Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The income of the Cora Family Trust for the current income year is limited to interest income of $10,000 derived from sources in Australia.

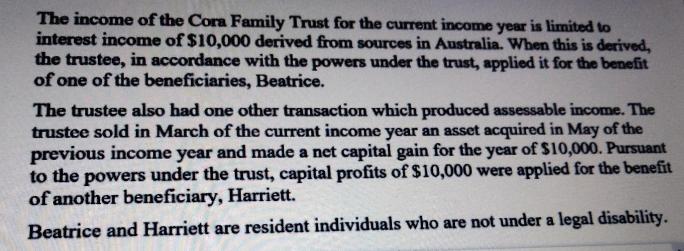

The income of the Cora Family Trust for the current income year is limited to interest income of $10,000 derived from sources in Australia. When this is derived, the trustee, in accordance with the powers under the trust, applied it for the benefit of one of the beneficiaries, Beatrice. The trustee also had one other transaction which produced assessable income. The trustee sold in March of the current income year an asset acquired in May of the previous income year and made a net capital gain for the year of $10,000. Pursuant to the powers under the trust, capital profits of $10,000 were applied for the benefit of another beneficiary, Harriett. Beatrice and Harriett are resident individuals who are not under a legal disability. Beatrice and Harriett are resident individuals who are not under a legal disability. Q23 Required: (i) Calculate, for the current income year, the net income of the trust. (ii) Calculate the assessable incomes for Beatrice and Harriett. (iii) Indicate the nature of the trust income in the hands of the beneficiaries and what implications this has for those beneficiaries. (10 marks)

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer page 1 Question is clearly base d Specific on entitlement Net in come ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started