Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The internal revenue service is studying the category of charitable contributions. A sample of 25 returns is selected from young couples between the ages of

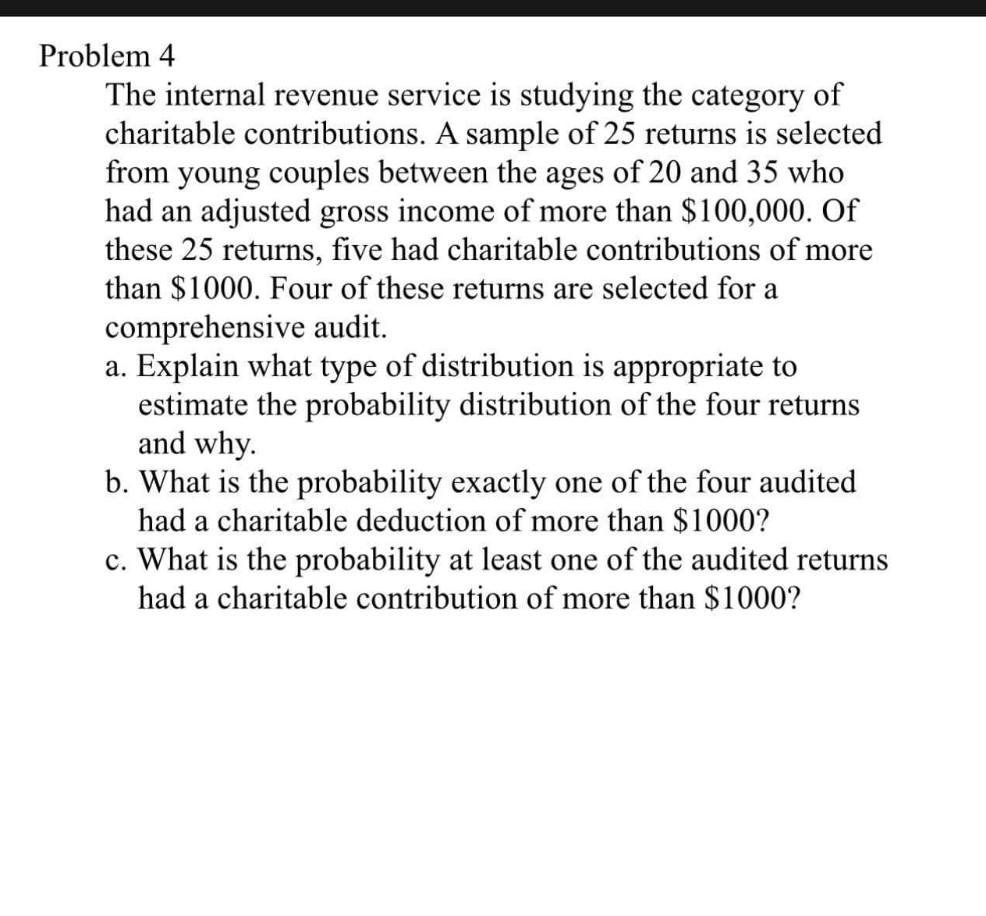

The internal revenue service is studying the category of charitable contributions. A sample of 25 returns is selected from young couples between the ages of 20 and 35 who had an adjusted gross income of more than $100,000. Of these 25 returns, five had charitable contributions of more than $1000. Four of these returns are selected for a comprehensive audit. a. Explain what type of distribution is appropriate to estimate the probability distribution of the four returns and why. b. What is the probability exactly one of the four audited had a charitable deduction of more than $1000 ? c. What is the probability at least one of the audited returns had a charitable contribution of more than $1000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started