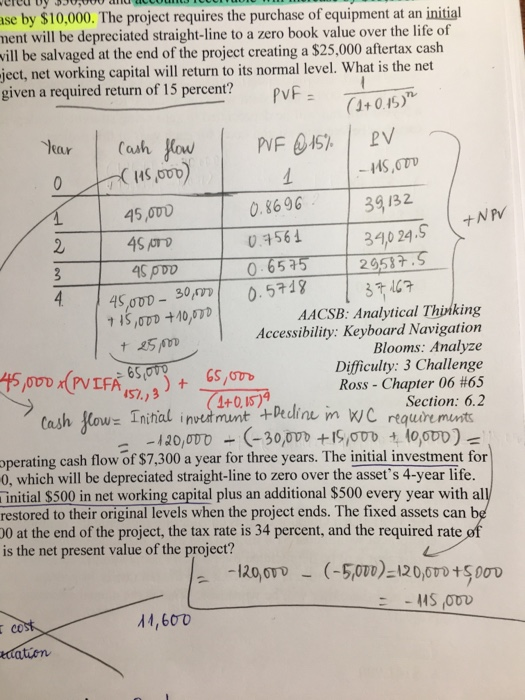

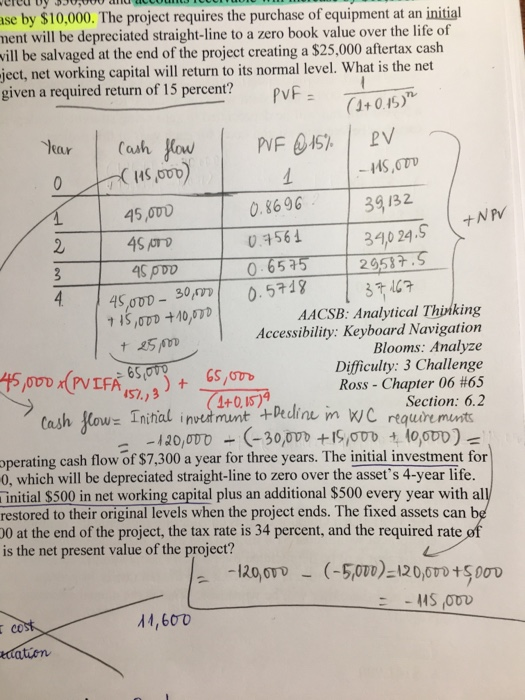

A project will produce operating cash flows of $45.000 a vear for four years. During the life of the project, inventory will be lowered by $30,000 and accounts receivable will increase by $15,000. Accounts payable will decrease by $10,000. The project requires the purchase of equipment at an initial cost of $120,000. The equipment will be depreciated straight-line to a zero book value over the life of the project. The equipment will be salvaged at the end of the project creating a $25,000 aftertax cash inflow. At the end of the project, net working capital will return to its normal level. What is the net present value of this project given a required return of 15 percent? A. $23,483.48 B. $16,117.05 C. $24,909.09 D. $22,037.86 E. $19,876.02 AACSB: Analytical Thinking Accessibility: Keyboard Navigation Blooms: Analyze Difficulty: 3 Challenge Ross-Chapter 06 #65 Section: 6.2 ase by $10,000. The project requires the purchase of equipment at an initial ment will be depreciated straight-line to a zero book value over the life of vill be salvaged at the end of the project creating a $25,000 aftertax cash ject, net working capital will return to its normal level. What is the net given a required return of 15 percent? PVF = (1+0.15) Cash ow Year PVF15% PV aao'st 39 132 0.8696 1 45,Ovv +N PV 390 24.5 29537.S 2 04561 O-655 0.5718 3 4 45, -30, AACSB: Analytical Thinking Accessibility: Keyboard Navigation Blooms: Analyze Difficulty: 3 Challenge Ross-Chapter 06 #65 Section: 6.2 Cash fow= Initial invedtmunt +Pecdine m WC requiremunts -420,000(-30,00 +15/000 l0,o00) operating cash flow of $7,300 a year for three years. The initial investment for 0, which will be depreciated straight-line to zero over the asset's 4-year life. initial $500 in net working capital plus an additional $500 every year with all restored to their original levels when the project ends. The fixed assets can be 0 at the end of the project, the tax rate is 34 percent, and the required rate of 25 45 oo (PVIFA GS, (1+0, I574 is the net present value of the project? -120,o (-5,0 -120,070 +5000 cost ,600 dation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started