Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The goal of the trading game is to end up with the most valuable portfolio. To refresh your memory of security markets, read relevant chapters

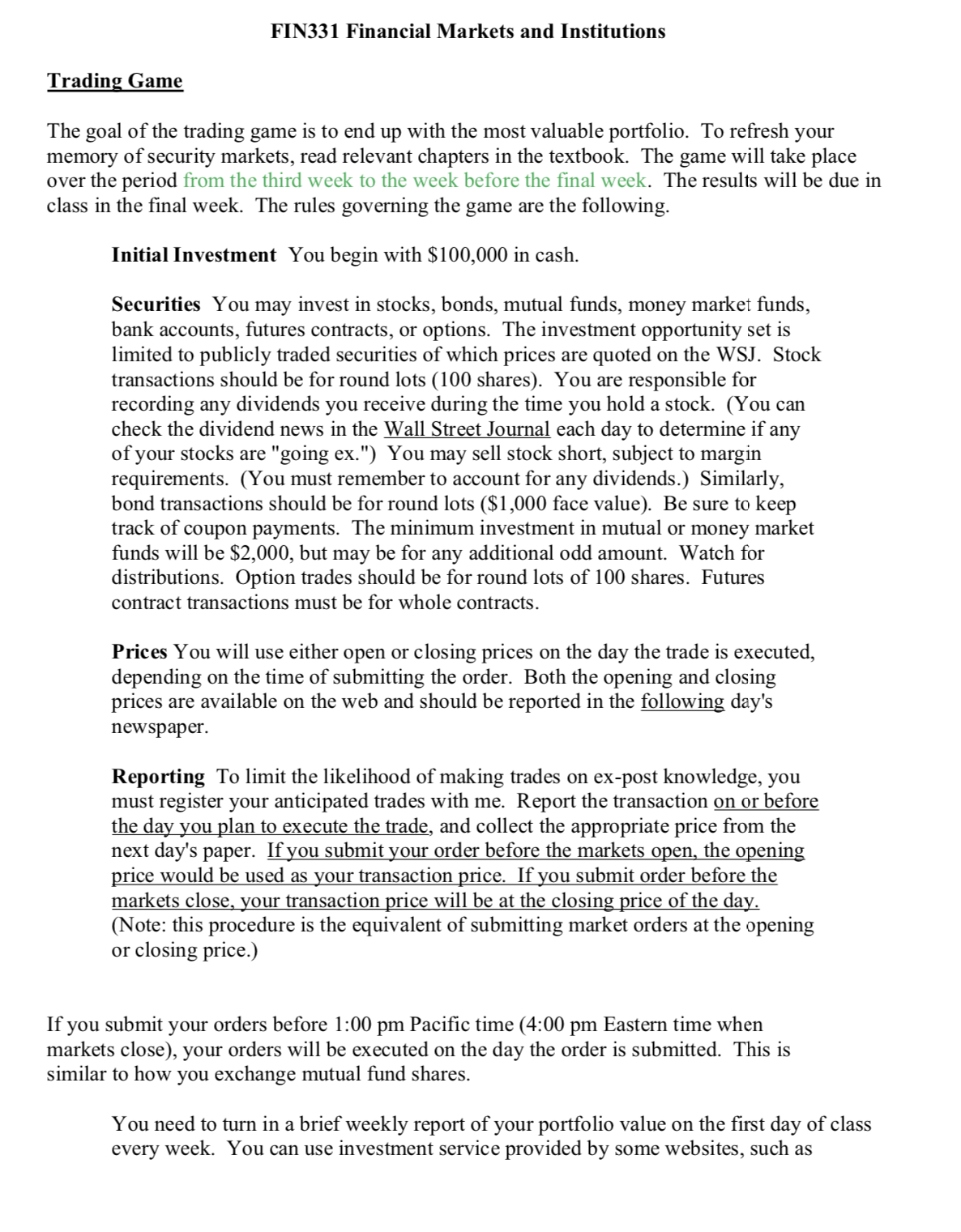

The goal of the trading game is to end up with the most valuable portfolio. To refresh your memory of security markets, read relevant chapters in the textbook. The game will take place over the period from the third week to the week before the final week. The results will be due in class in the final week. The rules governing the game are the following.

Initial Investment You begin with $ in cash.FIN Financial Markets and Institutions

Trading Game

The goal of the trading game is to end up with the most valuable portfolio. To refresh your

memory of security markets, read relevant chapters in the textbook. The game will take place

over the period from the third week to the week before the final week. The results will be due in

class in the final week. The rules governing the game are the following.

Initial Investment You begin with $ in cash.

Securities You may invest in stocks, bonds, mutual funds, money market funds,

bank accounts, futures contracts, or options. The investment opportunity set is

limited to publicly traded securities of which prices are quoted on the WSJ Stock

transactions should be for round lots shares You are responsible for

recording any dividends you receive during the time you hold a stock. You can

check the dividend news in the Wall Street Journal each day to determine if any

of your stocks are "going ex You may sell stock short, subject to margin

requirements. You must remember to account for any dividends. Similarly,

bond transactions should be for round lots $ face value Be sure to keep

track of coupon payments. The minimum investment in mutual or money market

funds will be $ but may be for any additional odd amount. Watch for

distributions. Option trades should be for round lots of shares. Futures

contract transactions must be for whole contracts.

Prices You will use either open or closing prices on the day the trade is executed,

depending on the time of submitting the order. Both the opening and closing

prices are available on the web and should be reported in the following day's

newspaper.

Reporting To limit the likelihood of making trades on expost knowledge, you

must register your anticipated trades with me Report the transaction on or before

the day you plan to execute the trade, and collect the appropriate price from the

next day's paper. If you submit your order before the markets open, the opening

price would be used as your transaction price. If you submit order before the

markets close, your transaction price will be at the closing price of the day.

Note: this procedure is the equivalent of submitting market orders at the opening

or closing price.

If you submit your orders before : pm Pacific time : pm Eastern time when

markets close your orders will be executed on the day the order is submitted. This is

similar to how you exchange mutual fund shares.

On excell please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started