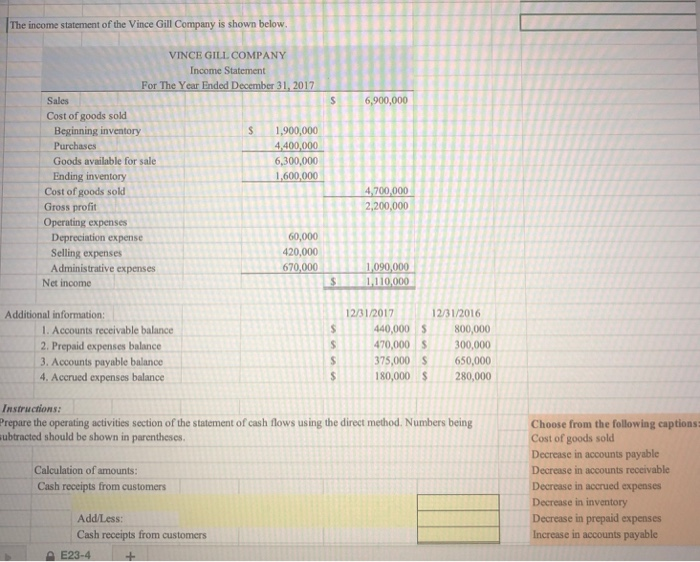

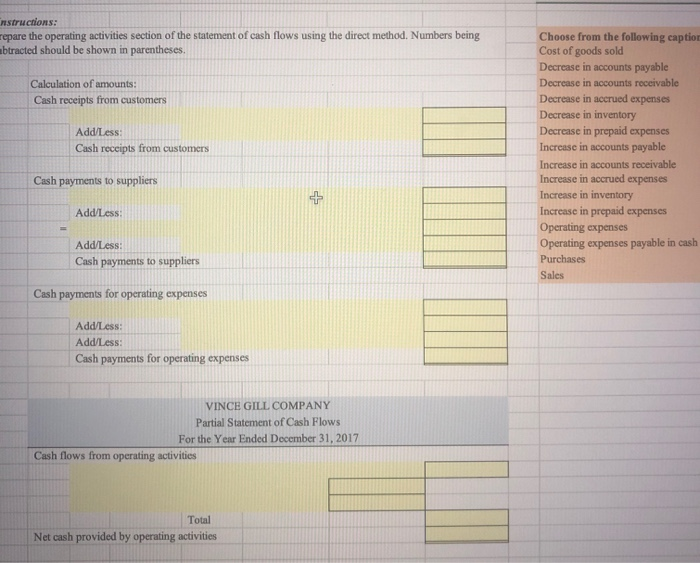

The income statement of the Vince Gill Company is shown below. VINCE GILL COMPANY Income Statement For The Year Ended December 31, 2017 Sales Cost of goods sold Beginning inventory $ 1,900,000 Purchases 4,400,000 Goods available for sale 6,300,000 Ending inventory 1,600,000 Cost of goods sold Gross profit Operating expenses Depreciation expense 60,000 Selling expenses 420,000 Administrative expenses 670,000 Net income 1.110,000 Additional information: 1. Accounts receivable balance 2. Prepaid expenses balance 3. Accounts payable balance 4. Accrued expenses balance 12/31/2017 12/31/2016 440,000 $ 800,000 470,000 $ 300,000 375,000 $ 650,000 180,000 $ 280,000 Instructions: Prepare the operating activities section of the statement of cash flows using the direct method. Numbers being subtracted should be shown in parentheses. Calculation of amounts: Cash receipts from customers Choose from the following captions: Cost of goods sold Decrease in accounts payable Decrease in accounts receivable Decrease in accrued expenses Decrease in inventory Decrease in prepaid expenses Increase in accounts payable Add Less: Cash receipts from customers E23-4 structions: spare the operating activities section of the statement of cash flows using the direct method. Numbers being ibtracted should be shown in parentheses. Calculation of amounts: Cash receipts from customers Add Less: Cash receipts from customers Choose from the following caption Cost of goods sold Decrease in accounts payable Decrease in accounts receivable Decrease in accrued expenses Decrease in inventory Decrease in prepaid expenses Increase in accounts payable Increase in accounts receivable Increase in accrued expenses Increase in inventory Increase in prepaid expenses Operating expenses Operating expenses payable in cash Purchases Sales Cash payments to suppliers Add/Less Add/Less: Cash payments to suppliers Cash payments for operating expenses Add/Less: Add/Less: Cash payments for operating expenses VINCE GILL COMPANY Partial Statement of Cash Flows For the Year Ended December 31, 2017 Cash flows from operating activities Total Net cash provided by operating activities