Question

The idea is set up a new business and do a budgeting plan for it. Please estimate the revenues based on market research. Set prices

The idea is set up a new business and do a budgeting plan for it.

Please estimate the revenues based on market research.

Set prices according to the market prices.

Cost of goods sold (COGS) could be estimated as 20% of the Prices per unit.

While they were doing their Business Plan, they took the following decisions:

Then plan to run the business at least, for 10 years.

The prices and wages have to be adjusted to the inflation. The European Central Bank has estimated the long-run inflation in the Euro-zone to be an annual 2%. They estimate that revenues can grow twice inflation rate

Things to keep in mind:

Initial Marketing (launching) Campaign and its estimation cost

Loan under French system. Consult the % interest rate

To evaluate the investment project, students have to do the following:

For assessing this investment, the required rate will be estimated using CAPM, considering Risk free rate as German federal Bonds, 10 years maturity (0.95%), market rate, as Ibex-35, last years return 7%, and risk will be considered by using a Beta of 1.60 (slightly above industry average)

- Calculate the Free Cash Flows of the investment project

- Evaluate the project using:

- Pay-back method

- Net Present Value

- Internal Rate of Return.

- What is the minimum occupancy to get break-even point?

For all the other assumptions, please clearly state them on the report.

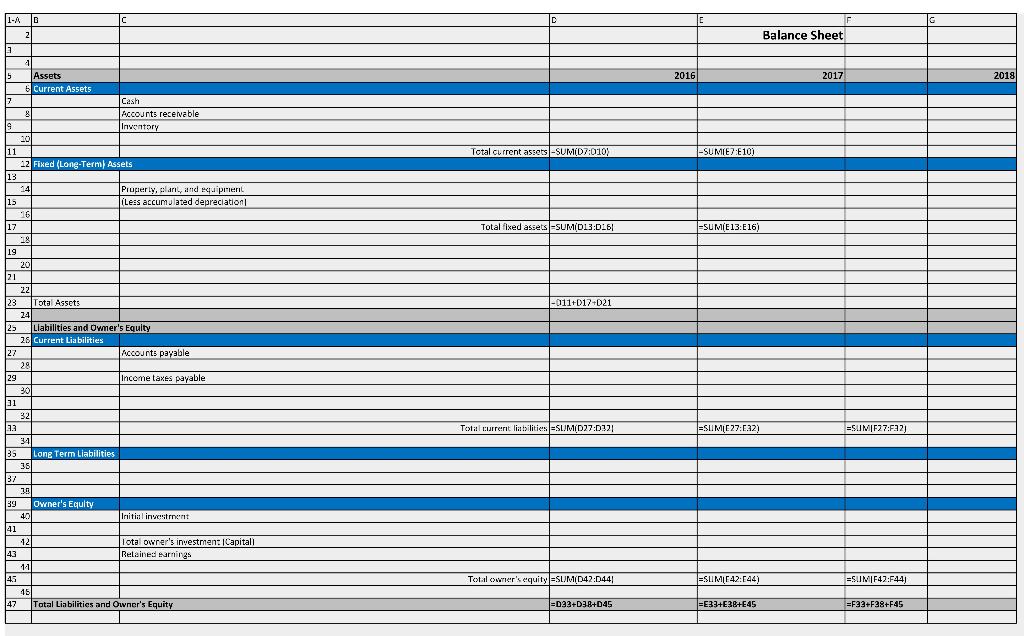

1-A B 2 3 4 Assets 6 Current Assets 8 10 11 12 Fixed (Long-Term Assets 13 14 15 16 17 18 19 20 21 22 23 Total Assets 24 25 25 27 29 31 3.3 35 35 137 38 39 89 Owner's Equity 40 41 42 43 11 45 45 47 Total Liabilities and Owner's Equity 5 7 19 Liabilities and Owner's Equity 25 Current Liabilities 28 30 32 34 Cash Accounts receivable Inventory Property, plant, and equipment (Less accumulated depreciation Long Term Liabilities Accounts payable Income taxes payable. Initial investment Total owner's investmen: ICapital) Retained earnings D Total current assets -SUM(D7:010) Total fixed assets -SUM(D13:D16 -011+017-021 Total current liabilities SUM(D27:0321 Total owner's equity =SUM(D42:D44) =D33+D38+045 2016 Balance Sheet 2017 -SUMIE7 E10) -SUM(E13:E16) =SUM(E27:E32) =SUMIE42:E44) =E33+E38+E45 =SUMIF27:F32) =SUMIF42:F44) =F33+F38+F45 2018 1-A B 2 3 4 Assets 6 Current Assets 8 10 11 12 Fixed (Long-Term Assets 13 14 15 16 17 18 19 20 21 22 23 Total Assets 24 25 25 27 29 31 3.3 35 35 137 38 39 89 Owner's Equity 40 41 42 43 11 45 45 47 Total Liabilities and Owner's Equity 5 7 19 Liabilities and Owner's Equity 25 Current Liabilities 28 30 32 34 Cash Accounts receivable Inventory Property, plant, and equipment (Less accumulated depreciation Long Term Liabilities Accounts payable Income taxes payable. Initial investment Total owner's investmen: ICapital) Retained earnings D Total current assets -SUM(D7:010) Total fixed assets -SUM(D13:D16 -011+017-021 Total current liabilities SUM(D27:0321 Total owner's equity =SUM(D42:D44) =D33+D38+045 2016 Balance Sheet 2017 -SUMIE7 E10) -SUM(E13:E16) =SUM(E27:E32) =SUMIE42:E44) =E33+E38+E45 =SUMIF27:F32) =SUMIF42:F44) =F33+F38+F45 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started