Answered step by step

Verified Expert Solution

Question

1 Approved Answer

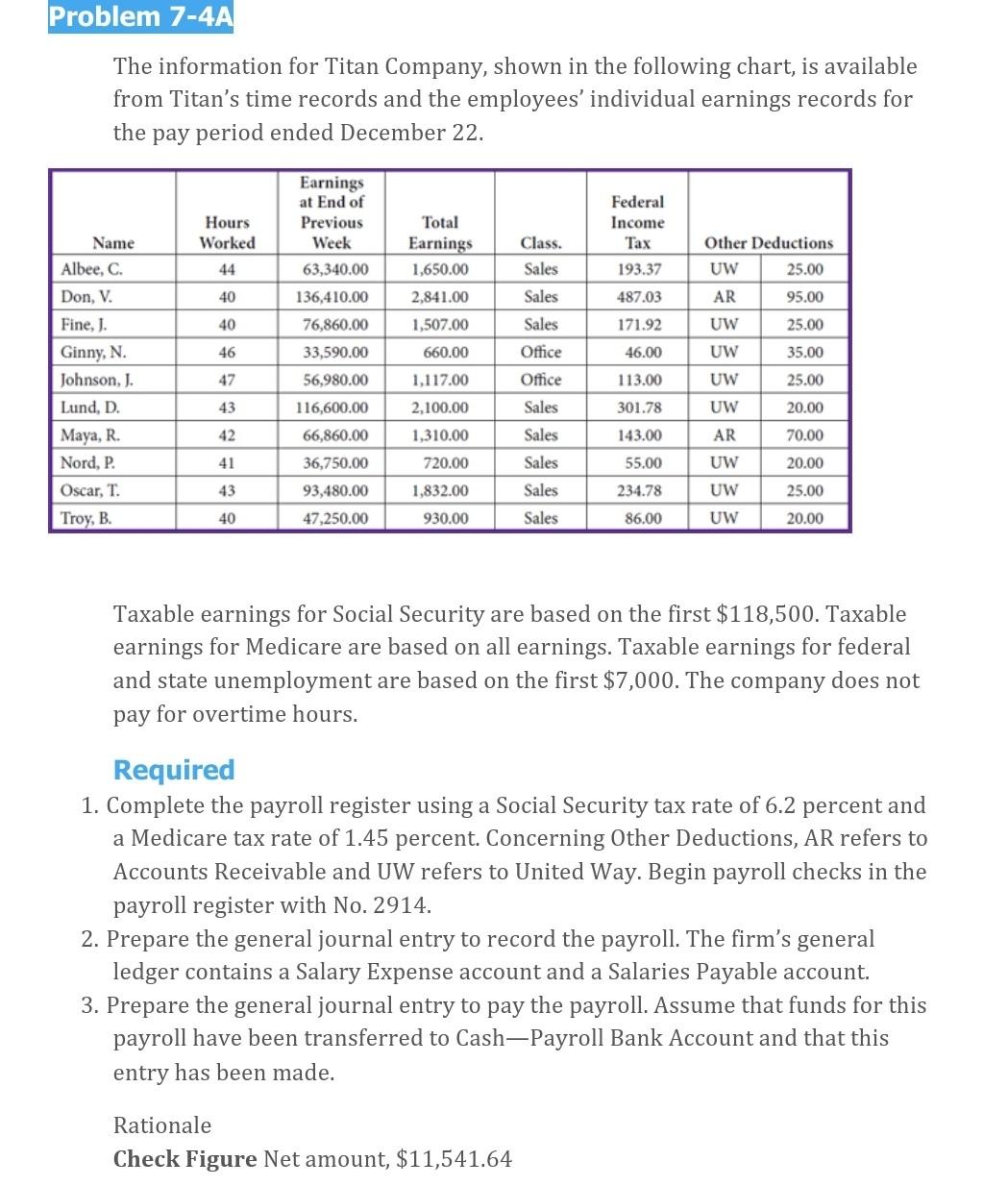

The information for Titan Company, shown in the following chart, is available from Titan's time records and the employees' individual earnings records for the pay

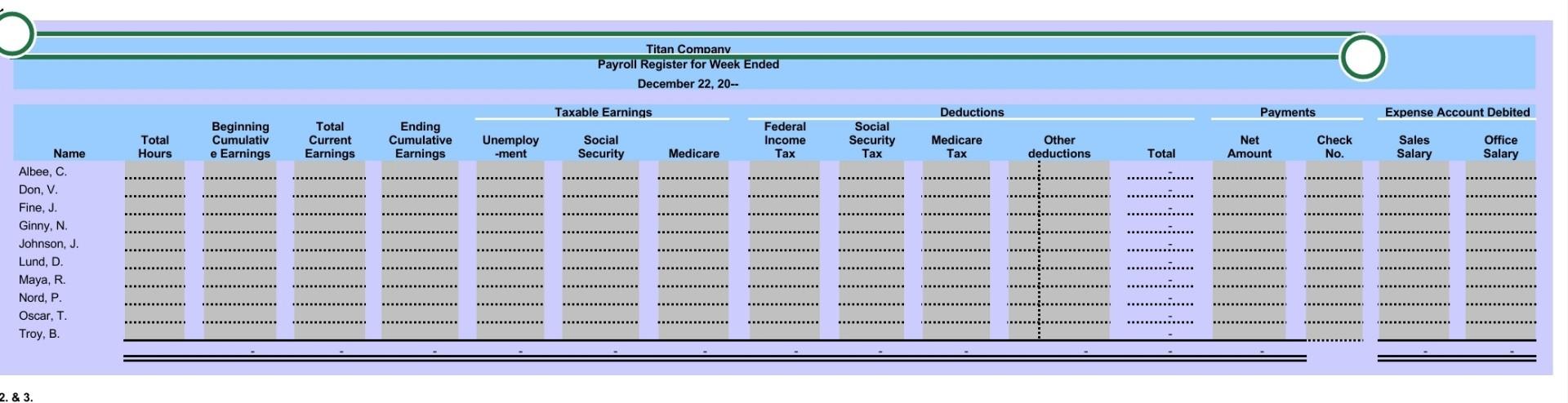

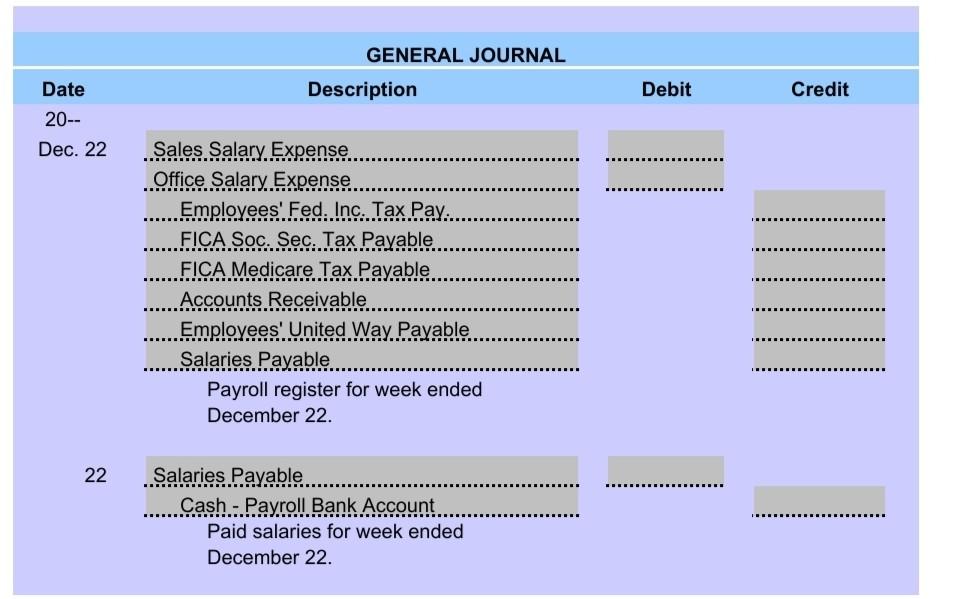

The information for Titan Company, shown in the following chart, is available from Titan's time records and the employees' individual earnings records for the pay period ended December 22. Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. The company does not pay for overtime hours. Required 1. Complete the payroll register using a Social Security tax rate of 6.2 percent and a Medicare tax rate of 1.45 percent. Concerning Other Deductions, AR refers to Accounts Receivable and UW refers to United Way. Begin payroll checks in the payroll register with No. 2914. 2. Prepare the general journal entry to record the payroll. The firm's general ledger contains a Salary Expense account and a Salaries Payable account. 3. Prepare the general journal entry to pay the payroll. Assume that funds for this payroll have been transferred to Cash-Payroll Bank Account and that this entry has been made. Rationale Check Figure Net amount, $11,541.64 GENERAL JOURNAL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started