Answered step by step

Verified Expert Solution

Question

1 Approved Answer

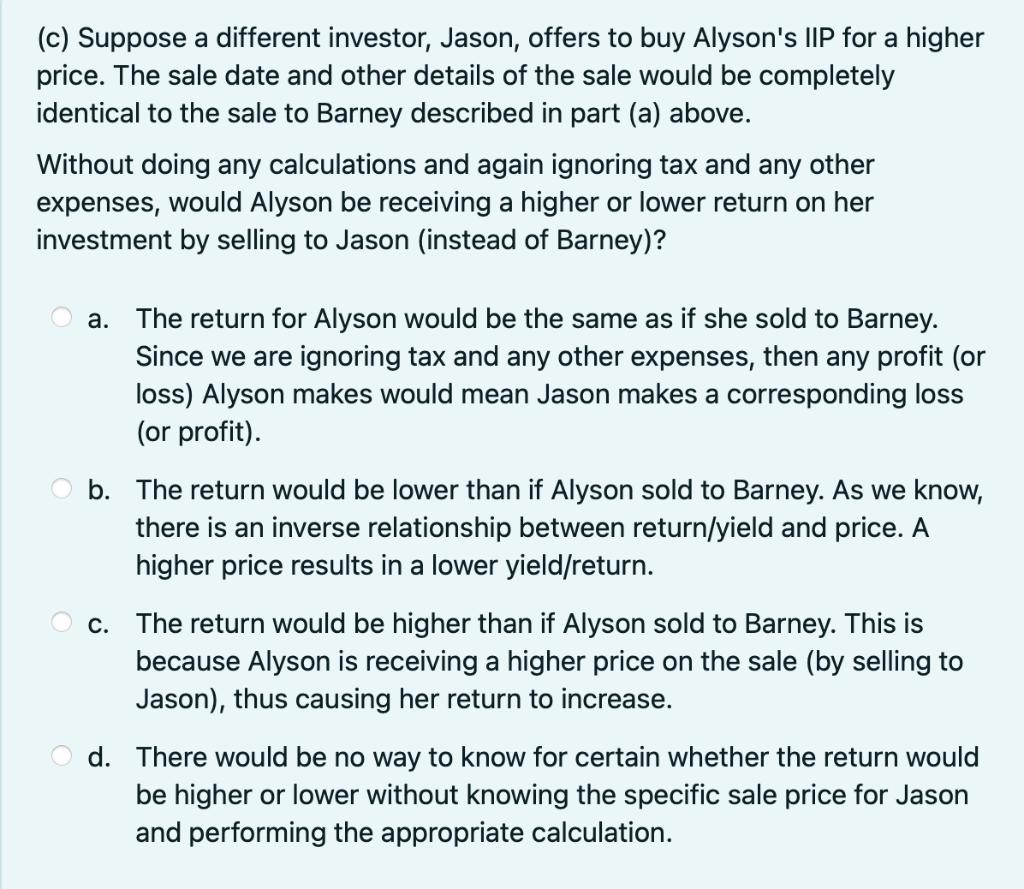

(c) Suppose a different investor, Jason, offers to buy Alyson's IIP for a higher price. The sale date and other details of the sale

(c) Suppose a different investor, Jason, offers to buy Alyson's IIP for a higher price. The sale date and other details of the sale would be completely identical to the sale to Barney described in part (a) above. Without doing any calculations and again ignoring tax and any other expenses, would Alyson be receiving a higher or lower return on her investment by selling to Jason (instead of Barney)? a. The return for Alyson would be the same as if she sold to Barney. Since we are ignoring tax and any other expenses, then any profit (or loss) Alyson makes would mean Jason makes a corresponding loss (or profit). b. The return would be lower than if Alyson sold to Barney. As we know, there is an inverse relationship between return/yield and price. A higher price results in a lower yield/return. C. The return would be higher than if Alyson sold to Barney. This is because Alyson is receiving a higher price on the sale (by selling to Jason), thus causing her return to increase. d. There would be no way to know for certain whether the return would be higher or lower without knowing the specific sale price for Jason and performing the appropriate calculation.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 If different investor offers to buy Alysons IIP for a higher price the amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started